Travel News

Nigeria’s Azman Air Suspends Operations And Puts Staff On Unpaid Leave - SIMPLY FLYING

The airline suspended all domestic services on April 18.

Nigerian-based domestic airline Azman Air has suspended its commercial services and sent all its staff on compulsory leave without pay. The mandatory leave for its personnel resulted from its end of Hajj operations and the unavailability of its Boeing 737 aircraft. The circular signed by the Human Resources Manager at the airline state that only eight senior staff members are exempt from unpaid leave.

Another suspension of services

It is not the first time that the airline has suspended its commercial operations. In March 2021, the airline suspended its flight services to all destinations in Nigeria. The airline needed to upkeep the aviation regulations in its operations and the safety of flights.

According to the Nigerian Civil Aviation Authority (NCAA), the suspension allows regulators to audit the carrier to determine the cause of previous incidents and recommend solutions.

Presently, the airline is struggling with the maintenance of its Boeing 737 fleet. The airline operates a fleet of five Boeing 737s (two -300s and three -500s) and an Airbus A340-600. All of the Boeing 737 fleet is currently out of service for C-Checks at different MRO locations.

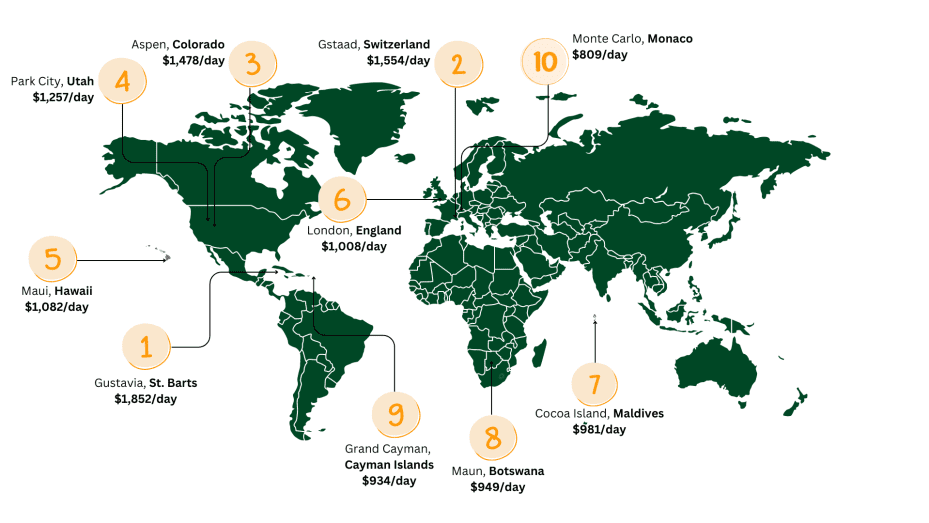

$1,850 a day? What it costs to visit the 10 most expensive vacation destinations in the world - CNBC

Looking to splurge on your next vacation?

The travel website FloridaPanhandle.com analyzed costs in 100 popular vacation spots, looking into average prices for accommodations, transportation, food and attractions.

Here are 10 destinations that certainly call for big budgets.

According to the analysis, the most expensive vacation destinations, excluding flight costs, are:

- Gustavia, St. Barts

- Gstaad, Switzerland

- Aspen, Colorado

- Park City, Utah

- Maui, Hawaii

- London, England

- Cocoa Island, Maldives

- Maun, Botswana

- Grand Cayman, Cayman Islands

- Monte Carlo, Monaco

The 10 most expensive vacation destinations around the globe.

Source: CNBC

The 10 most expensive vacation destinations around the globe.

Source: CNBC

The list was dominated by islands and ritzy ski towns, though the draw of eco-tourism safaris in Botswana and Europe’s financial capital, London, rounded out the ranking.

Where hotels average $1,000 per night

The Caribbean island of St. Barts is the most expensive vacation destination in the world, largely because of its high accommodation costs, which average $1,770 per night, according to the analysis.

Average hotel rates in Switzerland’s Gstaad (No. 2) are $1,360, according to the research. The town in the Swiss Alps also has the highest average food costs on the list, at $177 per day.

Accommodations at the third priciest spot — Aspen, Colorado — average $1,385 for one person, but a family of four can expect to pay $2,274, according to the analysis.

A street in downtown Aspen, Colorado.

Nik Wheeler | Corbis Historical | Getty Images

A street in downtown Aspen, Colorado.

Nik Wheeler | Corbis Historical | Getty Images

To find those prices, FloridaPanhandle.com researched average rates for four- and five-star hotels for stays during Christmas (Dec. 21-27) and the spring (May 19-25), but did not include taxes.

Attractions: from $0 to $333 per day

To estimate the price of activities, FloridaPanhandle.com calculated the average cost for each location’s three most-reviewed attractions on TripAdvisor.

The ski town of Park City, Utah, averaged $333 for daily attractions — the highest on the list.

Attractions in Maun, Botswana, Africa’s lone destination on the list, averaged more than $100 per day for activities like a one-day visit to the Okavango Delta.

Despite having higher overall average costs, St. Barts and the Maldives’ attractions were valued at $0. Vacationers may have to pay top dollar for hotels in those locations, but their beaches are free.

Monaco, Monte Carlo.

Ostill | Istock | Getty Images

Monaco, Monte Carlo.

Ostill | Istock | Getty Images

Monte Carlo had one of the lowest average rates for attractions on the list, a surprising result for a vibrant gambling hot spot.

While “Monte Carlo is known for its casinos, it is also not the most popular thing to do in town,” said a representative from FloridaPanhandle.com.

According to the company, the three most popular attractions in Monte Carlo are the Oceanographic Museum of Monaco, an outdoor area called Casino Square, and the Casino of Monte Carlo, which has an entrance fee of 18 euros ($20).

Gambling losses, however, are not included in Monte Carlo’s average attraction costs.

Petrol price: Marketers urge FG to tackle FOREX challenge - VANGUARD

By Obas Esiedesa

Oil marketers Monday in Abuja urged the Federal Government to act urgently to halt the consistent slide in the value of the Naira against the dollar as it has significantly impacted on the pump price of petrol.

The President of the Natural Oil and Gas Suppliers Association of Nigeria, NOGASA, Mr. Benneth Korie told journalists that the pump price would rise in the coming days due to the significant fall in the value of the Naira to the dollar.

Mr. Korie disclosed that petrol pump price may increase next week to reflect the market exchange rate of the Naira to the dollar, stressing that the government needs to streamline the currency trading market.

According to him, “Today was we speak, diesel is going for N920/950 per litre, before now, it was N600 plus, and then the government introduced tax on the product. We will suggest that the government should take action on the dollar issue otherwise diesel and petrol and other petroleum products will go up more than what you are seeing today.

“The only way out is (for the government) to take serious action by calling the BDC (bureau de change) and the bank managing directors to sit down with the Central Bank of Nigeria, CBN, and come out with one uniform price for the Naira against the dollar. Leaving it freely to be determined by the market will spell doom for the country. The way it is going, it will destroy a lot of things for us”.

The marketers also insisted that fixing the moribund refineries has become an urgent national issue, saying that getting the refineries back in operation will stabilize petrol pump prices and relieve the pressure on the local currency.

“We have Nigerian engineers and they should be saddled with fixing the refineries. I believe Nigerian engineers can fix the problems and with the right machineries. Every time, billions of Naira is spent on repairing the refineries by foreigners, now see where it has gotten us. One of the factors responsible for the problem we are facing today is that the government removed subsidies before fixing the refineries”.

The marketers also tasked the government on the need to fix the road networks in the country, stressing that it was having a heavy toll on the cost operations in the downstream sector.

“The route from Warri to Abuja is a no-go area. Our trucks are at a standstill, and our drivers are being kidnapped and killed. Our trucks are vandalized and the products are taken out of them and this is a waste of money. We had this same problem last year in the same place yet nothing has been done”, he added.

The NOGASA President lamented that the business environment has become stifling with several filling stations shutting down due to high cost of operations.

“If you go round, you’ll see a lot of filling stations are closing. If you were trading with N10 million before, forget about it. Someone who was trading with N100 million, you could buy one million litre of petrol in a month to sell but now, with N100 million you can only buy 150,000 litres in a month. You’ll also incur the same expenses when selling one million liters in a month”.

Foreign exchange crunch takes toll on Nigerian students in UK - BUSINESSDAY

The prevailing foreign exchange crunch seems to be taking its toils on Nigerian students in diaspora as three students were removed from the enrollment list at Swansea University, in the United Kingdom (UK), for paying fees late.

The Nigerian trio of Omolade Olaitan, Emmanuel Okohoboh, and Paulette Ojogun, paid their school fees a few hours later than expected, and have been asked by the university authority to go back to their country or defy the admission for making payment later than the stipulated time.

According to the students, “They have explained to the school that their school fees came late as a result of the cash crunch that hit Nigeria earlier in 2023.

Swansea University, UK, has, however, turned deaf ears and held on to the N3.8 million (4000 pounds) school fees while asking the students to pack their bags and go home.”

Olaitan, one of the students, explained that the deadline for the payment of her fees was March 27, 2023, but that made her payment on March 29.

“On March 29, I got an email from income tuition. They confirmed my payment and they told me that because the payment didn’t come in before the deadline, they can no longer allow me to enrol and that I should pack my bags and go back to my home country,” she said.

Okohoboh, another affected student, who got admission to start a master’s degree in Business Management, said that he had to sell two parcels of land to raise his fee only for the university to ask him to go back home.

“They are not fair, they are not compassionate, they are showing no signs of empathy.

I had to sell my dad’s land and a piece of my own personal land to get the resources to come to Swansea University to study. Coming here and going through this situation has been mentally draining and frustrating for me,” he said.

While Ojogun, another student who enrolled for a marketing management degree, also paid her fees after the deadline.

“I am happy that I am here, I am happy that I am studying, so why would you take that away from me because my school fees came in late? I’ve explained everything to them, I sent emails, and they still would not give me a listening ear,” she cried.

The Swansea University have expressed sadness over the ugly situation, but insist it cannot go against the UKV1 rules.

However, the Central Bank of Nigeria (CBN) has said it does not believe that the current naira freefall is caused by the market forces. Rather it says it is caused by speculators.

Folashodun Shonubi, the acting CBN governor said this in a broadcast, Monday, August 14, 2023, adding that the government is ready to take action to save the naira.

“I do not believe that the changes going on in the parallel market are driven by pure economics demand and supply, but I am topped by speculative demand by people,” he said.

Fresh pressure on Tinubu as illiquid power sector nears collapse - BUSINESSDAY

BY Titi Omobude

Nigeria’s tottering power sector, which has seen electricity generation fall to below the worst levels under the Muhammadu Buhari administration, now faces an acute cash shortage, which experts say could lead to its imminent collapse and with it a new front of pressure against the government of President Bola Tinubu.

Electricity supplied to the national grid is today as low as 3,700 megawatts (MW) and if the export power is excluded, that means Nigerians are receiving less than 3,000MW to their homes and offices, BusinessDay investigation has revealed.

Our investigation showed that the electricity market shortfall has now ballooned to a hefty N90 billion monthly or over N1 trillion a year on account of the massive devaluation of the naira, which has led to an unprecedented surge in the price of gas, a key energy input in Nigeria.

Nigerians who are already hammered by rising petrol price and a devalued naira with resulting inflationary pressures plus an erosion of purchasing power now get electricity less and less lately, and consumers could now be asked to pay as much as as N110 per kWh or a 50 percent jump in some of the premium bands to cover for the market shortfall that has now emerged and for the sector to be cost-reflective.

Read also: Top firms battle rising costs as energy bill hits N221bn

It seems like déjà vu all over again as energy subsidies, which created a national crisis have reared their ugly head largely on the back of the massive devaluation and floating of the naira, according to one energy economist.

Players in the sector told BusinessDay last night that the electricity sector is facing a liquidity challenge driven initially by the six underperforming distribution companies, which until the devaluation had been unable to meet their market obligations to the tune of about N30 billion per month.

With the devaluation and floating of the naira, industry estimates show that the shortfall may have reached N90 billion per month, easily the highest shortfall in the history of the beleaguered market.

Senior electricity sector officials say the shortfall is mainly driven by the abrupt naira devaluation causing significant hike in the gas pricing and the price of generation contracts (like Azura) that are pegged to the US dollar.

The situation is all the more worrisome as the Buhari administration had reduced subsidies from a peak of almost N600 billion in 2019 to just about N100 billion last year, and at the current trajectory, electricity subsidies would hit N1.2 trillion annually (another record) in two years, officials said.

“The more pressing concern by market experts is the fact that this new subsidy is unfunded and unplanned for by the administration,” one official said. “It seems the Tinubu administration, which has yet to appoint a cabinet six months after the February election, didn’t assess the full impact of the naira devaluation on the power sector at all.”

He added: “The key problem for government and the sector now is how do you pass on such a high cost of electricity to consumers that are receiving the lowest amount of energy since privatisation in 2013.”

With the persistent liquidity issues, generation and gas supply are grinding to a halt as generation companies (GenCos), especially those using gas, are groaning under the weight of mounting debts. One of the tasks the Nasir El-Rufai-led expert team had worked on was how to set up a sustainable solution for tariff shortfalls that would allow the sector thrive while balancing the impact on Nigerian consumers in an era of falling purchasing power.

The team is also said to have undertook a robust review on the debts owed to generators and gas suppliers, with an aim to improve supply in the short term and resolve the longstanding liquidity issues.

One expert told our reporter that “with the mounting debt and the record-breaking unfunded shortfall, it is only a matter of time before the market grinds to a complete halt. And that will be devastating.”

With the inability of the government to modulate the pricing of petrol as frequently as needed because of the volatility of the naira, it is feared that billions will now be spent to cover the emerging subsidy of petrol consumption.

Experts speak of an increasing negative investor sentiment on the Nigerian electricity supply industry without clear indication and uncertainty regarding who will lead the power (or energy) sector.

Development finance institutions and Nigeria’s multilateral partners are also relooking at the commitments made to the sector, given the lack of certainty in direction and the reversal of trajectory on electricity subsidies (a key pre-condition for their support).

One investor who asked to remain anonymous said: “The Nigerian electricity sector, as it stands now, is uninvestible due to legacy policy failures and regulatory uncertainties plus the emerging massive market cash shortfall. The expectations of an El-Rufai-led reform with strong backing from Tinubu had seemed exciting to us. But with that now not happening, we are all on a wait-and-see mode.”

Current investors are also quite concerned. A GenCo investor told our reporter: “At this rate, the debts that are mounting will make anyone think twice about putting any new money in Nigeria, for the model we see is unsustainable. The progress made in the past has now been wiped out.”

Nigeria Air has no operating licence, airlines allege - PUNCH

By Lilian Ukagwu

Airline Operators of Nigeria has stated that Nigeria Air, the country’s proposed national carrier, may not commence operations any time soon because it does not have an Airline Operator’s Certificate.

The spokesman of Airline Operators of Nigeria, Prof Obiora Okonkwo, told The Punch in Abuja on Monday, that if Nigeria Air were to begin operations in October 2023, it would be doing so without a valid Air Operator Certificate.

Okonkwo said, “The AOC is still on stage one. I don’t want to waste my time on that thing anymore. If they are starting in October, they are going to be operating without AOC.”

Meanwhile, the CEO of Ethiopian Airlines, Mesfin Tasew, in an interview with Bloomberg TV, on Friday, revealed that the new national carrier, Nigerian Air, would begin operations by October.

He added that the firm was eager to see Nigeria Air start flying local and international routes.

Recall that Nigeria Air had been embroiled in a lot of controversy, especially in the twilight of former President Muhammedu Buhari’s administration.

It could not progress to phase two of the AOC process in June 2023, according to a letter from the Nigerian Civil Aviation Authority.

Speaking further, Okonkwo, who is also the chairman of United Nigeria Airline, added that any action contradicting the court order would be a clear violation of the law.

He expressed a belief that the court would take the necessary step to address the matter.

“The court order is still sub-exiting, so anything against that is a total violation, surely the court would do the needful.

“We have made our position on Nigeria Air known. We don’t have any more time to waste. The industry is facing a more serious challenge now, which is our priority,” he stressed.

FG Unveils Strategy To Stop Japa - INDEPENDENT

The Federal Government has drafted the national business processing outsourcing strategy to nip in the bud the growing level of brain drain, popularly known as Japa in the country.

Kashifu Inuwa Abdullahi ,Director-General of National Information Technology Development Agency,NITDA, ,who disclosed this at the Cisco Incubation and Innovation launch, also said the development was necessary in order to make productive use of young Nigerians to enable them match global demands.

He said there are 16000 young Nigerians engaged in business outsourcing all over the world, but the government is desirous of multiplying this number through the business processing outsourcing strategy .

According to him, the strategy will also ensure that Nigeria overtakes India as the global preferred outsourcing destination through its talented ,creative and energetic young population.

He recalled the recent Memorandum, if Understanding the Federal government had with Cisco on improved public digital transformation, adding that the launch of the company’s innovation and incubation hub would deepen Cisco’s interest in Nigeria’s technological advancement through requisite investment and empowerment of start-up companies in the country.

He also said the launch of the hub aligns with the agenda of President Bola Tinubu’s administration to open up the country’s economy through digital prospect.

Cisco, he said, had already trained over 410,000 Nigeria, adding that the coming on stream of the company’s academy and other agreements the country have with global technology companies would put-paid to the country’s meeting its 95percent digital literacy target in few years.

Speaking, Guy Diederich, Senior Vice President and the Global Innovation Officer at Cisco, expressed his company’s interest in deepening digital transformation in Nigeria on the strength of active young population.

Travel warning for anyone taking hand luggage on flights - Ryanair, easyJet, BA & Jet2 bag restrictions - GB NEWS

With the August bank holiday fast approaching, some Britons may be planning to head to the airport for a staycation break or to go abroad.

There are some travel rules all holidaymakers need to follow when heading to the airport. This includes restrictions on carry on liquids and weight and size restrictions on baggage.

Carry on baggage can be particularly restrictive and getting this wrong could incur costly fees at the check in desk.

Here are the cabin bag rules for Ryanair, easyJet, British Airways and Jet2.

All flights include one small bag, with a handbag or laptop bag being the optimal size.

It must be no bigger than 40x20x25cm and fit under the seat in front of you. Holidaymakers can pay extra for a second cabin bag which must be less than 10kg and 55x40x20cm.

If that's not enough room, checked bags can be purchased at 10kg or 20kg.

Travellers get one free carry on bag that must be less than 45x36x20cm.

Larger cabin bags can be booked for an additional fee and they must be less than 56x45x25cm, including any handles and wheels.

Plus members and those who have booked a FLEXI fare can bring on the second cabin bag free of charge.

Jet2

Jet2 allows travellers to bring two cabin bags on board, free of charge.

The main bag must be no larger than 56cmx45cmx25cm and weigh less than 10kg. A small second bag, such as a handbag, can also be brought on board and it needs to fit under the seat in front.

British Airways

BA also allows holidaymakers to bring on board two bags, included in the price of the flight ticket.

A larger bag of up to 56x45x25cm can be taken on board, however this may need to go into the hold on busier flights.

A small personal bag can also be taken on board. This is guaranteed to go in the cabin.

7.5% VAT Pushes Diesel Price To N950 Per Litre - DAILY TRUST

By Sunday Michael Ogwu

The President of the Natural Oil and Gas Suppliers Association of Nigeria, Bennett Korie, has said the 7.5% value-added tax (VAT) on diesel has pushed pump prices to N900 at the least and N950 at the maximum across Nigeria.

He said this during a press briefing in Abuja while addressing the economic situation in the country which has deteriorated due to marketers’ inability to import diesel as they presently cannot access dollars.

Note that the exchange rate between the naira and dollar closed last week quoting for as high as N955/$1 on the black market.

Korie stated that the foreign exchange crisis, as well as the 7.5% VAT on diesel, have pushed prices from N650 per litre to over N900 per litre.

Korie also addressed the issue of road infrastructure on the Port-Harcourt-Warri road, which further compounds the problems at hand.

He said, “For two weeks now, our tankers have been on that road; you can’t cross it. Our roads are bad, our trucks are trapped on the Warri-Abuja road for two weeks, and our drivers are kidnapped, and killed, while others suffer.”

Ibom Air Becomes Full Member Of IATA - INDEPENDENT

Ibom Air has announced that it has become a full member of the International Air Transport Association.

A release by the General Manager of Marketing, and Communication, Ibom Airlines Limited, Aniekan Essienette and made available to newsmen in Uyo on Friday indicates that the airline was received into the body by the Director General of IATA, Mr. Willy Walsh, in a letter dated 15 August 2023.

Reacting to the development, the Chief Operating Officer of Ibom Air, Mr. George Uriesi, according to the release said, “We are delighted to have completed the administrative processes and to now become a full member of IATA.

“Apart from the multiple benefits Ibom Air stands to gain as a member of the Association, our membership particularly offers a whole new world of cooperation opportunities in the international airline community.

“We intend to tap fully into these as we expand our footprint into the region and continent”.