Market News

Foreign investors raise Nigerian investments by 74% - THE NATION

•Domestic investors sustain rally

Foreign portfolio investors have increased their participation in the Nigerian stock market by almost three-quarters as steady corporate earnings and improving foreign exchange (forex) Liquidity continued to sustain rally by Nigerian equities.

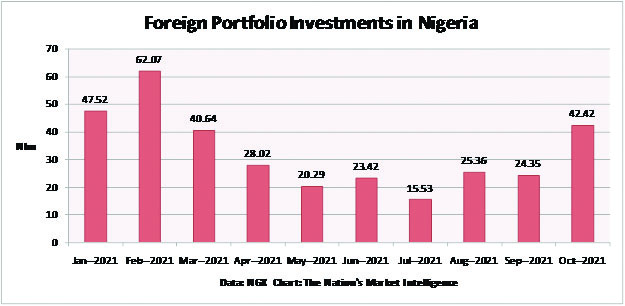

Latest trading data on foreign portfolio investments (FPI) in the Nigerian market at the weekend showed remarkable increase in foreign transactions, strengthening the overall market to sustain a two-month rally.

Total foreign transactions in the Nigerian equities market jumped by 74.2 per cent in October 2021 with inflows and outflows almost at par; a significant recovery from a long-running deficit of inflows to outflows.

The renewed foreign appetite for Nigerian equities further spurred domestic investors’ participation, pushing the overall market transactions up by 80.3 per cent from N118.15 billion in September 2021 to N213.07 billion in October 2021, the highest in seven months.

Total FPIs stood at N42.42 billion in October 2021 as against N24.35 billion in September 2021, the highest foreign turnover since February 2021. Total transactions by domestic investors also increased by 81.9 per cent from N93.80 billion in September 2021 to N170.65 billion in October 2021, the highest since March 2021.

- Advertisement -

A break-down of foreign transactions showed that the FPI deficit narrowed considerably with foreign inflows of N20.91 billion and outflows of N21.51 billion in October 2021 as against N11.93 billion and N12.42 billion respectively in September 2021. Institutional investors continued to drive domestic transactions with the proportion of institutional investors’ dealings rising from N62.04 billion to N112.31 billion. Retail investors’ transactions increased from N31.76 billion to N58.34 billion.

However, FPIs and total market transations continued to lag behind on a year-to-date basis. A 10-month analysis showed that total FPIs in 2021 so far stood at N329.62 billion compared with N591.97 billion recorded in comparable period of 2020.

Foreign outflows outpaced inflows at N173.02 billion and N156.30 billion in 2021, compared with N391.98 billion and N200.59 billion in 2020. Increased domestic transactions meanwhile closed the foreign gap as domestic transactions rose from 10-month turnover of N989.12 billion in October 2020 to N1.215 trillion by October 2021. With these, total transactions stood at N1.54 trillion by October 2021 as against N1.58 trillion by October 2020.

Most analysts attributed the recovery at the Nigerian market to the third-quarter corporate earnings reports,which showed steady improvements in the performance of major corporates as well as the relative improvement in forex liquidity, a major concern for foreign investors.

Analysts remain optimistic about the outlook for the Nigerian market, with most projecting a positive return for the second consecutive year.

“We expect domestic investors’ activities to maintain the current momentum as investors hunt for bargains in dividend-paying stocks ahead of 2021 financial year dividend declarations in first half 2022. Similarly, we expect increased participation from FPIs on account of expected improved dollar liquidity at the Investors and Exporters Window (IEW). Accordingly, we see scope for improved activities from both the domestic and foreign investors over the medium term,” Cordros Securities stated.

Analysts at Cowry Asset Management said the outlook for the market remains positive citing declining inflation rate and relatively high GDP growth rate.

“Also, investors who target appreciative dividend yield would begin to position in the stock market, especially in the banking sector which has recently suffered a pull back in share prices,” Cowry Asset Management stated.

The FPI report, coordinated by the Nigerian Exchange (NGX) Limited, included transactions from nearly all custodians and capital market operators and it is widely regarded as a credible measure of FPI trend. The report uses two key indicators-inflow and outflow, to gauge foreign investors’ mood and participation in the stock market and the economy.

While inflows and outflows indicate direction of portfolio transactions, total FPI measures the momentum and level of participation.

FPIs had declined by 22.64 per cent to a four-year low to close 2020 at N729.20 billion as against N942.55 billion recorded in 2019. The decline FPIs in 2020 counteracted the general increase in momentum of activities at the Nigerian stock market, which saw 12.45 per cent increase in total turnover value.

FPI reports had shown wider gap between foreign portfolio inflows and outflows, implying that foreign investors had divested more than two kobo for every kobo invested in 2020, the worst deficit in recent years.

Total FPIs had increased from N1.208 trillion in 2017 to N1.219 trillion in 2018, before dropping by 22.72 per cent to N942.55 billion in 2019.

The report also showed continuing negative trend in the mix of inflows and outflows, with more outflows than inflows, implying that foreign investors were selling more of their investments than buying more investments. This is known as FPI deficit.

Nigeria recorded FPI deficit of N234.66 billion in 2020, about 125 per cent increase on N104.3 billion recorded in 2019. This implied that foreign investors divested more than two kobo for every kobo invested in 2020. FPI deficit had stood at N66.3 billion in 2018.

The report also showed that the quantum of transactions by foreign investors relative to total transactions at the Nigerian market decreased from about 49 per cent of total activities in 2019 to about 34 per cent in 2020.

Foreign portfolio inflows stood at N247.27 billion as against outflows of N481.93 billion in 2020. Inflows and outflows had stood at N419.13 billion and N523.42 billion respectively in 2019.

Investment experts had attributed the continuing decline in FPIs to Nigeria’s heightened macroeconomic risks amid escalating security challenges and policy uncertainties.

Nigeria’s FPI had slipped into negative with a net deficit of N66.2 billion in 2018 after a world-leading stock market rally left the country with a surplus of N336.94 billion in 2017. Total foreign inflows in 2018 stood at N576.45 billion compared with outflows of N642.65 billion. Foreign inflows had in 2017 outpaced outflows at N772.25 billion and N435.31 billion respectively.