Market News

Africa Startups Defy Funding Slump as Debt Financing Fuels Growth - BLOOMBERG

BY , Bloomberg News

,

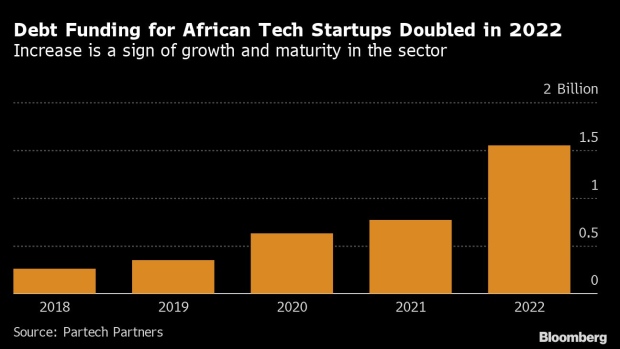

(Bloomberg) -- African startups more than doubled the amount of debt they raised last year, a surge that may continue as an economic slowdown makes equity funding more expensive and unsustainable over the long term.

Companies on the continent raised $1.55 billion in 71 debt deals in 2022, suggesting it’s become a solid alternative source of capital for African technology startups, venture capital firm Partech said in a report.

The growth in debt financing is forecast to continue in the next couple of years, Tidjane Dème, general partner at Partech, said.

“In the same way equity funding picked up over the last few years, driven first by fintech, we expect other sectors” to follow, he said. “We also expect to see more local players emerge and more global players to get involved.”

The surge helped the African technology sector become “one of the very few, if not the only, VC markets to boast net growth funding in 2022,” the Paris-based company said.

VC funding grew 8% to $6.5 billion in Africa, whereas globally it fell 35% last year, according to the firm’s annual survey of startups that have most of their operations in, or get the bulk of their revenue from the continent. Market intelligence company Briter Bridges’s data showed African startups raised a record $5.3 billion last year.

Fears of a global recession and slowing sales have led to a selloff in the world’s largest technology companies, prompting some such as Alphabet Inc.’s Google and Amazon.com Inc. to cut jobs. The slump has made private-equity and venture-capital firms reluctant to invest, increasing the cost of equity and forcing startups to look for alternative funding.

The number of active debt investors on the continent is growing 2.5 times year-on-year, with a good mix of local debt institutions, international lenders and development finance institutions, the report said.

Most of last year’s debt financing went into financial technology and clean technology startups, such as Moove.Africa and D.Light, the study found.

Kenya attracted more debt than any other African country, taking almost 40% of the total amount raised through 15 deals, while Nigeria received the most equity funding, getting $1.2 billion — a 36% decline, compared with a year earlier, in a 189 funding rounds, the report said.

(Updates with comment from Partech in paragraph three)