Travel News

Canadian job gains stall as unemployment rate hits new low - BLOOMBERG

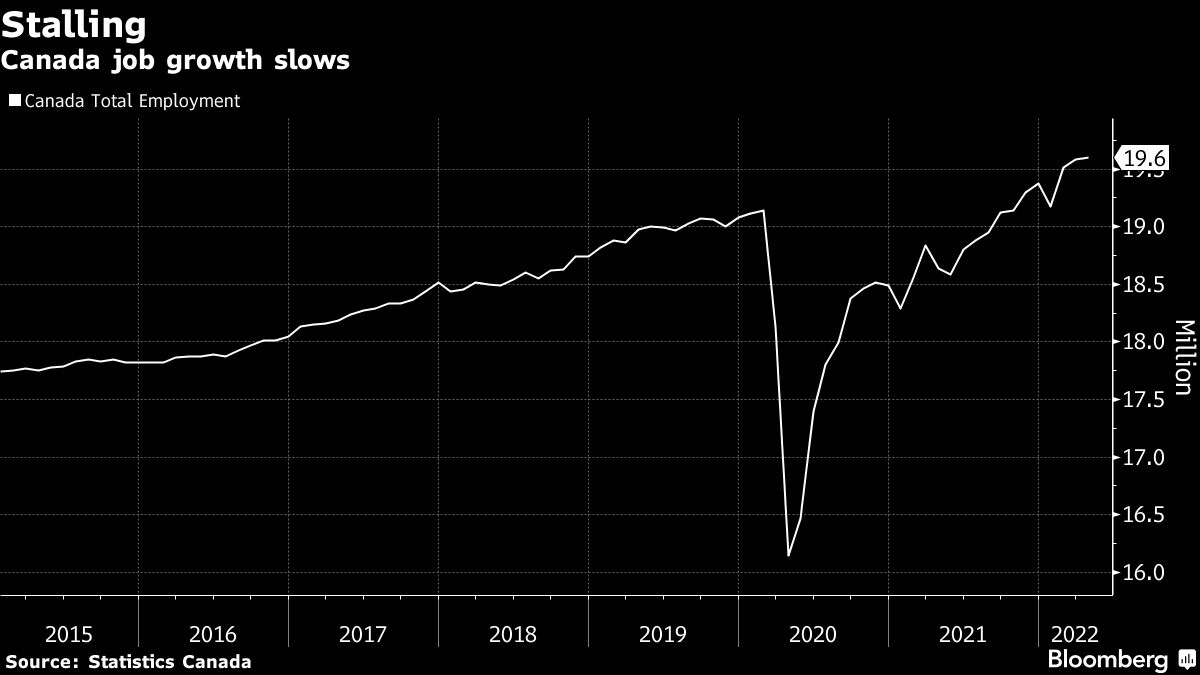

Canada’s labor market stalled even as the jobless rate fell to a new record low, hampered by a dearth of new workers.

The economy added 15,300 jobs in April, Statistics Canada reported Friday in Ottawa, fewer than half the 40,000 gain anticipated by economists. The small increase ended a surge that saw Canada create about 410,000 jobs over the previous two months.

The unemployment rate fell to 5.2 per cent in April -- the lowest in data going back to 1976 -- as the economy failed to produce any new growth in the labor force.

With employment already well above pre-pandemic levels, economists and policymakers have been anticipating a slowdown in job creation as the nation struggles to find new workers, amid elevated demand from employers. The imbalance between demand and supply of jobs is a primary reason why the Bank of Canada is tightening monetary policy. Canada’s economy has added almost 1 million jobs over the past year, with employment nearly half a million above February 2020 levels.

“This is an indication that we’re reaching a fairly mature stage in the economic cycle,” Josh Nye, a senior economist at Royal Bank of Canada, told BNN Bloomberg television. “It’s just going to be difficult to generate job gains on the scale that we’ve been used to in the past year or so.”

The yield on benchmark two-year Canada bonds dropped about 4 basis points after the numbers were released to 2.682 per cent as of 8:42 a.m. The loonie was little changed at $1.2836 per U.S. dollar.

Worries that Canada’s economy is up against capacity are stoking expectations the Bank of Canada will aggressively hike interest rates in coming months, including a half-point increase at its policy decision next month. The central bank has raised its policy rate by 0.75 percentage points since early March to 1 per cent, and trading in overnight swaps suggest it will climb another 2 percentage points by the end of this year.

Canada’s labor-force participation rate dipped to 65.3 per cent in April. Adding to evidence of a tightening market, involuntary part-time employment reached 15.7 per cent, a record low.

The data also show the extent to which the economy was impeded by a surge in coronavirus cases last month, as the omicron variant swept the nation. Hours worked fell 1.9 per cent in April, in part because of a jump in COVID-related absences, Statistics Canada said.

Average hourly wages were up 3.3 per cent from a year earlier, little changed from 3.4 per cent in February. For permanent employees, wages were up 3.4 per cent. The nation lost 31,600 full-time jobs in April, which was more than offset by a 47,100 increase in part-time employment.

Construction led declines, with employment in the sector down by 20,700 jobs. Service-related industries posted a 31,400 gain for the month.

Making Nigerian Airports Viable - THISDAY

With about 32 airports and counting, Nigeria may be one of the countries in Africa that have the highest number of airports, but most of the airports are not viable. Industry stakeholders are therefore proffering ways airports in Nigerian could be made viable and profitable, writes Chinedu Eze

One of the major challenges airports face in Nigeria is that many of them are not viable. Airport business is capital intensive and it takes whooping sum to maintain existing airports, because only few of them generate income that can be used to sustain their operations.

This is why many states that built airports in the past later handed them over to the Federal Airports Authority of Nigerian (FAAN) to manage. Many industry observers are of the view that the states that built these airports were not innovative to find ways to make the airports viable. They stated that in many parts of the world, airports are profitable because they are made host of many businesses, including hospitality facilities, enterprises, including shopping malls, and even discotheques. Recognising that the sterile areas of the airports are highly restricted, many other businesses can go on at other parts of an airport.

Recently the Chief Executive Officer (CEO), Finchglow Travels and the former President of the National Association of Nigeria Travel Agencies (NANTA), Mr. Bankole Bernard, spoke extensively on effective and profitable management of airports.

Concession

One of the reasons why aviation workers opposed the concession of four major airports in Nigeria, which include Lagos, Abuja, Kano and Port Harcourt was because these airports are the most profitable; so the question arises, if these airports are given out to the private sector as concession, how will the other airports that are unviable be sustained?

Bernard said, “We have all been distracted with the concessioning of the four major airports in Nigeria that we consider to be viable and we have neglected other airports all in the name of the fact that they are not commercially viable and my question is: Where is the document that revealed to any of us that those airports are not commercially viable? Are we looking at revenues from passengers as the only means that make an airport commercially viable?”

The former NANTA President explained that so much could be done with airport terminals and so many businesses and other investments could be hosted in airport terminals.

“As a matter of fact, let me tell you that airport terminals are no longer what they used to be. As a matter of fact, in some countries, they have turned their airports into a shopping mall – local and international where you can do and undo with a lot of things and that alone attracts passengers to ply such airport. So, if we have such a viable business outlook, why should we continue to say an airport is not commercially viable? There are quite a lot of things that we need to do and when we put those things in the right perspective, an airport becomes commercially viable.”

He argued that the federal government and the state government have not exploited the opportunities available to potentially maximiseopportunities offered by these airport facilities. For example, out of all the airports in Nigeria, only the Asaba International Airport has been given out in concession for the private sector to develop. Other states have held on tightly to their airports while they lament perennially that they are not profitable.

When Bi-Courtney opened the Murtala Muhammed Domestic Airport Terminal (MMA2) in 2007, established under the concession arrangement of Build, Operate and Transfer (BOT), it was expected that both the federal and the state government would take a cue from that successful concession and hand over many of the airports to the private sector. But it took another 14 years before Delta state government successfully concessioned the Asaba airport.

“If you say airport is not commercially viable, why don’t you allow those that have interest in those airports to turn them around? I have always said it that government is not in a business of doing business. They are regulators. They should stick to their strength, which is regulating, while we allow the business people to handle the business aspect of this.

Government can allow them to take some critical business decisions by allowing them to run the business the way it should be. I have been to some airports around the world and I will give you some instance.

“Do you know that the Baltimore/Washington International (BWI) Thurgood Marshall Airport in United States as small as it is, it is an active airport? It is active because they are building more shops and renovating the place so people can enjoy the airport.

Akure airport, for instance, had only one airline going there before, but now about three airlines go there. Are you still saying the traffic is still the way it was? Let me remind you at this point that Nigerians are constantly developing the culture of flying,” Bernard said.

Recovery

According to Bernard, statistics revealed that the recovery of travel in Nigeria is the highest in the world. He said the Nigerian figures indicated that the country is higher than the world and continent’s figures.

“But this is the same place where we have no money nor do we have a national carrier. This tells you that there is a culture. We have developed the flying culture and the number keeps increasing by the day. If the number is increasing by the day, it means it is a viable market.

“They shouldn’t tell us our airports are not commercially viable. People like us that come in have even the opportunity to prove that these airports are viable. How do you make an airport viable when you only put on the generator when you have an aircraft approaching and the moment the aircraft lands, you put off the generator again? This will not be viable because you have lost communication, so even when people show up and they can’t get electricity, they will probably stop,” he said.

The stakeholders noted that there are quite a lot of things that could be done to make nation’s airports commercially viable as long as there is a genuine interest and the facilities are given it to those that are passionate about the industry and not given to relatives and friends of political leaders to manage.

Travel expert and organiser of Akwaaba African Travel Market, Ambassador Ikechi Uko told THISDAY that airports can be profitable on their own, even when the aeronautical revenue is lean. He said that airports could be turned into tourist hub, businesses could be created around the airport, as aerotropolis, but when this is not done, airport environment could become residential area.

For example, many parts of the Lagos airport have been taken over by individuals and built private houses and it is difficult to recover those areas as airport premises.

“An area where businesses enterprises could be established in an airport environment could be turned to high quality real estate if such spaces are not quickly utilised to host business hubs, hotels.

“Many years ago, I made a proposal to build 13 hotels in the so-called unviable airports. An airport owner, whether state, federal government or individual can make his money by locating other businesses at the airport,” he said.

Federal Governments Airports

The Chief Executive Officer of Finchglow Travels said both federal government and state government owned airports are still under the scrutiny and regulation of the Nigerian Civil Aviation Authority (NCAA), noting that if the authority does not give approval, no airport would operate and government is considered to be the same everywhere. So there should be no difference in practice or in expectation from the airports owned differently.

“If NCAA doesn’t give an approval, it can’t operate and government is the same anywhere in the world. It is just in this part of the world that we try to demarcate one from the other. Since government is the same, it means the users of the airports must just see it as the same. In a state owned airports, are the state governments saying the airports are not commercially viable? If they are saying same, then, let them give it out to a private sector that will run them effectively and efficiently that you will produce the kind of result that you like,” Bernard said.

He remarked that there are so many opportunities airport managers can make money from. For example, at the MMA2 at Lagos airport there are banks, eateries, gym, car parks, meters and greeters, communications companies, pharmacy and many others.

“If you give me the Murtala Muhammed Airport (MMA), Lagos to run for one year, I will turn it around to the extent that I will triple the income that comes in. There are certain things that you will not joke with. How effective are the Wi-Fi within our airports? And it has to be free usage for everybody. For everybody that logs in, I am capturing their data. With that alone, I can tell you what the traffic is at that airport.

“Then, the shops now become viable because they now have Internet to trace and monitor a lot of things. Look at the toilets, why will you get to a toilet and the whole place is in a mess? Water on the floor, yet somebody is being paid? We have to remove all manners of sentiments. Let the best man that can do the job do it. These are the Key Performance Indicators (KPIs). Those things are necessary,” he said.

Car Park

Many industry observers believe that FAAN has no maximise the benefits of car parks by building more car parks like the one at the international wing of the airports. They remarked that multi-story car parks maximsesspace and add value by protecting vehicles from sun and rain while charging for the services. In addition, ancillary services like car wash, maintenance services could be established through concession and these would add to more activities that earn revenue at the airport.

According to Bernard, there must be arrangement whereby cars are parked and the government is making money from it.

“The car parks are not properly managed. You don’t have to see anybody there giving out tickets and collecting money. When you travel abroad, you don’t see anybody at the car park. From the terminal, you have paid your toll. The Closed Circuit Television (CCTV) cameras are there monitoring activities. Then can we say our airports are not viable? They are, but it is just our approach that we create around it. Then, we should stop this idea of do you know who I am? Who are you? We are all VIPs. If we all respect the law, we will make this country good for us and our generation yet to come,” he said.

According to FAAN sources, only few airports managed by the agency earn good revenue and the money earned by the Murtala MuhammedInternational Airport, Lagos is used to sustain other airports in the country. THISDAY learnt that non-aeronautical revenue sources are totally under developed in many airports in the country, especially those airports FAAN was forced to take over by the federal government. Industry stakeholders blame lack of innovation and lack of creativity as the major reason why many airports in Nigeria are unviable.

Some retired FAAN officials posit that for FAAN to develop the airports under its management, it must be made autonomous and the meddlesomeness of government through the Ministry of Aviation must be stopped, but for now, FAAN is micromanaged by the Ministry of Aviation.

British Airways is the latest airline to cut its summer flight schedule as it scrambles to hire enough staff to cope with the rebound in air travel - BUSINESS INSIDER

British Airways reduced its summer flight schedules by 10% amid staff shortages.

Southwest Airlines, JetBlue, and Alaska Airlines had already cut flight numbers this year.

Demand is returning to pre-pandemic levels but airlines are dealing with a lack of staff.

British Airways reduced its flight schedules this summer, following its decision to cut almost 10,000 jobs when it faced travel restrictions during the pandemic.

The Financial Times reported the news on Saturday.

The UK airline is joining several other carriers in slashing the number of flights it is offering passengers this year. It plans to cut 10% of its flight schedules between March and October, due to a shortage in staff, according to the FT.

JetBlue Airways cut flights for May by between 8% and 10% and plans to make similar reductions for the summer, a CNBC report says. JetBlue made 2,500 new hires already this year but it is still understaffed, per the report.

Similarly, Alaska Airlines cut 2% of its flight schedule until the end of June after being forced to cut flights in April as a result of a lack of staff, per the CNBC report. While Southwest Airlines cut 65,000 spring flights, an SEC filing shows, and 20,000 summer flights, Dallas Morning News reported.

The airline industry is now grappling with staff shortages as it previously cut its workforce during the pandemic, amid global travel restrictions and reduced demand. Delta Air Lines was forced to drop more than 10 routes last year because of the slowdown in demand.

The number of flights British Airways has cut is the equivalent of 8,000 round trips, a majority on short-haul routes, British Airways chief executive Sean Doyle told the FT.

The airline plans to hire 6,000 new staff members to cope with demand, which Doyle says is between 65% and 70% of 2019 levels for business travel.

"The US carriers had similar rebuild problems earlier in the process, we see problems in Europe and the UK industry getting the system back up and running," Doyle told the FT.

However, not all airlines are coping with the return in demand but cutting flights as they have fewer operational challenges than big carriers. British Airways told Insider that while the past few weeks have been "challenging," the company is focused on its customers, supporting its "biggest recruitment drive," and increasing its operational resilience. "We've taken action to reduce our schedule to help provide certainty for our customers and are giving them maximum flexibility to either rebook with us or another airline as close to their original departure time as possible, or to receive a full refund," British Airways said in a statement.

JetBlue, Alaska Airlines, and Southwest Airlines were not immediately available for comment.

Nigerian airlines suspend plans to ground local flights over cost of jet fuel - REUTERS

By Camillus Eboh and Macdonald Dzirutwe

ABUJA, May 8 (Reuters) - Nigerian airlines have suspended plans to ground all local flights due to the soaring cost of jet fuel just hours before the move was due to take effect, the airline operators association said on Sunday.

The Airline Operators of Nigeria has been under pressure from the government, consumer protection bodies and customers to shelve the planned shut down since it was announced on Friday. read more

Airlines are complaining about paying for jet fuel upfront in cash at 700 naira ($1.69) per litre, a price that has more than doubled this year, partly as a result of Russia's invasion of Ukraine, increasing their operating costs by around 95%.

Dollar shortages in Nigeria and a weaker local currency have worsened the woes for the sector, which also faces the country-wide challenges stemming from double-digit inflation, slow growth and mounting unemployment and insecurity.

The aviation ministry said earlier on Sunday that local airlines have faced unfavourable global oil market dynamics but efforts are ongoing to find a "lasting solution to the perplexing issue of aviation fuel availability and affordability".

Fuel shortages and high debts caused some carriers to suspend local flights indefinitely in 2016. Though the government has intervened with financial assistance to support the sector.

Nigeria subsidises imported petrol to keep pump prices low. But with the rise in global oil prices, the country has endured soaring costs in order to avert strikes, especially in the run-up to presidential elections next year.

Air Peace, Nigeria's biggest carrier, with flights to Dubai and Johannesburg, said on Sunday the suspension would go ahead before the association changed its stance.

Ibom Air on Saturday pulled out of the flight suspension due to obligations to financiers and suppliers. It was followed by Dana Air. read more

($1 = 414.69 naira)

(This story was refiled to fix typo in para 6.)

Why queues returned to Abuja filling stations — NNPC - VANGUARD

By Obas Esiedesa, Abuja

The Nigerian National Petroleum Corporation (NNPC) Limited has attributed the appearance of queues at filling stations in Abuja to disruption in loading due public holidays last week.

The Corporation in tweets on its official Tweeter handle in the early hours of Monday said it was ramping up loading to eliminate the queues.

The NNPC Limited stated: “The NNPC Ltd notes the sudden appearance of fuel queues in parts of Abuja. This is very likely due to low loadouts at depots which usually happen during long public holidays, in this case, the Sallah celebrations.

“Another contributing factor to the sudden appearances of queues is the increased fuel purchases which is also usual with returning residents of the FCT from the public holidays.

“NNPC and the Nigerian Midstream and Downstream Petroleum Regulatory Authority (@NMDPRAtweets) in conjunction with our marketing partners have taken necessary measures to ramp up loadouts from all depots.

“We assure all residents of the FCT, and indeed all Nigerians, that we have ample local supplies and national stock in excess of 2.5 billion liters, with sufficiency of more than 43 days.

“The NNPC Ltd hereby advises motorists not to engage in panic buying as supplies are adequate as will become increasingly evident in the coming days”.

Fuel queues resurface in Abuja, neighbouring states - PUNCH

BY Okechukwu Nnodim

Most filling stations in Abuja and neighbouring states of Nasarawa and Niger that dispensed Premium Motor Spirit, popularly called petrol, on Sunday were greeted with long queues.

It was observed that many other outlets were shut as they claimed not to have products to dispense, a development that led to the crowding of the filling stations that dispensed the commodity.

Queues were seen at the Nipco filling station along the busy Zuba-Kubwa expressway in Abuja and at the Conoil and Total filling stations located opposite the headquarters of the Nigerian National Petroleum Company Limited in the capital city.

In Zuba, Niger State, the few stations that dispensed products also had long queues formed by motorists. The same scenario played out in Mararaba, Nasarawa State.

The spokesperson of NNPC, Garba-Deen Mohammad, promised to revert with an explanation on what might have led to the resurfacing of queues in Abuja, when he was contacted. He, however, did not.

But dealers told our correspondent that a number of factors could have warranted the queues, as they explained that petrol transporters had been calling for improved bridging claims due to the high cost of diesel.

This, it was gathered, had occasionally discouraged some tanker owners from lifting products to retail stations.

Also, they stated that the loading of products had been low, as this was partly due to the recent Sallah break and the limited number of trucks to transport products.

They, however, assured that the queues would clear in days, as efforts were on to handle the situation.

This came as NNPC announced on Sunday that it evacuated 537.75 million litres of petrol between April 25 and May 1, 2022, translating to an average daily evacuation of 76.82 million litres during the review week.

After Intense Pressure, Airlines Rescind Planned Shutdown - DAILY TRUST

By Abdullateef Aliyu And Chris Agabi

After an intense pressure from the Federal Government, the Airline Operators of Nigeria (AON) yesterday backtracked on its decision to suspend flights nationwide over the skyrocketing price of aviation fuel known as Jet A1.

They said the decision was in respect to the appeal by the Federal Government to call off the action while promising to urgently intervene in the crises being faced by airlines “due to the astronomic and continuously rising cost of JetA1.”

However, the aviation unions said they would go ahead with the plan to embark on a two-day warning strike beginning on Monday over issues bothering on conditions of service.

If the planned strike should go ahead, it means there would be flight disruption as the air traffic controllers would not be on duty.

Daily Trust however reports that the decision by the AON was coming after no fewer than six airlines had already chickened out of the planned shutdown.

The airlines which pulled out of the earlier joint decision to suspend operations over skyrocketing Jet A1 included Ibom Air, Dana, Arik, Aero, Overland and Green Africa Airways.

President of the AON, Alhaji Abdulmunaf Yunusa Sarina issued a statement announcing the reversal of the planned shutdown.

He said, “We have also reached this decision with the highest consideration for our esteemed customers who have been faced with uncertainty over the last few days and to enable them to have access to travel to their various destinations for the time being during the period of discussions with relevant authorities.”

The Minister of Aviation, Senator Hadi Sirika had earlier in a statement by his special assistant, Dr James Odaudu lauded those who have pulled out of the planned shutdown and expressed hope that the airlines would “consider the dire implications of the planned action for businesses and individuals and review their decision likewise.”

The minister also “assured foreign airlines operating in the country that all the requisite logistics and services for their operations remain in place as usual and that no disruptions whatsoever should be envisaged.”

President of ART, Dr Gabriel Olowo who earlier pleaded with the operators to heed the appeal of the Minister said, “Aviation Fuel has been an issue for upwards of 20 years in Nigeria without serious attention. Yet airlines keep operating out of being patriotic. Regrettably this is planning for an accident.

“If any Airline pretends about this problem, such Airline must be receiving subsidies for the business or “cutting corners”. No operational and management skill can answer for this uncontrollable factor of the business. My take is that the government must provide a lasting solution once and for all at this time.”

However, General Secretary of the National Union of Air Transport Employees (NUATE), Comrade Ocheme Aba told our correspondent that the planned industrial action in aviation agencies would go ahead.

The agencies affected are the Nigerian Airspace Management Agency (NAMA), the Nigerian Civil Aviation Authority (NCAA) and the Nigerian College of Aviation Technology (NCAT).

Prepare for worst fuel scarcity, petrol marketers alert Nigerians - PUNCH

BY Tukur Muntari

The Independent Petroleum Marketers Association of Nigeria has asked Nigerians to prepare for the worst fuel crisis.

To avoid this, the petrol marketers association asked the Federal Government to prevail on the Nigerian Midstream and Downstream Petroleum Regulatory Authority to pay its members their outstanding bridging claims amounting to over N500 billion.

The IPMAN chairman in Kano State, Bashir Danmalam, made the remarks while addressing a news conference in Kano State on Monday.

He said the failure of the NMDPRA to pay the the bridging claims, otherwise known as transportation claims, had forced many of its members out of business as they couldn’t transport the commodity due to high cost of diesel.

He lamented that non-payment of the claims by NMDPRA for over eight months had crippled the businesses of many of their members as they couldn’t transport the commodity even though it was available.

“NMDPRA is responsible for the payment of bridging claims otherwise known as transportation claims

“For failure of the NMDPRA to pay the outstanding claims for about nine months, many marketers cannot transport the product because their funds are not being paid. Despite the high price of diesel, they manage to supply the petroleum products nationwide.

“The resurfacing of fuel queues in Abuja is just a tip of the iceberg with regard to the petroleum scarcity.

“Out of 100 per cent, only five per cent of the marketers can supply the petroleum products because of the failure of NMDPRA to pay them.”

He noted that after the amalgamation of DPR, PEF, and PPRA to NMDPRA, the agency had paid them only two times.

Danmalam, therefore, called on the Federal Government to intervene before the situation degenerated into a serious fuel crisis and spread to other parts of the country.

“As leaders, we have to come out to say the truth because our members are suffering from the failure of the agency to pay the fund. This Petroleum Equalisation Fund is our own money we contribute to each litre. This agency is doing more harm than good to us,” Danmalam said.

He said Nigerians should not blame their members for the fuel scarcity but rather ascribe it to NMDPRA.

“We are not agitating for a transportation fee increase, we are only clamouring for payment of our bridging claims that is over N500 billion,” he added.

Aviation fuel: NNPC, airlines agree on three-month supply at N480/litre - PUNCH

BY Leke Baiyewu

The House of Representatives on Monday held a stakeholders meeting to resolve the crisis trailing the aviation fuel price increase, with the Nigerian National Petroleum Company Limited and domestic airline operators reaching a deal.

It was agreed that the NNPC would supply Jet-A1 to marketers nominated by airline operators for a period of three months at N480 per litre, pending when the carriers would be granted licences to import the commodity.

This is just as the AON said it had nominated 10 marketers for the purpose.

The Speaker of the House, Femi Gbajabiamila; and Deputy Speaker, Ahmed Wase, presided over the meeting that lasted about four hours, with the Governor of the Central Bank of Nigeria, Godwin Emefiele; and the Group Managing Director, Nigerian National Petroleum Company Limited, Mele Kyari, among others in attendance.

Airline operators had last week threatened to halt their services over soaring aviation fuel prices, effective Monday (yesterday).

They had given a notice to the Minister of Aviation, Hadi Sirika; and the Director-General, Nigerian Civil Aviation Authority, Musa Nuhu.

The AON said the price of aviation fuel had risen from N190 to N700 per litre.

The operators, however, suspended the planned flight shutdown for economic and security reasons.

The Senate and the House had intervened in the fuel crisis before the notice.

After the meeting on Monday, Gbajabiamila said the stakeholders had reached a four-point agreement, following their meeting with the airlines. Firstly, he said the carriers had agreed to call off the proposed withdrawal of services.

The Speaker said in part, “Two, NNPC and the airline operators have both agreed that in the interim – for three months, your (AON’s) marketers of choice, that you are comfortable with, that you know their price would not drive you out of business, would be supplied with jet fuel.

“The third resolution is that in the mid-term to long-term, in fact right now, you will begin or commence the process of applying for your license to be able to import your own jet fuel, so that it will remove middleman or the vagrancies of it; you will know the landing cost and how it will assist you in your business.

“According to the CBN governor, there are six million litres available now at N480. You will get an allocation in the next three months through the companies (marketers) that you have nominated so that you would not come back and say jet fuel is now a certain amount and it is the fault of the NNPC. You have nominated those people that are selling to you.”

Gbajabiamila added, “And in the process of applying for their licence, Midstream would as much as possible grant as many waivers as possible that do not touch on security and safety.”

The meeting also agreed that the House Committee on Aviation should be part of the further talks between oil regulators, aviation regulators and the airline operators.

Reechoing what other stakeholders had alleged, Gbajabiamila stated, “I agree with you; I think the problem is with the marketers.”

While thanking those in attendance, the Speaker said, “The last people we want to thank are the marketers right now.”

Before then, Kyari had accused the AON of “attacking” and “making institutions” on the NNPC over its role in the crisis.

The Vice-Chairman, AON, Allen Onyema, who is also the Chairman of Air Peace, however, denied the allegation, saying the operators took exception to the GMD’s comments.

Earlier in his opening remarks, Gbajabiamila said, “We are at the precipice today in Nigeria. It is a crucial moment for us. There is a crisis at hand. The shutdown of airline operations has the potential of shutting down this government. We cannot sit here as stakeholders and fold our arms and watch this happen. We need to address this matter once and for all.”

Onyema also said, “We were told here at that last meeting that fuel would be sold to us at N500, which we protested that it was still on the high side because even when fuel was selling at N200 or N250, the operating cost was about 40 per cent worldwide. It is like that.

“It rose to N400 and then to N450, and that was when we were alarmed and you noticed that everybody tweaked his inventory when we now raised our base fare to about N50,000, which did not actually address the matter. That was when it was N400.

“We were invited to the House and when we came here, it was reached that they would give us fuel at N500 within three days. That never happened. We continued writing and nothing happened.”

The AON vice chair added that Nigerian Midstream and Downstream Petroleum Regulatory Authority later invited the operators and they were told that the President, Major General Muhammadu Buhari (retd.), had “approved 25,000 metric tonnes for us as a palliative to help us.”

He said, “We were very grateful to the President. It was not free. We were happy. We were told to nominate marketers that would market this product for us. We were told to have a meeting with these marketers. We called all the marketers. We held a meeting with them. We decided the logistics, so they would take their logistical costs and everything.

“At the end of the day that fuel was getting to them, they told us, at N335. So, we put everything together and it would be less than N400 for the cost and we said even if they sell to us at N450, it would be okay.

Onyema stated, “If we crumble today, over a million jobs would be lost.” Kyari also admitted that the last meeting agreed to make the marketers sell the product to airlines at N500 per litre for three days, pending the day they would sit down and agree on this pricing formula.

He said, “I confirm that they had sat down and engaged and agreed on a pricing structure. Needless to say, there is no fixed price. This is a deregulated product. So, you cannot hold onto any price. And indeed, what you have seen in the media is a N700 reference point. It cannot be a reference point. It depends on the market condition. It can be higher than N700, depending on the market. This market shifts. As we speak, it is closely related to the price of crude oil.

“We cannot fix the price. We cannot ask for N500. We cannot say it must be below N600 or N700. That is why we insisted they go and have a formula that is transparent that each one of us can see. The only way we can have fixed prices is if we put subsidies on. You can say it can sell for N500 in any circumstance, then somebody has paid for that difference. I am not sure this is what we are doing.”

Heathrow to reopen Terminal 4 in July as 53 million expected to book flights - YAHOO FINANCE

London's Heathrow airport has said it will reopen Terminal 4 by July and is already recruiting up to 1,000 new security officers.

Heathrow increased its 2022 passenger number forecast from 45.5 million to nearly 53 million as it warned of “significant challenges” ahead.

The London hub said outbound leisure travellers and people cashing in airline vouchers obtained for trips cancelled due to the coronavirus pandemic are driving the recovery in demand.

This 16% rise in expected travellers follows a “strong” April, with 5.1 million people using the west London airport.

In what it said was a “realistic assessment”, Heathrow expects passenger numbers to reach 65% of pre-pandemic levels this year.

It still expects to remain lossmaking throughout this year.

The airport cautioned that the war in Ukraine, higher fuel costs and cost of living squeeze “creates uncertainty going forward.”

“The ongoing war in Ukraine, higher fuel costs, continuing travel restrictions for key markets like the United States and the potential for a further variant of concern creates uncertainty going forward.

“Together with last week’s warning from the Bank of England that inflation is set to pass 10% and that the UK economy will likely ‘slide into recession’ means we are taking a realistic assessment that travel demand will reach 65% of pre-pandemic levels overall for the year,” the London airport said in a statement.

Chief executive John Holland-Kaye added: “We all want to see travel get back to pre-pandemic levels as quickly as possible, and, while I am encouraged by the rise in passenger numbers, we also have to be realistic.

“There are significant challenges ahead. The regulator can either plan for them with a robust and adaptable regulatory settlement that delivers for passengers and withstands any shocks, or they can prioritise airline profits by cutting back on passenger service, leaving the industry to scramble when things go wrong in future.”

Airlines have accused Heathrow of playing down the recovery of demand as part of efforts to convince the Civil Aviation Authority (CAA) to allow it to raise fees further.

The regulator is in the final stages of setting a five-year cap on the airport’s charges.

Heathrow does not forecast paying dividends to shareholders in 2022.