Travel News

U.K. Covid Testing Companies Face Removal Over Misleading Prices - BLOOMBERG

BY , Bloomberg News

Bloomberg) -- Almost a fifth of companies advertising Covid-19 tests for travelers returning to the U.K. from abroad face removal from the government’s list of providers over misleading prices, the health department said.

Some 82 private travel testing companies will be issued a two-strike warning and could be removed from the government’s website, Health and Social Care Secretary Sajid Javid said on Monday in an emailed statement.

Javid earlier this month asked the U.K.’s competition watchdog to probe testing companies in order to help stamp out any “exploitative behavior” by rogue firms. Monday’s action marks a clamp-down on “cowboy” practices, Javid said. His department said that as part of the ongoing review, “regular spot checks will be introduced from this week to make sure companies are complying with the rules.”

The GOV.UK site will also be updated this week to reflect the true cost of travel tests this week, it said. Fifty-seven companies will be removed from the list because they no longer exist or don’t provide relevant services.

People returning to England from a countries deemed at lower risk must take a Covid-19 test before departure and book a test for day two after arrival. People headed to and from the U.K. by air spent at least 380 million pounds ($520 million) on tests in the first six months of the year, based on a Bloomberg analysis of passenger traffic data from the Civil Aviation Authority and London Heathrow airport.

Canada's Big 5 banks will mandate COVID-19 vaccines for staff - THE

All five of Canada's big banks will soon make vaccines mandatory for all staff who wish to return to the office, and those who don't comply will have to agree to regular testing.

TD told its employees in an email Friday that all employees are being asked to register their vaccination status with the bank by the end of next month.

"Effective November 1, 2021, full vaccination of an approved COVID-19 vaccine will be a requirement for all TD colleagues entering the TD workplace," reads the email from chief human resources officer Kenn Lalonde obtained by CBC News.

The memo does not say what the punishment will be for non-compliance, but makes it clear that anyone who is unvaccinated will have a number of hoops they must go through.

"Starting November 1, 2021, there will be additional protocols for colleagues who are still not fully vaccinated, or have not disclosed their vaccination status, including the completion of a learning module about the benefits of vaccination, mandatory COVID-19 rapid testing, and the wearing of a face covering at all times," the memo reads.

CIBC wrote a blog post to staff announcing a similar policy that will be in effect by the end of October.

"We have … strongly encouraged every member of our CIBC team to get vaccinated," said Sandy Sharman, the bank's group head of people, culture and brand.

"It's the single best way to turn the corner on the pandemic, and an important way we can protect our family, friends and colleagues. That's why today, I wanted to share with you that we will be requiring employees to be vaccinated by October 31, 2021."

Bank of Montreal told all staff in an email from chief human resources officer Mona Malone that due to the rise of the delta variant, it will also be mandating vaccines for all in-person staff.

"Our new requirement is that all North American employees and contractors eligible for vaccination get their shots, with a target completion date of October 31," Malone said. "Those who remain unvaccinated will be required to complete twice-a-week COVID-19 testing and comply with alternative health and safety measures to enter a BMO location."

Scotiabank is making a similar move, although is not attaching a firm date to the policy. "We are moving in the direction of making vaccinations mandatory for all Canadian-based employees, and contractors, later in the fall," chief human resources officer Barb Mason told all staff in a memo obtained by CBC News.

The Royal Bank of Canada will also be mandating vaccinations, with CEO Dave McKay saying on a post on social media platform LinkedIn that "over the coming days and weeks, we will be [attempting to] confirm the vaccination status of all our employees. This effort will begin in Canada and the U.S., where those who are able to be fully vaccinated will be required to do so by October 31."

The moves by four of Canada's biggest banks come a week after the government in Ottawa asked federally regulated industries — which would include banks — to mandate vaccinations as COVID-19 cases caused by the delta variant of the coronavirus continue to mount.

Porter Airlines and financial conglomerate Sun Life made similar moves on Wednesday. Numerous municipal governments, universities and public services such as the Toronto Transit Commission have announced vaccine mandates in recent days.

Scotland Warns Virus Rules May Be Reimposed Amid Record Cases - BLOOMBERG

(Bloomberg) -- Scotland’s First Minister Nicola Sturgeon said her government could reimpose coronavirus restrictions amid a record number of new daily cases.

The country of 5.5 million people reported 4,323 new Covid-19 cases in the last 24 hours, the highest daily number since the start of the pandemic.

“If this surge continues and accelerates and we start to see evidence of substantial increase in serious illness, we cannot completely rule out having to reimpose some restrictions,” Sturgeon told reporters in Edinburgh.

The bulk of Scotland’s remaining restrictions on movement and social interaction were lifted in early August as increasing numbers of the country’s population received their vaccinations.

While about 80% of Scotland’s adult population is now fully vaccinated, there’s been a reluctance among younger people to get inoculated and approximately half of all new cases are in people younger than 25, Sturgeon said.

Sturgeon earlier confirmed plans to set up an independent judge-led public inquiry into her government’s handling of the pandemic before the end of the year. Scotland’s devolved government is responsible for some parts of the economy, including health.

Canada's Trudeau goes big on housing policy to woo back voters - REUTERS

By Steve Scherer and Julie Gordon

HAMILTON, Ontario (Reuters) -Canadian Prime Minister Justin Trudeau, seeking to revive his election prospects, on Tuesday unveiled a housing plan that pledged a ban on foreign buyers, a rent-to-own program and other measures to tackle soaring home prices.

Trudeau promised to build more homes and make home buying more transparent to help the many Canadians who are unable to join the housing market.

"If you work hard, if you save, that dream of having your own place should be in reach," Trudeau said in Hamilton, Ontario, a fast-growing city outside Toronto.

The election is on Sept 20.

Trudeau, buoyed by a successful vaccination campaign, appeared to be cruising toward a majority after calling the vote on Aug 15. But support has melted away and his Liberals are now at 33% to 31% for their rival Conservatives, according to a recent Nanos Research poll.

Housing affordability is a key issue, given housing prices have sky-rocketed during the COVID-19 pandemic. The Canadian Real Estate Association's home price index is up 69.7% since November 2015, when Trudeau first took office.

To address the demand side, the Liberals are promising to ban new foreign ownership of Canadian homes for the next two years and expand an existing tax on foreign-owned vacant housing, along with a new anti-flipping tax and a more transparent bidding process.

"We'll crack down on predatory speculators that stack the deck against you," said Trudeau.

He also outlined a new rent-to-own program to help Canadians turn a portion of their rent into savings for a down payment and a separate tax-free down payment savings plan for younger would-be buyers.

Trudeau's main rival questioned his record so far.

"Mr. Trudeau has had six years and has failed," said Conservative leader Erin O'Toole. "The housing crisis has exploded in the last three or four years under his leadership."

O'Toole pledged last week https://www.reuters.com/world/... to build a million homes over three years and also said he would ban non-resident foreigners from buying Canadian homes for at least two years.

Steve Pomeroy, a professor of public policy at Ottawa's Carleton University, said the foreign buyer bans and measures like flipping taxes would do little to tackle affordability.

"It's an easy target," said Pomeroy. "But in terms of actual sales, it's not so much the foreign buyers that are driving up home prices, it's domestic buyers. Appreciation begets more appreciation."

(Writing by Julie Gordon in Ottawa; Editing by David Ljunggren, Jonathan Oatis and Dan Grebler)

Delta Air Lines to Impose Monthly Surcharge on Unvaccinated Employees - BLOOMBERG

(Bloomberg) -- Delta Air Lines Inc. will impose a $200 monthly surcharge on employees who aren’t vaccinated against Covid-19, becoming the first major U.S. company to levy a penalty to encourage workers to get protected.

The new policy was outlined in a company memo Wednesday from Chief Executive Officer Ed Bastian, who said 75% of the carrier’s workers already are vaccinated. Increasing cases of coronavirus linked to a “very aggressive” variant are driving the push for all employees to get the shots, he said.

Read more: Worker Support Grows for Harsher Vaccine Stances From Employers

The fee applies to employees in the airline’s health-care plan who haven’t received shots by Nov. 1. The company also will require weekly testing for employees who aren’t vaccinated by mid-September.

Delta stopped short of a mandatory vaccine requirement like the one imposed earlier this month by United Airlines Holdings Inc. and a growing number of other companies. Goldman Sachs Group Inc., Alphabet Inc.’s Google and Facebook Inc. also have announced vaccine requirements.

While mandates have increased since Pfizer Inc. and BioNTech SE’s vaccine received full Food and Drug Administration approval on Monday, some employers are treading carefully for fear they’ll hurt morale and spur defections in a tight labor market. Some health-care consultants doubt that surcharges will be as persuasive as mandates.

The fee for unvaccinated employees is “to address the financial risk” from their decision, Bastian said. The average hospital stay for Covid-19 patients has cost Delta $40,000 each, he said.

“With this week’s announcement that the FDA has granted full approval for the Pfizer vaccine, the time for you to get vaccinated is now,” Bastian said.

Under the new policy, any worker not fully vaccinated by Sept. 12 will be required to take a weekly coronavirus test “while community case rates are high,” the note said.

Employees who aren’t vaccinated must wear masks in all indoor settings, effective immediately. Delta also said that starting Sept. 30, Covid pay protection will be provided only to workers who have received both shots but who still get sick.

National Security Has Iceland Pushing for Domestic Payment Tool - BLOOMBERG

(Bloomberg) -- Scarred by the financial crisis and reminded by the pandemic that the world is a precarious place, Iceland’s central bank wants new domestic retail payment tools that would reduce its reliance on global card giants.

The Reykjavik-based Sedlabanki wants to add a solution to the interbank system to let banks offer retail payment tools to customers for seamless transactions with shops and service providers, Deputy Governor Gunnar Jakobsson said in an interview. He named Sweden’s mobile payment app Swish as a model.

The virtual disappearance of cash in several Nordic countries has sprung from a wave of innovation in retail payments. In Iceland, the effort is driven mainly by national security, as nation’s financial meltdown in the wake of the 2008 financial crisis exposed the risk that global credit card giants could block credit cards issued by Icelandic banks.

“The primary driver is national security so that we have domestic instant payment solutions if for some reason Visa and MasterCard could not or did not want to service the Icelandic market,” Jakobsson said.

Visa and MasterCard stopped using the Icelandic krona in the settlement of credit cards in 2008, when Iceland was forced to turn to the International Monetary Fund for help, according to a report by the Bank for International Settlements published last year.

The clearing of credit card payments “would have seized up with drastic consequences for the Icelandic payment system” if Visa and Mastercard had not accepted the assurances from the central bank after it declined to provide a blanket guarantee, it said.

“Debit cards are now cleared on the Visa and MasterCard infrastructure,” Jakobsson said. “So if the same situation would arise as in 2008, where it looked like credit cards could not be used in Iceland, we could in the worst possible scenario be in a situation where neither debit or credit cards could be used.”

The vulnerability has increased since the crisis, as the clearing of Icelandic debit card payments that was previously handled domestically is now done offshore.

Fully Committed

“Visa is fully committed to the Icelandic market,” and would be pleased to talk to the central bank about its strategy, Visa said in an emailed response. Visa’s offering “includes settling in local currencies as a core capability, thus enabling the Icelandic market to remain open and active at all times.”

Jim Issokson, a Mastercard spokesman, said “our support of our Icelandic customers and cardholders is the same as we offer in other geographies.” The company’s efforts in Iceland “come with the continued engagement with the central bank on payments technology and innovation,” he added.

The central bank hasn’t yet done detailed analysis of the economic benefits of the move, Jakobsson said. The cost is likely to be lower than using credit and debit cards, of which a “considerable share is paid to providers outside of Iceland,” he said.

Central banks across the world are increasingly focused on instant payment solutions, such as the European Central Bank’s TIPS system and FedNow in the U.S., amid concerns that their monetary authority is being eroded as the global technology giants gain ground in the payments market.

Read more: Nordic Digital Wallets Merge to Stave Off Apple, Google Pay Apps

As part of the solution to ensure secure payments as cash use dwindles, more than 85% of global central banks are exploring their own digital currencies, according to BIS. Along with China, Sweden leads major economies in developing a central bank digital currency, or CBDC.

While Iceland is “closely” following the developments in the other Nordic countries, “it is unlikely that we will be a leading nation when it comes to implementing an e-krona or CBDC,” Jakobsson said.

Foreign Students Begin U.S. College Deferrals as Delta Spreads - BLOOMBERG

(Bloomberg) -- With the delta variant of Covid-19 spreading across the U.S., some colleges are seeing a pickup in deferrals from international students as the worsening public-health situation adds uncertainty for those already struggling to secure flights and visas.

It is one more sign that campuses will be anything but normal this fall, as schools have had to turn to mask mandates, vaccine requirements and testing regimens to get students back to in-person learning and keep them safe amid the surge in infections.

In a typical year, about 1 million foreign students come to the U.S. to study, led by those from China and India. Deferrals from this group aren’t likely to be as widespread as they were last fall. But any uptake of this option could be a drag for schools, not least because international students tend to pay full tuition.

“As of the last week or two, we’re starting to get phone calls,” said Erin O’Brien, assistant dean and chief enrollment officer at University at Buffalo School of Management, part of New York’s state university system. “When we get phone calls from overseas, they’re usually deferrals.”

O’Brien said that last year, 44% of those admitted to the graduate business school ended up deferring. The proportion was higher among international students, with 59% of them choosing this route. This year, with a week left before classes begin, only 6% of foreign students have deferred, though she expects that figure to increase.

“If they were completely absent from our campus, it’s obviously a revenue hit,” O’Brien said, referring to all international students at the school. “It’s also a campus community hit, a cultural hit, a student life hit.”

Pennsylvania State University, which started classes this week, expects to have almost 9,000 international students learning in-person this fall, though some have indicated they may arrive late. Still, the public university has heard from 185 students requesting to defer their visas to Spring 2022 or later, said Lisa Powers, a spokesperson. The number may yet increase.

“We have seen a bit of a scramble in the last two weeks of students who have discovered that they may not be able to arrive in time,” Powers said. “We are attempting to help these individuals as much as we can, however, some things are beyond our control.”

The situation at these schools may signal a boomlet of eleventh-hour deferrals from foreign students at colleges nationwide, some of which don’t start classes until after Labor Day.

Even before the surge in Covid-19 cases, foreign students were having trouble getting to U.S. college campuses. Some had a hard time finding flights, while others struggled to get visa appointments as embassies and consulates operated with reduced staffing due to the pandemic. Delta’s rise has added fresh concerns, including how safe and enjoyable it might be to live on campus.

Michigan State University is also hearing from international students that they are deferring, at least for the semester, according to spokesperson Dan Olsen. The school is expecting 492 first-year undergraduates from other countries, down from 780 in 2019 before the pandemic, Olsen said. It did not provide detailed numbers on deferrals. Classes begin at the campus in East Lansing on Sept. 1.

At Lehigh University in Pennsylvania, where classes began Monday, about 10% of the 260 graduate students expected for the fall semester had deferred as of last week, according to Amanda Connolly, director of international students and scholars. That number is expected to increase.

“If we had not planned to allow students the flexibility to start remotely, definitely deferrals would be much higher,” Connolly said.

Colleges are eager to turn the page on the two previous academic years, after the pandemic forced them to close campuses in March 2020 and switch to virtual learning. International enrollments in the spring term were down 16% from the previous year, according to National Student Clearinghouse Research Center. Overseas students who participated in Zoom classes were often stuck doing so at odd hours from their home countries. Before the pandemic, Olsen, the MSU spokesperson, said deferrals among international students were rare.

Some lawmakers have called attention to the difficulties of getting international students on campus. Earlier this month, two dozen U.S. senators signed a letter to the State Department about the backlog of student visas, which swelled during the pandemic.

“International students coming to the United States provide significant and essential value to the higher education system and our economy,” the coalition of Democratic lawmakers wrote. “While we recognize that the COVID-19 pandemic remains a challenge, other competitor countries have issued clear guidance for international students, and we urge the State Department to do everything it can to expeditiously process student visas.”

Biden’s Election Will Lure MBA Students Back to U.S., But Slowly

When students defer, it may be a first step in considering options elsewhere, said Rich DeCapua, founding president of the Global Alliance for International Student Advancement.

U.S. colleges face growing competition from Australia, Canada and some European countries, which offer an easier path to study there, he said. “The caliber of those programs has risen significantly.”

Nigeria's Green Africa Airways in ownership court challenge - CH-AVIATION

Barely two weeks after lift-off, Nigerian startup Green Africa Airways (Q9, Lagos) is facing an ownership challenge in the Federal High Court in Lagos from an alleged former business partner of chief executive officer Babawande Afolabi.

United States-based Nigerian citizen Kenny Awosika is claiming co-founder status, 55% of the airline’s authorised share capital, and NGN625million naira (USD1.5 million) in damages for an alleged breach of agreement. Alternatively, he wants the defendants to pay him USD30.25 million equal to the value of 55% of the airline’s share capital at the last valuation in 2019, reports Nigeria's Vanguard newspaper.

Green Africa Airways spokesperson Oyindamola Fashogbon declined to comment. As reported, the airline launched commercial operations between Lagos and Abuja on August 12 with three ATR72-600s from ACIA Aero.

The defendants in the case include Babawande Afolabi, Green Africa Airways Ltd, Taiwo Afolabi, Kuramo Africa Opportunity II (Mauritius) LLC, Nigeria’s Corporate Affairs Commission (CAC), and the Nigerian Civil Aviation Authority (NCAA).

Awosika, in his statement of claim, alleges that he is the co-founder and director of Green Africa Airways Ltd (registered in Nigeria in 2015) and also functions as its director of Information Technology and Innovation.

He also claims to be the founder and co-owner of Green White Group LLC (GWG Maryland), a limited liability company registered in Germantown, Maryland, USA. The company was registered on September 26, 2013, by himself and Afolabi to provide the financial and technical support for the formation and incorporation of Green Africa Airways.

The partners had agreed that Awisika should remain in the USA, where he was earning a salary as a US government contractor, to financially support the incorporation of Green Africa Airways. With Awisika’s financial, support, Afolabi had returned to Nigeria and registered the airline with the CAC with a NGN500million (USD1.2 million) initial share capital.

Awosika claimed he had eventually resigned his job, exited his private US businesses, and gave up his US government security clearance to return to Nigeria to help run the business.

However, unknown to him, and contrary to the arrangement between them, Afolabi had listed himself and his brother Taiwo Afolabi as the only shareholders and directors of Green Africa Airways.

The defendants are yet to file a response. No date has been set for the hearing.

British Airways Proposes New Unit to Lower Costs at Gatwick - BLOOMBERG

(Bloomberg) -- British Airways is prepared to bring back short-haul flights at London Gatwick airport that were terminated at the start of the coronavirus crisis, if unions back the formation of a new unit with less costly contracts.

The end of furlough support from the U.K. government combined with lingering travel curbs means the restoration of European flights at Gatwick will require a “competitive operating model,” British Airways said in an internal memo to staff seen by Bloomberg News.

“We are working with our unions on proposals for a short-haul operation at Gatwick,” the unit of IAG SA said in an emailed statement. “We are not prepared to comment further while this process continues.”

BA is operating only long-haul flights from London’s second-biggest hub, with shorter services limited to its main base at nearby Heathrow and regional routes from London City. Air travel is still struggling to recover from the Covid-19 pandemic, with U.K. demand held back by ever-changing rules and pricey tests required for incoming passengers.

The U.K.’s Coronavirus Job Retention Scheme, which supports 1.9 million people, is due to end on Sept. 30 following the lifting of almost all pandemic restrictions last month. Travel firms have warned that thousands of jobs may be lost if the government fails to offer an extension.

BA’s new Gatwick operation would run alongside the existing long-haul business from summer 2022, allowing a sustainable short-haul presence to be restored “over time,” the staff memo said.

Where the World’s Superyachts Are Right Now - BLOOMBERG

, Bloomberg News

BC-Where-the-World’s-Superyachts-Are-Right-Now , Kevin Varley

(Bloomberg) -- The world’s rich are sailing the Mediterranean, enjoying a holiday haven on the sea to escape the crowds and the threat of Covid-19.

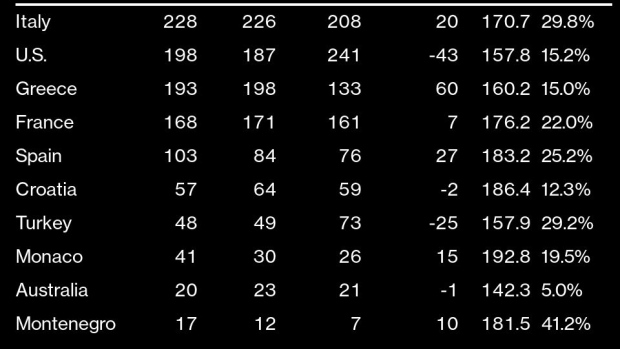

Eager to jump-start the lagging tourist economy and compete with Greece and Spain, Italy tops the mega-yacht leaderboard for a second consecutive month in August. There have been 228 super yachts pinging off Italy over the last five days, a 20-vessel jump from this time last year, according to tracking data compiled by Bloomberg.

Following behind are the U.S., which dropped 43 yachts from last year, and Greece, which saw a gain of 60 vessels. Monetenegro, a surprise entrant to the leaderboard, came in 10th with 17 yachts. The Adriatic nation hopes to build its yacht presence as the wealthy look for alternatives in the area to favorites like Croatia.

Europe dominated the latest Bloomberg Resilience Ranking for best places to be during the pandemic, with a middle-ground strategy of widespread immunization and reopening based on vaccination status.

Celebrities like Kendall Jenner, Paris Hilton, Dwyane Wade and Gabrielle Union were seen basking in the sun aboard yachts anchored off the coast of Italy.

The 511-foot Dilbar, reportedly owned by Alisher Usmanov, the 437-foot Al Mirqab, owned by Sheikh Hamad Bin Jassim Bin Jaber Al Thani, and the 355-foot Le Grand Bleu, owned by Eugene Shvidler, are among the largest yachts spotted in Italy.