Travel News

A new UK visa aims to bring talented graduates to Britain - QUARTZ AFRICA

By Sarah Todd

Senior reporter, Quartz and Quartz at Work

In the aftermath of Brexit, the UK is grappling with a dwindling talent pool. A new visa program, aimed at recent graduates from the world’s top universities, aims to give British businesses access to an influx of skilled young workers.

What is the High Potential Individual visa?

The UK’s High Potential Individual (HPI) visa will be open to applicants beginning May 30. Introduced as part of a broader post-Brexit government strategy to make the country more globally competitive, the program offers visas to people who completed a degree from a qualifying university outside the UK within the last five years. It’s available to people of any nationality who are at least 18 years of age.

Applicants aren’t required to have a job offer in order to qualify for visas. That’s presumably appealing for UK employers, who will be free to hire HPI visa holders without paying sponsorship fees. After arriving in the UK, visa holders can apply for jobs in any industry.

Which universities are included?

Applicants must have attended a university from the Home Office’s Global University List. Released annually, the list will comprise schools outside the UK that appear in the top 50 on at least two of the following world rankings:

- Times Higher Education World University Rankings

- Quacquarelli Symonds World University Rankings

- The Academic Ranking of World Universities

The schools that appear on world rankings may vary from year to year, but tend include a lot of familiar names, such as Harvard, Stanford, and the Massachusetts Institute of Technology in the US; Canada’s University of Toronto; Peking University and Tsinghua University in China; and the University of Tokyo in Japan.

What are the eligibility requirements?

People who’ve received their bachelor’s, master’s, or post-doctorate degrees from a qualified school within the past five years also have to meet a few other eligibility requirements. According to the immigration law firm Richmond Chambers, these include:

- An English language requirement, which involves showing that you either come from a majority-English-speaking country or that you’ve passed a test or received a degree demonstrating your English language ability

- A financial requirement, which asks that applicants have at least £1,270 available in cash

How long can you stay in the UK with an HPI visa?

If you have a PhD from a qualifying university, your HPI visa is good for three years, according to Richmond Chambers. Those with bachelor’s or master’s degrees can stay for up to two years. The UK government said in a statement that people who are granted HPI visas “will be permitted to move into other long-term employment routes,” leaving the door open to their settling down in the UK.

How is the HPI visa different from graduate visas?

The key difference between the HPI visa and the UK graduate visa is that the first is available specifically to graduates of schools outside the UK. The UK graduate visa allows people who’ve completed a degree within the UK to stay for at least two years after graduating.

What you need to know about the new High Potential Individual visa route - EIN.ORG.UK

Written by Helena Sheizon, Kadmos Consultants

The High Potential Individual (HPI) route is similar to the Graduate route but offered to recent graduates of the top ranking universities outside the UK. This route opens on 30 May 2022.

High Potential Individuals will be given permission to stay for two or three years depending on their degree level and will be allowed to take up employment without sponsorship, set up a business or work as self employed. The route will not lead to settlement.

This visa can only be granted once and will not be available to those who have already had Graduate visa. Dependants (partner and children under 18) are allowed.

Qualifying Universities – Global Universities Lists

The list will be published by the Home Office on the Gov.uk website. It will be compiled once a year. The list will include overseas universities that are ranked in the top 50 of at least two of the following three ranking systems: (1) Times Higher Education World University Rankings, (2) Quacquarelli Symonds, (3) The Academic Ranking of World Universities.

The University has to be on the list for the year of graduation. It is expected that the list will go back five years and a new list will be added for each year after introduction of this route.

Degree requirement and period of grant

The degree has to be awarded within five years of the application. The degree can be in any discipline but has to be equivalent to not less than UK bachelor's degree.

Graduates with a bachelor's or a master's degree will be given a two-year visa. Graduates with a PhD or another doctoral level qualification will be given three years.

English Language Requirement

Unless the degree was taught in English, the applicant will need to pass an accepted English language test offered by an approved language test provider to at least B1 level in four components – reading, writing, speaking and listening.

If you are relying on a degree taught in English, you will need a certificate from the awarding body or a transcript issued by the university, or an official letter from the university. If the degree was awarded outside the UK, you will need confirmation from Ecctis that the qualification meets the required standard of a UK bachelor's, master's or doctorate degree.

Financial Requirement

Applicants who have lived in the UK for at least 12 months in another immigration category do not have to meet the financial requirement. Those who are applying for entry clearance from overseas have to demonstrate that they have at least £1270 (or equivalent in another currency calculated using Oanda website applying the exchange rate on the date of application). This amount has to have been held in a bank account for at least 28 days prior to the date of the application.

Dependants of a High Potential Individual

A High Potential Individual can bring their partner and children under the age of 18 to the UK.

Partner means the spouse or civil partner, or unmarried partner in a durable relationship. Unmarried partners have do demonstrate that they have lived together for at least two years and that their relationship is genuine and subsisting.

Children include children of the main applicant's partner if they have sole responsibility for the child or if the other parent of the child is settled in the UK, or where there are serious and compelling reasons to grant the child leave to enter or remain.

The child has to be under the age of 18 on the date of application. Their leave to remain will have the same expiry date as that of the main applicant.

Financial requirements for dependants of a High Potential Individual

If the dependants are switching to this category inside the UK and have lived in the UK for at least 12 months prior to the application, the financial requirement is considered as met.If applying for leave to enter from outside the UK, or with less than 12 months residence in the UK, the following funds are required:

1. At least £285 for the partner 2. £315 for the first child 3. £200 for each additional child.

The funds have to have been held in a bank account for at least 28 days before the date of the application.

Switching to this route inside the UK

Both the main applicant and dependents can switch into this route from another immigration category without leaving the UK, with the exception of visitors, short-term students, those who have been granted leave to remain outside the immigration rules, parents of a child at school and domestic worker visa holders.

Work options for HPIs and their dependants

This route is not related to sponsorship and there is no requirement to have a job offer in the UK. The main visa holder and their dependent partner can work in the UK without restrictions, and can set up their own business or register as self-employed.

Immigration options on completion of leave as a High Potential Individual

This route is envisaged as an opportunity for High Potential Individuals and their family members to establish stronger connections with the UK. The route allows switching into any work permitted category leading to settlement, such as skilled worker, start up and innovator, exceptional talent, or scale up route. You are allowed to switch, i.e. apply for a variation of the visa, at any time before its expiry date. However, you cannot return to the High Potential Individual Route if you have spent less than the full length of the permitted period under this route.

How HPI compares to the Graduate route

There are certain perks in the High Potential Individual route. First, is that it is available during the five years after graduation. The application can be made from either the UK or from overseas. Secondly, the dependants can be included in the application without any special conditions, and can also be added to join the main applicant if the main applicant is already in the UK as a High Potential Individual.

About the author

Helena Sheizon is the founder and managing director of Kadmos Consultants.

Kadmos Consultants immigration lawyers specialise in UK immigration and nationality law and provide business immigration solutions to clients throughout the world.

United, Alaska Air Drop Face Mask Mandates After Court Ruling - BLOOMBERG

(Bloomberg) -- Two major U.S. airlines, United Airlines Holdings Inc. and Alaska Air Group Inc., said Monday they’ll no longer require travelers or employees to wear face coverings on domestic and some international flights.

The decisions came hours after a U.S. judge overturned a federal mandate for passengers to cover their faces on board airplanes and trains. United said its employees may continue to wear masks “if they choose to do so.”

The airlines said they also will not require the use of masks at boarding gates or elsewhere in airports.

Earlier this month U.S. airlines had asked the Biden administration to end its masking requirement for public transport. But last week the Centers for Disease Control and Prevention extended the ban until May 3.

Local airlines seek stiffer penalty, fines for unruly passengers - THE GUARDIAN

By Wole Oyebade

U.S. leads with 5,981 reported cases in year

Local airlines operators have pushed for severe sanctions against unruly passengers, which may include a ban and fines in extreme cases.

The operators, under the aegis of Airline Operators of Nigeria (AON), said they would no longer condone cases of assaults on staff and crew members, public intoxication and verbal abuses by irate passengers.

Globally, coronavirus-induced changes in air travel patterns and flight delays have caused frustrated air travellers to push back violently at airlines with the United States alone accounting for 5,981 cases of unruly passengers. Of the lot, the Federal Aviation Administration (FAA) reported 4,290 – nearly 72 per cent – were mask-related incidents.

Nigerian airports have had a fair share of irate passengers attacking officials and destroying facilitation equipment in protest against flight delays and cancellations.

Recently, Max Air was attacked by some passengers at Abuja airport, who destroyed computers and other equipment at the check-in counter.

President of the AON, Abdulmunaf Yunusa, called on the Federal government through the Ministry of Aviation and the Federal Airports Authority of Nigeria to beef up security at the nation’s airports and ensure that the lives of airline staff and their properties are lawfully protected.

“May we also state that should a similar occurrence like the unfortunate case with Max Air happen to any of our member airlines going forward, AON may be forced to have a rethink on how to respond in such circumstances,” Yunusa threatened.

A member of the association told The Guardian that the zero-tolerance policy for unruly conduct should go a step further with a lengthy ban and fines to deter perpetrators.

“It is obvious that a lot of Nigerians have found the operators as easy targets for the expression of their frustrations. The system has been condoning them and I fear a major safety breach will occur someday. Ideally, anyone caught henceforth should be given the stiffer sanction that should include ban for air travel, fined, named and shamed publicly, if we are serious about curtailing the extremely violent behaviours,” he said.

The operators recognised that the extant rules prohibit unruly conduct. For instance, Part 17.92.1 of the Nig. CARs 2012, Vol. II states that: “Any passenger who becomes unruly at the airport terminal or onboard an aircraft commits an offence.”

Part 17.92.2(c)(d)(e)(f) defines the word “unruly” as fighting or other disorderly conduct on board an aircraft or at the terminal building; any conduct/act constituting a nuisance to other passengers; disobedience of lawful instructions issued by the aircraft commander, flight crew, cabin attendants, check-in staff and/or security screening staff; and any conduct that endangers or is likely to endanger the safety of flight operations.

Part 17.92.3 states further that: “Where any passenger becomes unruly on board an aircraft or at the terminal building, the aircraft commander or airport authority shall take necessary measures including restraint where necessary: to protect the safety of the aircraft, terminal building or of persons or property therein; or to maintain good order and discipline on board or at the terminal building, and to enable him to deliver such person to competent authorities.

Yunusa, who is the chairman of Azman Air, noted the airport vicinity is a sensitive and sacrosanct environment where people are not allowed to behave callously and uncontrollably.

“A situation where passengers are allowed to have access into sensitive restricted areas of the airport and attack airline staff or prevent a plane from departing to other destinations because a particular flight is delayed or cancelled puts the country in a bad light in the international community.

“Issues of delay or cancellation can be addressed civilly without resorting to violence. The unruly passengers that went after Max Air and destroyed the computer reservation systems further exacerbated the problem for other passengers going to other destinations. Such acts are completely unacceptable.

“AON understands the frustrations whenever a flight is delayed or cancelled and we apologise to passengers on behalf of airlines for such delays or cancellations. It is however instructive to note that delays happen worldwide and some conditions cause them,” he said.

Before 2021, the FAA in the United States didn’t track the number of unruly passenger incidents reported because the number was fairly consistent. But a sharp uptick in unruly passenger behaviour in late 2020 spurred the agency to begin tracking the reports in 2021.

However, the FAA has recorded the number of unruly passenger incidents that rose the level of being investigated since 1995.

From 1995 to 2020, an average of 182 investigations were initiated per year. In 2021, the FAA initiated 1,081 investigations – a 494 per cent increase over the historic average of investigations.

How China’s COVID restrictions could threaten the country’s economic recovery - YAHOO FINANCE

Shehzad Qazi, managing director at China Beige Book International, joins Yahoo Finance Live to discuss what's impacting China's GDP numbers and how its recent uptick in COVID cases could affect its economic recovery.

Video Transcript

RACHELLE AKUFFO: And the pressure on China is an importer of course, you have COVID and then you have the Russia Ukraine crisis. So let's break some of this down as China comes out with key GDP data. We're bringing in our guest here, Shahzad Qazi, China Beige Book International managing director. Welcome to the show. So first, I want to start with China's first quarter GDP data coming in at 4.8% year on year. How would you characterize it as well as the impact that its COVID zero tolerance policy has had on economic growth?

SHEHZAD QAZI: Yeah, there are a couple of things that I want to point out for your audience here. The first one is that the Chinese economic data are certainly looking a lot better than what a lot of the folks in the markets, and especially Wall Street, were predicting going as far as saying that there was going to be 0% growth. One of the things that we've been telling clients for weeks and weeks now is that economic conditions are far better than a 0% growth scenario. You're seeing factory activity lose steam. You're seeing retailing taking a battering. But you are seeing a nascent recovery in the property market.

And to your second question, the COVID lockdown situation, what you're seeing is the services industry actually did better in January and February compared to where it was last year. And it may have done continued that path of acceleration. But what you got were these large scale lockdowns started to take place in various parts in the major cities. And you see an immediate reversal in services performance where you see the sector just getting absolutely shattered in the month of March. And so that's the lens with which we should view the rest of the year, the impact of COVID lockdowns on economic growth this year.

RACHELLE AKUFFO: And obviously, there's always high expectations when it comes to China's economic growth. So it important to put that into context. And we do know that Beijing is looking for 5.5% growth for 2022. Do you think the worst of the economic fallout has already been factored in at this point.

SHEHZAD QAZI: So Chinese GDP growth figures are number one a political figure. And we know from history that if the Chinese government decides, the party decides it's going to have a certain GDP growth figure, it's going to always hit it officially whether it's through data manipulation or whatever else you may have. The real question is trying to understand what's going on on the ground in terms of what thousands of businesses are actually experiencing. And I think we can-- looking far up ahead, we can continue to see that there's going to be a lot of pressure on the consumption side of the economy.

We also know that the growth playbook in China has changed. We no longer have that old model of high debt, high investment, high growth, which means that slower growth is something that we're going to have to get used to. And those days of double digit growth, a 6.8% growth, are long gone. So again, COVID is the one to look out for. But of course, the other real question is, which industry is going to be the growth driver this year in China? And there isn't any one contender that sticks out.

RACHELLE AKUFFO: And that's certainly not good news for China's economy when you consider it was really trying to push for this dual circulation strategy to be the next growth engine there. What are your expectations there? And what do you think we might see in terms of potential government intervention?

SHEHZAD QAZI: So government intervention is the other important thing to talk about stimulus, policy easing. Again, we've gotten a lot of predictions. They've all fallen flat because stimulus is part of that old playbook again that I had mentioned is out the window. Now you are going to get some type of policy support no doubt. And as a matter of fact, what you're seeing on the ground in the China Beige Book surveys for example, is that even though companies are not borrowing right now, borrowing is at an all time low, the indicator for pent up demand for credit, as in demand for loans, is starting to perk up. It's starting to rise.

So we would expect in the coming months and in the coming weeks even perhaps for corporate borrowing to start to rise, which could potentially ease some pressures. However, we're not looking at a American-style consumer stimulus take place, which means that if there are lockdowns, if there is a rise in virus cases, well, consumption activity is going to remain under serious and tremendous amounts of pressure even if Chinese companies get some amounts of support as far as access to loans, and credit, and lending is concerned.

RACHELLE AKUFFO: And we did see the Chinese yuan is also under pressure from the ongoing fallout from Russia's invasion of Ukraine. We saw the Institute of International Finance calling the capital outflows from global investors unprecedented. Do we expect to see perhaps any changes in terms of businesses or any acts that we might see in terms of fiscal policy?

SHEHZAD QAZI: Look, there are certain signs that we're picking up. For some amounts of fiscal support, very limited in nature, it's not certainly going to be the big juicer of growth this year. That much, I think we can say with a lot of certainty. In terms of capital outflows, yes you are seeing that challenge. But there isn't any type of large scale relocation of businesses to the extent that companies wanted to move supply chains out of China or diversify their supply chains. We've seen a lot of that happen over the last couple of years. There isn't necessarily a giant push for that to be the case in 2022.

RACHELLE AKUFFO: Now I do want to look, obviously China is one of these economic performers that the IMF and others really thought would be the global growth engine for the rest of the world as they do try and come out of this pandemic slump. But we did see numerous reports about China's second largest property developer Evergrande. And there were all these concerns about contagion. But you're saying that those were overstated. What are you seeing that's making you more optimistic about what you're seeing in China's real estate sector?

SHEHZAD QAZI: Yeah, you're always going to have these high profile companies, which will suck up a lot of the oxygen in the room, especially if they're on the verge of default, et cetera. But when you go out there and you talk to, or you survey hundreds and hundreds of property companies, what you walk away with seeing is that the worst of the crisis was most certainly at the end of last year. You're starting to pick up a nascent recovery on the developer side, you're starting to see sales pick back up, you're starting to see pricing improve a little bit, and especially in the big markets.

That's the real tell. Because those are the drivers of the property market in China. And business conditions are starting to improve. Now, the residential side of the property market is yet to catch up. It's not seeing the same sort of improvement or recovery, nascent recovery as I like to call it, that the commercial side is. But most certainly, the idea that the property market continues to struggle is dated. And I think data that will come out in the coming weeks will most certainly show that we've reached that inflection point, that there is a recovery that's taking place.

RACHELLE AKUFFO: All right. Great to get your insights. Shehzad Qazi there, China Beige Book International managing director. Thank you so much.

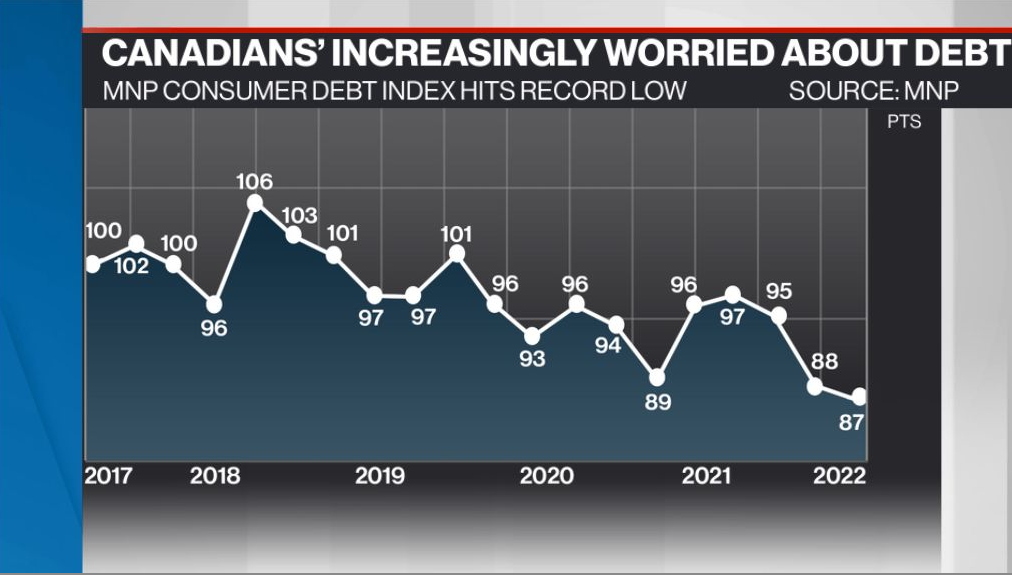

31% of Canadians don't earn enough to pay their bills: Survey - BLOOMBERG

A new survey suggests almost one-third of Canadians aren't pulling in enough income to cover basic monthly expenses.

Thirty-one per cent of respondents to an Ipsos survey conducted for MNP said they don't earn enough to pay their bills and debt payments, and almost half of all respondents (49 per cent) said they are within $200 of insolvency.

“It's a bit unnerving. It almost seems unrealistic. But this is what the survey continues to tell us, that people are concerned and that they're $200 away from not making their financial obligations,” said Grant Bazian, president of MNP Ltd., in an interview.

Two thousand Canadian adults were surveyed by Ipsos from March 9-15 — about one week after the Bank of Canada raised its main policy rate for the first time since 2018. The central bank ramped up its efforts to rein in inflation last week when it delivered its first half-point hike since 2000, and also announced it would start allowing its balance sheet to shrink later this month.

The survey for MNP demonstrates the extent to which some Canadians were being squeezed prior to last week's supersized hike.

A little more than half of respondents (52 per cent) said in March they were already feeling the effects of higher rates, according to the release from MNP on Monday.

“I would imagine now that with the extra (rate) increase that's already happened, that angst and nervousness has probably picked up even more,” said Bazian.

The most recent official data from the Office of the Superintendent of Bankruptcy, shows 7,392 Canadians filed either for bankruptcy or a proposal to settle debts under alternate terms in February. That was a 12.6 per cent increase from January, and a dip of 1.6 per cent from a year earlier. By comparison, prior to the pandemic taking hold in Canada, there were 11,251 bankruptcy and proposal filings by consumers in February 2020.

Bazian said there was “most definitely” some complacency among Canadians as emergency COVID-19 aid programs shielded households from the economic ravages of the pandemic. He added that the Canada Revenue Agency (CRA) wasn’t as aggressive for a period of time, and that banks didn’t “want to be seen as the bad guy.”

Bazian acknowledged that the survey is strictly based on sentiment, since Ipsos and MNP aren’t analyzing respondents’ financial accounts. However, he said that with the overall survey index slipping to the lowest level since it was introduced in 2017, there are worrying signs about how some Canadian households are holding up.

“Our index is very clear. It’s the sentiment of the Canadian. They’re showing that they’re more concerned now than ever.”

Survey respondents who were in the market for a mortgage demonstrated some notable cautiousness in March. Among Canadians who said they're planning to renew their mortgage in the next 12 months, 91 per cent said they're planning to be more careful about how they spend money, compared to 81 per cent among the broader population.

The Bank of Canada's rate hikes ripple through the country's housing markets by pushing up prime rates, which are linked to variable-rate mortgages. For Canadians who take out fixed-rate mortgages, the bond market was pushing up the cost of borrowing long before the central bank started hiking.

“I like to say the glue that holds all this together was low interest rates. It’s (sic) been so low for so long a period that people are structuring their finances around those low interest rates,” Bazian said.

“So when the subsidies and the relief is coming to an end, and the grace periods by some of the lending institutions may be coming to an end, coupled with rising interest rates — I think that’s where you’re getting the nervous tendencies.”

Most Major U.S. Airlines Drop Mask Mandates on Court Ruling - BLOOMBERG

(Bloomberg) -- Most major U.S. airlines are no longer requiring travelers or employees to wear face coverings on domestic and some international flights.

The decisions came hours after a U.S. judge on Monday overturned a federal mandate for passengers to cover their faces. The U.S. Transportation Security Administration said after the court ruling that it would stop requiring passengers on planes

The five largest U.S. carriers -- American Airlines Group Inc., Alaska Air Group Inc., Delta Air Lines Inc., Southwest Airlines Co. and United Airlines Holdings Inc. -- said they were dropping their mandates effective immediately. Use of masks will be optional for both passengers and staff, they said.

JetBlue Airways Corp. said on its Twitter account that “in line with Monday’s federal court ruling and the TSA’s guidance, mask wearing will now be optional on JetBlue within the U.S. While no longer required, customers and crew members may continue wearing masks in our terminals and on board our aircraft.”

Delta said customer communications and signs in airports will be updated to reflect the change, and cautioned that local mask mandates may remain in effect. “We are relieved to see the U.S. mask mandate lift to facilitate global travel as Covid-19 has transitioned to an ordinary seasonal virus,” the Atlanta-based carrier said in a statement.

In spite of the easing, most people weren’t in a hurry to take their masks off immediately. At San Francisco’s airport, most passengers and employees still had their face coverings on Monday night.

“That’s fine but I just prefer to wear my mask in these kind of open spaces,” said Camila Crews, 39, who was getting on a flight to Los Angeles. “The masks have been working.”

In spite of the easing, most people weren’t in a hurry to take their masks off immediately. At San Francisco’s airport, most passengers and employees still had their face coverings on Monday night.

“That’s fine but I just prefer to wear my mask in these kind of open spaces,” said Camila Crews, 39, who was getting on a flight to Los Angeles. “The masks have been working.”

Halting Enforcement

United, which among was the first of the U.S. airlines to drop its mask mandate, told employees they’ll be spared the task of forcing passengers to comply with Centers for Disease Control and Prevention guidelines.

“This means that you are no longer required to wear a mask -- and no longer have to enforce a mask requirement for most of the flying public,” the Chicago-based carrier said in a memo to staff.

Earlier this month U.S. airlines had asked the Biden administration to end its masking requirement for public transport, but last week the CDC extended the ban until May 3. The CDC said late Monday that the national mask requirement on public transportation is no longer in effect, citing the court ruling .

Mask mandates have led to a marked increase in disruptive passengers and airline employee assaults since being imposed in early 2020. “I am very relieved,” said Lillian Fakatou, 24, who was flying to Salt Lake City from San Francisco after the court ruling. “I am so much happier.”

“I am very relieved,” said Lillian Fakatou, 24, who was flying to Salt Lake City from San Francisco after the court ruling. “I am so much happier.”

Airlines have also pressed for a new “no-fly” list for passengers who assault their workers or fellow air travelers. Alaska said Monday that it would continue to ban some past customers “whose behavior was particularly egregious” even after the era of mandatory mask wearing is over.

“We fully recognize that enforcement of the mandate has placed an incredible burden on flight attendants,” the Association of Professional Flight Attendants, which represents more than 24,000 flight American employees, said in a statement.

The airlines said they also will not require the use of masks at boarding gates or elsewhere in airports.

Read more at: https://www.bloombergquint.com/business/united-alaska-air-drop-face-mask-mandates-after-court-ruling

Hajj 2022: Pilgrims To Pay More As Naira Tumbles - DAILY TRUST

Prospective pilgrims to Saudi Arabia from Nigeria would most likely pay more this year because of the deteriorating value of the naira, Daily Trust...

- By Abdullateef Aliyu

Prospective pilgrims to Saudi Arabia from Nigeria would most likely pay more this year because of the deteriorating value of the naira, Daily Trust reports.

This is even as there is anxiety among stakeholders and intending pilgrims over the 2022 hajj as about 150,000 pilgrims may compete for about 45,000 slots, being the expected seat allocation by the Saudi Arabian authorities for Nigeria.

There was no hajj in 2020 and 2021 following the COVID-19 pandemic, which ravaged the world with several countries locking down to contain the spread of the virus.

Therefore, some of the thousands of intending pilgrims who paid for the spiritual journey in 2020 and 2021 said they hope to perform the hajj exercise this year in addition to those hoping to pay also.

Respite came the way of many Muslims, especially intending pilgrims around the world when the Ministry of Hajj and Umrah of the Kingdom of Saudi Arabia announced about 10 days ago that one million pilgrims would perform the 2022 Hajj, out of which 85 per cent would be allocated to external pilgrims while the remaining percentage would be for Saudi residents.

The one million is 50 per cent less than the usual figure of two million pilgrims that performed the exercise pre-COVID – 19.

Pre-COVID, Nigeria used to get 95,000 slots for both states and the private hajj operators.

But with the reduction in the number by Saudi authorities, stakeholders say the slots would be 50 per cent or less than the usual 95,000 slots implying that Nigeria might get between 45,000 or 50,000 slots for both states and the private tour operators.

It would be recalled that about 65,000 performed the exercise in 2019 comprising 45,450 for states and 20,000 for the private tour operators.

With the 65,000 benchmark, stakeholders envisage a backlog of 130,000 intending pilgrims or more to jostle for the slots being expected from Saudi Arabia.

It was also learnt that the National Hajj Commission of Nigeria (NAHCON) is planning towards 50,000 or less as most countries are doing because of the reduced slots from Saudi.

Hajj is one of the pillars of Islam, which every Muslim with the financial wherewithal is required to perform at least once in his lifetime.

Price hike imminent

Findings by Daily Trust revealed that many intending pilgrims have been contacting both the state pilgrims’ welfare boards and the tour operators over the 2022 hajj without getting concrete information on the modalities.

But our correspondent learnt that the hajj fare for this year may be between N2.5m and N3m based on the current economic realities.

The major components of hajj fare include airfare, accommodation in Makkah and Madinah and the Basic Travelling Allowance (BTA), among others.

Daily Trust reports that hajj fare in 2019 was around N1.5m, which is the current price of Umrah (lesser Hajj). At that time, the official exchange rate was N306 to a dollar but now the official rate is N416 and N580/N585 in the black market.

Also, it was learnt that many Umrah pilgrims paid as much as N500, 000 for visas when it used to be N250, 000.

Another source told our correspondent that virtually all the service providers in Saudi Arabia have doubled their prices.

“Definitely, the cost of accommodation has gone up, the cost of the tent in Mina and Arafat will not be the same and all this would determine the cost of hajj fare,” the informed source said.

Also, the cost of air ticket is going to be high considering that many airlines have recently hiked the fare in the domestic markets due to the high cost of aviation fuel known as Jet A1 and the general increase in operational cost.

The cost of airfare alone in 2019 was $1,650 for the southern part of Nigeria; $1,600 for the North and $1,550 for Maiduguri. But this year, it could be between $2,500 (N1.04m) to $3,000 (N1.2m).

Also, while the N270,000 was exchanged to get a BTA of $850, about N353,600 would be required this time around to get the same $850 at the official exchange rate of 416/$.

‘Preparations on hold’

By this time before COVID, preparations for hajj would have reached a crescendo. NAHCON would have signed a Memorandum of Understanding (MOU) with service providers in Saudi, sealed contracts with the air carriers while the states would have also advanced with their arrangements.

However, as of the time of filing this report, stakeholders say preparation is currently on hold because there has not been any official communication from Saudi.

A NAHCON source said, “We don’t know the arrangement yet. We have not signed any contract with any airlines. We have not interviewed any carrier, we have not invited the NCAA to inspect and certify any airline. We have not also signed any contract with GACA (General Authority of Civil Aviation) in Saudi, we have not also signed an overflight agreement with Sudan and other countries. So everything is on hold.”

Speaking with our correspondent, a former President of the Association of Hajj and Umrah Operators of Nigeria (AHUON), Alhaji Abdulfatah Abdulmojeed said the Saudi authorities have to hasten up with the plan.

He said, “Preparation is on hold. Of course, people have heard there is going to be hajj this year but what sort of hajj? So if anybody is preparing, preparing for what? We have not operated hajj post-COVID-19 or during COVID-19, we have not. So any planning you want to base on before COVID-19, you are deceiving yourself because a lot of things have changed, whether here or even there.”

He, however, tasked NAHCON to sustain its policy of first-come, first-served since it is clear that many people would not be able to perform the exercise.

“But what I think NAHCON is doing, which I think is good is to insist on the Hajj Saving Scheme so that you know people who are there. Whether they have been able to meet up with the cost, would be another issue. Those that cannot meet up can wait,” he said.

Also speaking, the Managing Director of An-Noor Air Service, a tour operator based in Abuja, Alhaji Harun Ismail said from the turnout of intending pilgrims for the Umrah exercise, many people would be eager to perform hajj.

However, he observed that the picture is still very unclear as to what would play out.

NAHCON spokesperson, Hajia Fatima Sanda Usara told our correspondent that the circumstances of the 2022 hajj are still unknown as the commission awaits the number of slots to be given to Nigeria, however, said the principle of first-come, first-served basis would be applied.

“Yes, we are going to apply the first-come, first-served system,” she said.

Asked, if there would be any interest on the deposits made by the pilgrims in the last two years, she responded that NAHCON doesn’t keep pilgrims’ money.

“All I know is that by the time the components are stated, NAHCON will announce it for those that have any balance to make up to do so. NAHCON does not keep pilgrims’ money,” she said.

Intending Pilgrims speak

Some of the intending pilgrims who spoke with our correspondent said they were not unaware of the current economic realities and as such, they were prepared to make up for the balance.

However, they said having left their money with the government since 2019, they should be considered first, to participate in the exercise.

An intending pilgrim from Kwara State, Abdulwasiu Olaiya said he deposited N1.3m to participate in the 2020 hajj.

“I know that the situation is not the same. The value of the money we paid at that time is not the same at the moment and we were told the money is in the Treasury Single Account (TSA).”

Another intending pilgrim, Alhaja Bola Abdulrasheed said she deposited N1.4m and would try to pay up the balance once the Hajj fare is announced.

“Since we are doing it for the sake of Allah, I don’t think anything is too much to serve God Almighty. We are praying that God will provide the balance when the time comes,” she said.

State pilgrims’ boards not collecting deposits

Findings by our correspondent indicated that most state pilgrims’ welfare boards are reluctant in collecting fresh deposits because of the backlog for 2019, 2020 and 2021.

The Lagos State Muslim Pilgrims’ Board confirmed to our correspondent that it has stopped the sale of forms because of the backlog for 2020 and 2021.

Public Relations Officer of the board, Mr Taofeek Lawal said many people who made deposits for 2020 and 2021 did not collect their money, adding, “We are still expecting slots from NAHCON.”

Also, the Kaduna State Pilgrims’ Board said it has also stopped selling forms to avoid a situation where those who paid would not be able to perform the exercise when it was glaring that the state would not get up to 4000 slots usually allocated to the state.

PRO of the board, Salisu Sani said, “We don’t have the actual allocation now. We are still waiting for NAHCON to get the communication from Saudi Arabia. In 2019, we had 4000. In 2020, we had 4000 but we don’t have any slot in 2021, but for this year, we don’t think we would get that 4000.

“We stopped selling forms because we have a backlog of pilgrims for 2020, 2021 totalling more than 3000. We don’t want to sell any form because we don’t know the number of slots to be given to us,” he said.

UPDATED: Nigerian Air Force aircraft crashes in Kaduna – Report - PREMIUM TIMES

Kaduna is also the state where bandits attacked a moving train, killing some of the passengers and kidnapping dozens of others.

By Nasir Ayitogo

An aircraft belonging to the Nigerian Air Force (NAF) has crashed in Kaduna, PRNigeria has reported.

The online media, which has links to Nigeria’s security institutions, said the aircraft is a training aircraft.

“While details of the incident are still sketchy, sources told PRNigeria that two pilots were onboard the aircraft at the time of the incident,” the newspaper reported.

The Air Force has yet to speak about the crash at the time of this report. Its spokesperson, Edward Gabkwet, did not respond to telephone calls and SMS from PREMIUM TIMES.

However, a flying officer who does not want his name mentioned confirmed the incident to this newspaper.

The officer who is also a pilot and resides at the Air Force base in Kaduna said one of the two occupants of the aircraft was a trainee.

He, however, said the details were still sketchy to insiders as senior officials are concealing the information.

Kaduna is one of the states most troubled by banditry in Northern Nigeria.

Hundreds of people have been killed or kidnapped in the state in the past year.

Kaduna is also the state where bandits attacked a moving train on March 28, killing some of the passengers and kidnapping dozens of others.

Past mishaps

The Nigerian Air Force (NAF) has suffered casualties in the last one year, losing at least four of its aircraft and several personnel.

At least 20 officers also died during these tragic incidents, including senior army personnel.

The most notable of the crashes was the one involving the late Chief of Army Staff, Ibrahim Attahiru, and 10 others last year.

The crashes occurred even as the air force is trying to acquire more equipment to help in the fight against insurgents and bandits in various parts of the country.

The most recent is the acquisition of new aircraft and other equipment worth $1 billion from the U.S. government. The purchase has been approved by the U.S. government but the equipment have yet to be delivered.

Before then, 12 Super Tucano fighter jets were also acquired for the Air Force from the United States.

The jets were sold to Nigeria by the U.S. to aid combat actions and air assaults.

Flight delays, cancellations beyond airlines – Domestic operators - PUNCH

BY Anozie Egole

Domestic carriers under the aegis of the Airline Operators of Nigeria have explained that 80 per cent of flight delays and cancellations are due to factors beyond their control.

This is even as the group condemned the recent attack by some passengers on the staff of Max Air and the wanton destruction of airline’s property due to flight delays.

Some passengers of the airline at the Abuja airport had gone berserk over the delay of their flight, venting their anger on the airline staff and destroying the facilities of the airline.

The President, AON, Abdulmunaf Yunusa Sarina, in statement, said airlines in Nigeria were forced to operate in an environment with poor infrastructural facilities.

He said, “In Nigeria, 80 per cent of the causes of delays and cancellations are due to factors that are not in the control of airlines. Airlines operating in Nigeria are forced to operate in an environment that is wrought with infrastructure deficiencies that are highly disruptive to normal schedule reliability and on time performance.

“Some of the more prevalent causes of delays and cancellations include: unavailability and rising cost of Jet A1 (which today costs above N585 per litre in Lagos, N607 in Abuja and Port Harcourt, and N685 in Kano), inadequate parking space for aircraft on the apron sometimes leading to ground accidents, inadequate screening and exit points at departure, inefficient passenger access and facilitation, natural and unforeseen circumstances such as weather and catastrophic failures (e.g. bird strikes & component failures), and restrictions caused by sunset airports among others.”

He added, “The Airline Operators of Nigeria hereby condemns in the strongest terms the recent attack by some unruly passengers on staff of Max Air and the wanton destruction of the airline’s properties due to a flight delay. The unfortunate development further heightens our deepest concern and worry over the increasingly deplorable state of security and the rising threat to the lives of airline staff and their properties at Nigerian airports.”