Travel News

Nigeria, African Airlines Show Signs Of Recovery - NEW TELEGRAPH

African airlines seem to be returning to profitability. The last three years had been excruciating for airlines and the travel industry. It was a crisis that ‘crumbled’ literally the entire global travel industry. But since the relaxation of COVID-19 rules, airlines and the travel trade operators have dusted themselves up by posting fantastic financial results.

Although the carriers are not yet back to their pre-COVID- 19 state, they have shown remarkable signs to bounce back. Nigerian carriers are not doing too badly despite a very poor economy. With the high airfare introduced in the wake of the astronomical cost of Jet A1 and the harsh economic situation, they have been able to remain afloat, although they are not out of the woods yet.

With the increase in the number of airlines in operations and about four others that are on the verge of securing their all-important Air Operators Certificate (AOC), Nigeria is seeing a boom in domestic airline operations despite the ravaging impact of COVID-19 on aviation and travels.

Amid the gloom of the pandemic, Nigeria’s domestic carriers are said to be on their way to recovery with more interconnectivity by the carriers linking remote airports to others; a new strategy to bring air travel to every part of the country.

While airports are opening up in many places like Anambra and Bayelsa, among others, the desire to connect these aerodromes is high with short distances like Lagos to Ibadan, Ibadan to Ilorin, Ibadan to Akure, Abuja to Kaduna, Asaba to Port-Harcourt among others that are not helped by the high-level kidnapping on the roads.

Meanwhile, the continent’s carriers had a 134.9 per cent rise in May RPKs versus a year ago. May 2022 capacity was up 78.5 per cent and load factor climbed 16.4 percentage points to 68.4 per cent the lowest among regions.

The International Air Transport Association (IATA), at the weekend, announced passenger data for May 2022, showing that the recovery in air travel accelerated, heading into the busy Northern Hemisphere summer travel season. Nigerian airlines and other African airlines had a 134.9 per cent rise in May RPKs versus a year ago.

May 2022 capacity was up 78.5 per cent and load factor climbed 16.4 percentage points to 68.4 per cent the lowest among regions. The industry has returned to year-on-year traffic comparisons, instead of comparisons with the 2019 period, unless otherwise noted.

Owing to the low traffic base in 2021, some markets will show very high year-on-year growth rates, even if the size of these markets is still significantly smaller than they were in 2019. Total traffic in May 2022 (measured in revenue passenger kilometers or RPKs) was up 83.1 per cent compared to May 2021, largely driven by the strong recovery in international traffic.

Global traffic is now at 68.7 per cent of pre- crisis levels. Domestic traffic for May 2022 was up 0.2 per cent compared to the year-ago period. Significant improvements in many markets were masked by a 73.2 per cent year-onyear decline in the Chinese domestic market due to COVID- 19-related restrictions. May 2022 domestic traffic was 76.7 per cent of May 2019.

International traffic rose 325.8 per cent versus May 2021. The easing of travel restrictions in most parts of Asia is accelerating the recovery of international travel. May 2022 international RPKs reached 64.1 per cent of May 2019 levels.

“The travel recovery continues to gather momentum. People need to travel. And when governments remove COVID-19 restrictions, they do. Many major international route areas – including within Europe and the Middle East- North America routes – are already exceeding pre-COVID-19 levels. “Completely removing all COVID-19 restrictions is the way forward, with Australia being the latest to do so this week.

The major exception to the optimism of this rebound in travel is China, which saw a dramatic 73.2 per cent fall in domestic travel compared to the previous year.

Its continuing zero-COVID policy is out-of-step with the rest of the world and it shows in the dramatically slower recovery of China-related travel,” said Willie Walsh, IATA’s Director- General.

Heathrow cancels more than 60 flights before lunchtime - THE TELEGRAPH

Heathrow has cancelled more than 60 flights this morning and warned it could ask airlines to slash more capacity as the summer of travel chaos continues.

The airport has cancelled 61 out of around 1,100 scheduled flights due to concerns about how many passengers it could safely accommodate amid widespread staff shortages.

A Heathrow spokesman said: “We are expecting higher passenger numbers in Terminals 3 and 5 today than the airport currently has capacity to serve, and so to maintain a safe operation we have asked some airlines in Terminals 3 and 5 to remove a combined total of 61 flights from the schedule.

“We apologise for the impact to travel plans and we are working closely with airlines to get affected passengers rebooked onto other flights.”

Heathrow also apologised for recent disruption, adding it would review the schedule changes made by airlines and ask them to take further action if necessary.

Heathrow said nearly 6m passengers passed through the airport in June, taking the total for the first six months of the year to 25m.

The sharp rebound in demand means the airport has experienced 40 years of passenger growth in just four months.

It comes as the train drivers' union prepares to announce its decision on whether to strike in what could be the first national walkout across Britain's railways in 25 years.

The billionaire Benetton family have inked a deal to sell their controlling stake in motorway restaurant operator Autogrill to duty free specialist Dufry.

The deal will create a $6bn player in the travel retail market, with the Benettons taking control of as much as 25pc of Dufry, which is in turn set to bid for the remaining stake of the Autogrill.

The merger comes after the Benettons agreed a deal with Blackstone to take motorway operator Atlantia private.

Alessandro Benetton, son of founder Luciano, is carrying out a shake-up of the family's holding company Edizione in the wake of the deadly 2018 bridge collapse in Genoa on a section of the road managed by its Autostrade company.

The Benettons eventually sold Autostrade to end a stand-off with the Government over the disaster.

London Hit With Dangerous Heatwave That Could Get Worse - BLOOMBERG

(Bloomberg) -- London is in the midst of a potentially dangerous heatwave that’s also spreading across western Europe, with little relief in sight.

Temperatures in UK capital are set to hit 31 degrees Celsius (87.8 degrees Fahrenheit) Monday, according to the Met Office. Early next week could be even hotter in the south of England.

The scorching weather follows Europe’s third-warmest June on record, underscoring the consequences of a warming planet. Temperatures are expected to be higher to much higher than normal in southern UK, France, Germany and Italy through the middle of next week, according to forecaster Maxar Technologies.

“When it comes to summer heat, climate change is a complete game changer and has already turned what would once been have called exceptional heat into very frequent summer conditions,” said Friederike Otto, senior lecturer in climate science at Imperial College London. “Every heatwave we experience today has been made hotter because of the fossil fuels we have burned over the last decades in particular.”

Health Alert

The Met Office on Monday issued a Level 3 heat-health alert, which requires social and health-care services to take actions to protect high-risk groups, such as the elderly, young children and people with respiratory problems.

With periods of extreme heat likely to become more common in the UK, local government councils will be working to ensure communities can be kept safe, said David Fothergill, chairman of the Local Government Association’s Community Wellbeing Board.

The Met Office expects a slight cold front may bring down temperatures on Wednesday, before very hot temperatures return during the weekend.

“Temperatures are likely to build again with another hot spell lasting into the start of next week that could see temperatures higher than at the moment for southern areas of the UK especially,” Annie Shuttleworth, a meteorologist for the Met Office, said by email.

Energy Impact

The rise in temperatures is adding pressure to already-high energy prices, as people turn on air conditioning to keep cool.

UK power prices for Monday reached the highest level since June 29, though they eased slightly for Tuesday, according to Epex Spot SE data. Wind generation is set to climb throughout the day Monday and into Tuesday morning, bringing some relief to prices.

Power demand in Britain is forecast to peak at 34.6 gigawatts at 6 p.m. on Monday before slipping on Tuesday, according to data from National Grid Plc.

Air Canada Is Left Behind as Nation’s Airports See Major Delays - BLOOMBERG

(Bloomberg) -- Air Canada’s hope for a strong recovery in 2022 has been foiled by chaos at Canada’s biggest airports.

Travelers are back in big numbers as the summer vacation season kicks off. But Toronto’s Pearson International Airport has descended into scenes of long lines and a sea of luggage, and the nation’s largest airline is paying the price.

About 65% of Air Canada flights tracked by FlightAware.com were delayed on Friday and Saturday, again making it one of the worst-performing airlines in the aviation website’s daily rankings. More than half of Pearson departures -- for all airlines -- took off late on those two days, the site said. Nearly half of departures from Montreal’s Trudeau International were delayed on Saturday.

Like other large carriers, Air Canada has cut back its summer schedule, canceling about 9,000 flights to relieve pressure and improve operations. Investors have been unimpressed: the shares have fallen 23% in three months for the second biggest decline in the Bloomberg Americas Airlines Index. Air Canada is worst performer in that index since the onset of the Covid-19 pandemic in March 2020.

Travel bottlenecks are a problem globally as airlines and airports struggle to hire and train enough people to handle a wave of passengers who want to fly after two years of Covid restrictions. British Airways last week scrapped another 10,300 flights; Deutsche Lufthansa AG, EasyJet Plc, Delta Air Lines Inc. and other carriers have made similar moves. It’s all leading to a lot of finger-pointing as airlines, airports and governments seek to shift blame.

Air Canada says it has 32,000 employees compared with 33,000 prior to the pandemic, yet is operating only 80% of its June 2019 schedule. Despite that, it still faces a shortage of baggage handlers and other staff, said Cowen Inc. analyst Helane Becker.

It’s been a long process of hiring workers after Canada kept Covid-19 travel restrictions in place longer than the US did, forcing Air Canada and other employers to constrain their capacity growth last year.

“It just isn’t that easy to turn things around,” Becker said. “There is a fair amount of new employees, so there’s a learning curve.” She thinks that delays and cancellations could continue until the middle of next year.

Ahmad Rawanduzy’s daughter arrived in Toronto from Frankfurt, Germany, through an Air Canada connection in Montreal on July 1 and could not find her luggage. Three days later, they received a text message saying that her bags were at Pearson airport. Upon arrival, they were informed that the bag was still in Montreal without a tag.

Rawanduzy, who lives in a city about 45 minutes away from the airport, said the process is frustrating because of “the traveling chaos, the price of gas, and paying for parking for a few hours at a time.”

The delays have heaped pressure on the federal government, which has been criticized for being too slow to handle passport applications and hire security staff to deal with passengers. Transport Minister Omar Alghabra said in a statement Friday that nearly 1,200 screening officers have been hired since April and asserted that things are getting better.

At Pearson, 79% of travelers got through security lines within 15 minutes during the week of June 27, Alghabra’s office said in a statement Friday. Rachel Bertone, a spokesperson for Greater Toronto Airports Authority, said there have been “improvements both on the arrivals and departures sides.”

Rising cases of Covid-19 are exacerbating the problem. Short-notice schedule changes sometimes happen because members of the flight crew are forced to isolate with virus symptoms, a positive test or because they came into contact with an infected individual, Air Canada said in an email to a customer that was seen by Bloomberg.

Air Canada spokesperson Peter Fitzpatrick said the airline is working with airports to streamline operations and improve the movement of baggage. Reductions to the summer schedule will also help alleviate pressure on airport gating, customs and air traffic control, he said.

“The system has never been stressed like this before,” said Richard Aboulafia, managing director of aerospace consulting firm Aerodynamic Advisory LLC. “I think it’s going to be a brutal summer.”

Fuel hits N250/litre in Abuja, others, queues spread - PUNCH

Some filling stations in Lagos, Abuja, Niger and other states dispensed Premium Motor Spirit at between N200/litre to N250/litre on Sunday, higher than the government-approved retail price of N165/litre, as queues for the product extended to more states.

It was gathered that the worsening queues for petrol in Lagos and neighbouring states, as well as its prolonged persistence in Abuja and environs, were due to the insufficient supply of products by the Nigerian National Petroleum Company.

NNPC is the sole importer of petrol into Nigeria for several years running. It often claims to have enough products to keep the country wet for months. It, however, stayed mute on Sunday when contacted.

Our correspondents gathered that some filling stations in Lagos sold petrol to motorists at N200/litre and still had queues, as black marketers dispensed the product at N300/litre.

In Abuja, Khalif filling station in Kubwa, dispensed the commodity at N250/litre on Sunday but had N165/litre displayed on its pumps. But once a motorist tells the fuel attendant the amount he or she wishes to buy, this would be calculated based on N250/litre.

The queues for petrol in Abuja has never ceased since February this year, but it grew worse in neighbouring states of Nasarawa and Niger on Sunday as motorists search for PMS to move around during the Sallah break.

Oil marketers denied claims of product hoarding or diversion, as they stressed that the insufficient supply of PMS by NNPC and the non-payment of bridging claims for the transportation of petrol were the key reasons for the scarcity.

The President, Petroleum Products Retail Outlets owners Association of Nigeria, Billy Gillis-Harry, told our correspondent that filling stations that had products were dispensing, while those that were shut had no petrol to sell.

He said, “The problem is that every side needs to be transparent. We as retail outlet owners are ready to sell petroleum products to the teeming Nigerian public. We have no reason why we should not sell our products.

“The money used in buying the 45,000 litres of petrol from depots, almost N7m, is borrowed, and time-bound. So every retail outlet owner knows that the wise thing to do in this business is to sell out and try to turn around that sale as many times as possible.

“So with this scenario in view, there is no retail outlet owner that is hoarding product or diverting it. Yes, we know there may be bad eggs among the good bunch, but the fact that we are not having sufficient products is what has remained the cause of fuel scarcity.”

Gillis- Harry added, “In the case of Abuja, it is clear to understand that if the bridging claims are paid to marketers, they will be able to continue their products’ purchase cycle. That is just the reality. So payment of bridging claims is an issue and insufficient supply is also another issue.

“This is because if there is product and there is money for us to buy, then why won’t we buy and sell? What else are we in business for? Are we going to buy products and keep them? The answer is no! So this is the reality.”

On what could be the solution to the current crisis in the downstream oil sector, the PETROAN president stated that everything still boiled down to the need to end the current fuel subsidy regime.

He said, “There is a solution and it is simple. The subsidy that is being paid should be stopped. The money should be channeled to other developmental infrastructures such as health, education, etc.

“And since the refineries have not been fixed by the government, they should either give it wholly to private sector practitioners like PETROAN that own the retail outlets to manage.”

The NNPC stayed mum when asked to react to claims of insufficient supply of petrol by the national oil company. Its spokesperson, Garba-Deen Mohammad, did not answer calls and had yet to respond to a text message sent to him on the matter.

Fuel price hits N200/litre in Lagos, scarcity persists

Further checks show that some filling stations in Lagos and Ogun states sold fuel at N200/litre.

While many stations were under locks and keys despite a promise by the NNPC to keep the country wet, many among the few that had products were seen dispensing above N200/litre.

According to findings, the Federal Government and oil marketers are yet to come to a compromise on how much a litre of petrol should be sold, and marketers are beginning to sell products at prices not approved by the Nigerian Midstream and Downstream Petroleum Regulatory Authority.

The continuous rise in prices comes on the heels of recent threat to withdraw the licenses of marketers that sell above official price of N165/litre issued by Chief Executive, NMDPRA, Farouk Ahmed.

A source close to the matter had told The PUNCH that marketers met with Ahmed in Abuja last week, where he pleaded with them not to increase their pump price.

“The meeting was held with NMDPRA last week, and Mr. Farouk begged marketers not to increase the price. But the long queues you are seeing are due to inadequate supplies. Marketers have also gone ahead to increase prices unofficially due to high operational costs. There was no formal letter to the effect though. It was just a word of mouth agreement to increase price between N175-N180 per litre”, our source said.

He advised the government to issue a statement on the marginal increase in the pump price of petrol.

Executive Secretary of the Major Oil Marketers of Nigeria, MOMAN, Clement Isong, declined to comment on the causes of the rising petrol prices.

The PUNCH had recently reported that oil marketers were currently pushing for compensation from the Federal Government if petrol would remain at N165 per litre.

Among other things, marketers are lamenting high operational costs due to rising diesel price which is currently being sold above N800/litre at depots. There are fears that diesel prices could hit N1500/litre if nothing is done to tame prices.

The National Operations Controller of Independent Petroleum Marketers Association of Nigeria, Mike Osatuyi, however, debunked allegations that NMDPRA and marketers secretly agreed to increase the price.

“That’s not true. There is no letter to that effect from NMDPRA,” he said.

However, when asked why the fuel price was rising, he said it was due to the hike in the price of diesel.

“Those stations you see that sell above N165 do so because they have to recover their costs,” he said.

On when the Federal Government would pay marketers the promised bridging claims, he said the payment process could stretch till July ending.

“Marketers are just submitting their claims and they will be verified first. So payment could be by the end of July,” he said.

Reacting to the continuous price face-off between the Federal Government and marketers, industry analyst and former Group Chairman/CEO, International Energy Services Limited, Dr. Diran Fawibe, said the issue of fuel supply appeared to have defied solutions.

“Everybody is throwing figures about costs and prices to sell and what not to sell. At the end of the day, it’s the consumers that will bear the brunt. What we have noticed is that prices vary from station to station, and from state to state, and obviously, that’s what the bridging payment by the Federal Government was supposed to address”, he said.

On his part, Chief Executive Officer, Centre for the Promotion of Private Enterprise and former Director-General, Lagos Chamber of Commerce and Industry, said the current price was not sustainable.

According to him, the government is not in any way in the best position to control the prices of petrol if it cannot control diesel prices.

Commuters groan as transport fares rise

Meanwhile, findings by our correspondents show commercial buses have increased transport fares significantly, following the development.

According to residents from Alagbole-Akute axis of Ogun State, transport fares have increased by 50 cent – 100 per cent with bikes and buses becoming scarce. The residents blamed the situation on the fuel scarcity that has begun to manifest as long fuel queues and the reduction in the number of bikes plying the area as a result of the Sallah break.

One resident, who identified himself as Tayo Okediji, said, “Alagbole to Berger was between N200 and N300 today. There are more commuters on the roads because most of the bike operators are observing the Sallah break, and the few available ones have hiked the price. According to them, there is no fuel.”

U.S. recession looks likely — and there are 3 ways the economy could get hit, analyst says - CNBC

KEY POINTS

- The odds of the U.S. economy falling into recession by next year are greater than 50%, TD Securities said Monday.

- Outlining three potential risks, the investment bank named rising gas prices, a hawkish Federal Reserve and a generally slowing economy.

- “The odds of a recession in the next 18 months are greater than 50%,” global head of strategy, Richard Kelly told CNBC.

Rising gas prices are piling pressure on the U.S. economy.

Bloomberg | Getty Images

Rising gas prices are piling pressure on the U.S. economy.

Bloomberg | Getty Images

The odds of the U.S. economy falling into recession by next year are greater than 50%, Richard Kelly, head of global strategy at TD Securities, said Monday, outlining three possible ways it could get hit.

Rising gas prices combined with a hawkish Federal Reserve and a generally slowing economy are among the tripartite risks facing the world’s largest economy right now, according to Kelly.

Could that raise the possibility of a recession? “I don’t think it’s a potential,” he told CNBC’s “Street Signs Europe.”

“The odds of a recession in the next 18 months are greater than 50%,” Kelly added.

Exactly when that downturn might hit is harder to predict, however.

Kelly said the economy could slip into a technical recession — defined as two consecutive quarters of negative growth — as soon as the end of the second quarter of 2022. Analysts will be closely watching the Bureau of Economic Analysis on July 28 for early estimates on that.

Alternatively, the fallout from surging gas prices following Russia’s unprovoked invasion of Ukraine and the Fed’s continued interest rate hikes could both weigh on the economy by the end of the year or into early 2023, he said.

And if the U.S. manages to weather all of that, a general slowdown could take the wind out of the economy’s sails but mid- to late-2023.

“You really have three shots at a recession right now in the U.S. economy,” said Kelly.

“We haven’t even hit the peak lags from gas prices, and Fed hikes really won’t hit until the end of this year. That’s where the peak drag is in the economy. I think that’s where the near-term risk for a U.S. recession sits right now,” he continued.

“Then, if you get past that, there’s the overall gradual slowing as we get into probably the middle or back half of 2023.”

Investment firm Muzinich agreed Monday that a forthcoming recession was not a matter of “if” but “when.”

“There will be a recession at some point,” Tatjana Greil-Castro, co-head of public markets, told CNBC, noting that the forthcoming earnings season could provide a gauge for when exactly that might occur.

“Where earnings are coming in is for investors to establish when the recession is likely to happen.”

The comments add to a chorus of voices who have suggested that the economy could be on the cusp of a recession.

David Roche, veteran investment strategist and president of Independent Strategy, said Monday that the global economic outlook had recently shifted, and it had now become easier to assess how different parts of the world might respond to various pressures.

“You can now make detailed prognosis for different parts of the world which are themselves very different from the simply blanket recession picture,” he said.

Roche said he considered a recession the loss of 2-3% of jobs in a given economy, suggesting that a U.S recession may be some way off. Data published Friday by the Bureau of Labor Statistics showed stronger-than-expected jobs growth, with nonfarm payrolls increasing by 372,000 in the month of June, well ahead of the 250,000 expected.

However, he noted — not for the first time — that Europe is on the brink of what he calls a “war-cession,” with the fallout from the war in Ukraine piling economic pressure on the region, particularly as it pertains to energy and food shortages.

“Europe may be hit by an energy crisis all of its own which produces the war-cession. The recession caused by war,” he said.

It comes as Nord Stream 1, the primary pipeline supplying natural gas to Europe from Russia, is shut down this week for maintenance, raising concerns that it could be turned off indefinitely due to ongoing disputes over Ukraine sanctions.

Column: King dollar delivers hedge funds' best FX quarter since 2017 - REUTERS

ORLANDO, Fla., July 11 (Reuters) - Hedge funds had a torrid second quarter, but their faith in the dollar paid off spectacularly.

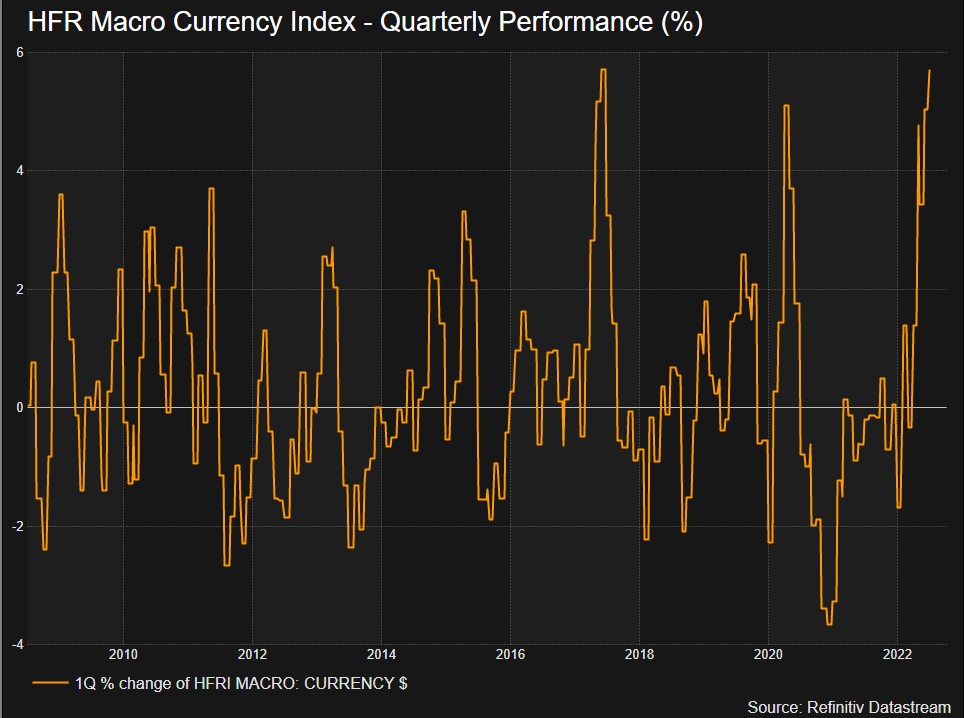

Industry data provider HFR's Currency Index, part of the broader Macro (Total) Index, rose 1.76% in June, the biggest monthly rise since March 2020, which brought the April-June increase up to 5.70%.

That was the best quarter since a 5.72% surge in the same period in 2017.

Or put another way, currency strategies tracked by HFR essentially just had their joint-best quarter since the index was launched in 2008. Central to that was funds' consistent and sizeable long dollar position.

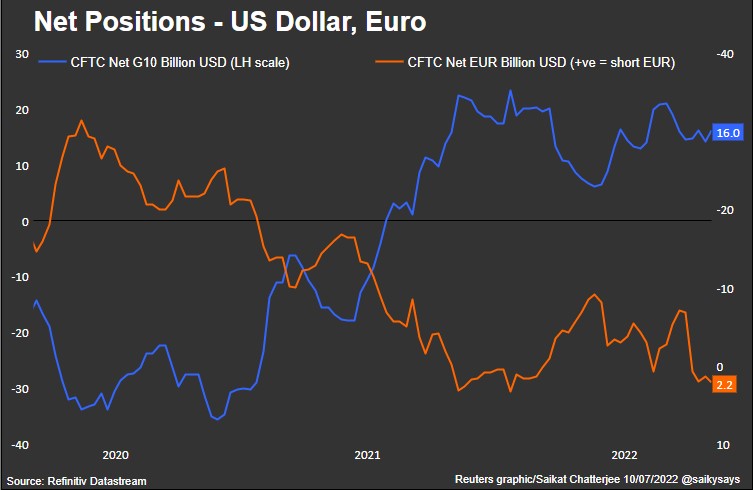

According to Commodity Futures Trading Commission data, hedge funds have been long of dollars against a basket of G10 currencies every week for 51 weeks. The average net long dollar position in the second quarter was worth around $15 billion.

Advertisement · Scroll to continue

Thanks to a widespread belief that the Federal Reserve will raise U.S. interest rates to combat inflation more than other central banks, the dollar went on a tear in Q2.

It is now at its strongest level in 20 years against the euro and a basket of major currencies, and its 6.5% rise on an index basis in April-June was its best quarter since 2016.

The latest CFTC data showed that funds increased their net long dollar position against G10 currencies by $2 billion to $16 billion in the week through July 4, simply reversing the $2 billion reduction from the week before.

Advertisement · Scroll to continueReport an ad

This suggests that despite the dollar's strong gains, lofty position, and a general softening of investors' expectations for the Fed's tightening cycle, funds are confident the greenback can climb even higher.

MUFG's Lee Hardman notes that the stronger-than-expected U.S. employment report for June on Friday and the latest public comments from Fed officials point to another 75 basis point rate hike later this month.

Advertisement · Scroll to continueReport an ad

"The dollar strongly regained upward momentum over the past week and we expect this to extend further in the near term," Hardman wrote in a note on Friday.

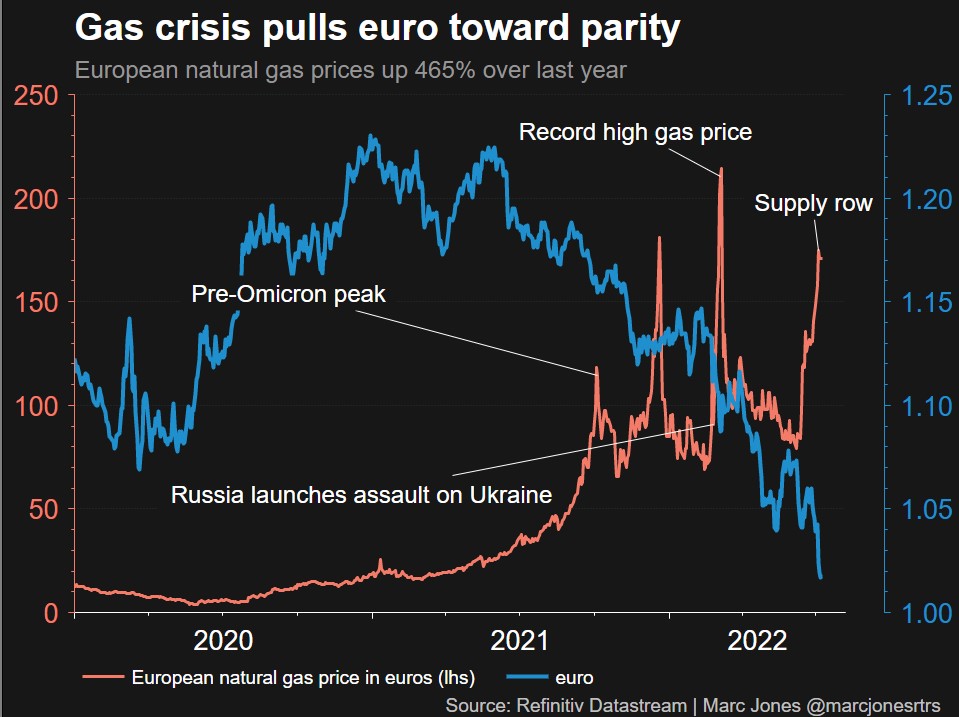

The relative weakness of the dollar's major counterparts, particularly the euro, cannot be ignored though.

CFTC funds increased their net short euro position to 16,852 contracts from 10,596 a week earlier. That is the biggest net short this year and marks the fourth week in a row funds have been net short the euro.

A short position is essentially a bet that an asset will fall in value, and a long position is a bet that it will rise. Funds are now holding a $2.16 billion bet on the euro weakening. A month ago, they had a $6.8 billion bet on it strengthening.

The flip is paying off.

The euro slumped to a 20-year low of $1.0070 last week, close to parity, on fears that the energy crisis will tip the euro zone economy into recession, and that the European Central Bank will struggle to support growth while trying to tame record inflation and rein in widening sovereign bond yield spreads.

Hardman recommends selling the euro at $1.0160, targeting a break through parity down to $0.9760 soon. It looks like a growing number of hedge funds would be on board with that.

(The opinions expressed here are those of the author, a columnist for Reuters.)

Heathrow Asks Airlines to Stop Selling Seats to Ease Staff Woes - BLOOMBERG

Bloomberg) -- London’s Heathrow airport said it would ask airlines to stop selling tickets for summer travel as the hub imposes a cap on daily passenger numbers to try to avert chaos due to staffing issues.

The UK’s biggest airport will limit daily passenger traffic to 100,000 people through Sept. 11, according to a statement Tuesday. The airport said that new recruits were not yet “up to full speed” and functions including ground handlers for baggage were “significantly under resourced.”

The airport said the latest travel forecasts show that the airport would have to handle as many as 104,000 passengers a day over the summer.

The U.S. Dollar Just Matched the Euro. Is It Time for a European Vacation? - THE ASCENT

Key points

- On July 12, 2022, the U.S. dollar and the euro reached an equal value.

- American tourists traveling abroad could benefit from more favorable exchange rates.

If you're an American who is planning a trip to Europe, you may be able to benefit from favorable exchange rates. The U.S. dollar and the euro are now equal in value for the first time in two decades. What does this mean for tourists? Since the U.S. dollar will go further in many European countries, could this be a good time to plan a vacation?

The euro continues to lose value against the U.S. dollar. In the early morning of July 12, the U.S. dollar matched the euro for the first time in years. This is big news and not typical.

Around this time last year, $1 U.S. dollar was worth around 0.84 euro. At that time, $500 would equal around 420 euros. When the U.S. dollar and the euro match, $500 equals 500 euros.

This is a big difference. The last time the currencies were equal was in late 2002.

Your money will go further

What does this mean for American tourists going to Europe? American travelers can benefit from the U.S. dollar being equal to the euro.

Your money will go further than it usually would when traveling in countries where the euro is the official currency. While the euro isn't accepted in all parts of Europe, 19 countries use this currency.

It's also easier to figure out how much something costs when currencies are close to or equal in value, eliminating the need to use a currency calculator app while traveling.

Should you plan a European vacation?

With favorable exchange rates, you may wonder if now is a good time to take a European vacation. You'll likely benefit if you already have a trip starting in the coming weeks or days.

For those who have yet to make trip plans, make sure that you consider other factors. While the exchange rate is favorable, travel as a whole costs more these days.

You'll likely be paying higher costs when buying a plane ticket, booking a hotel, or making other reservations. That means higher travel costs may cancel out the savings you get from a favorable exchange rate.

You should also consider the current state of the global economy and your own financial situation. If you have extra money in your savings account and can afford to travel internationally, taking a trip might be a good option.

But if you have minimal savings, you may want to hold off until you're in a better financial position to travel. If you start saving up now and follow a vacation budget, you can take an affordable trip in the future.

If you decide to travel to Europe, look for bargains. If you can score a cheaper flight, you could save money on the cost of your trip. Make it a point to seek out cheap travel deals.

Use a credit card with no foreign transaction fees

When traveling abroad, bring the right credit card with you.

You'll want to use a credit card with no foreign transaction fees. Cards with these fees typically charge a fee of 3% for every foreign transaction.

If you take a trip to France and spend $1,000 and use a credit card that charges a 3% foreign transaction fee, you'll be paying $30 in extra fees.

Think ahead before you depart for your next trip abroad to avoid unwanted additional fees.

Luckily, many no foreign transaction fee credit cards don't charge this fee. A lot of these cards are geared toward travelers. To earn rewards on your travel spending, check out our list of best travel credit cards.

Top credit card wipes out interest until 2024

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR until 2024! Plus, you'll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

Summer: Emirates advises travellers on early booking - PUNCH

Emirates Airlines has urged intending summer holiday customers who are yet to make travel arrangements to do so at once in order to ensure that they are able to travel on their preferred dates and flights.

This comes as daily booking volumes accelerate and travel rebounds from the impact of the pandemic.

The summer holidays period, which happens to be about the busiest time for most airlines, sees Emirates preparing for its busiest period with over 550,000 customers expected to fly out from the UAE between June and July on over 2,400 weekly network-wide departures.

The airline said in a statement that it had continued to add flights and frequencies where possible as it ramped up the summer schedule. Emirates noted that it would be operating close to 80 per cent of its pre-pandemic capacity, or over one million weekly seats for this summer to serve demand.

The airline added that it had also introduced other technology-centric services, including self-check-in and bag drop kiosks at DXB, for a smoother and contactless airport experience.

Emirates customers also now have the option to cut down their wait time with 25 mobile check-in ports, where they can get their boarding cards, weigh and tag their bags, and have any of their questions answered by check-in staff.

However, from August 1, customers travelling from Dubai to London, Paris and Sydney will be able to experience the airline’s full Premium Economy experience, complete with dedicated check-in areas at DXB and luxurious seats offering unrivalled comfort, the airline further said.

Customers returning from their holidays abroad can continue their summer experiences on the ground in Dubai with My Emirates Pass.

Customers traveling between May 1 and September 30, 2022 can enjoy exclusive offers at over 500 locations, including restaurants, big-name retail outlets, spas and exclusive attractions across the city by simply showing their Emirates boarding pass, it noted.