Travel News

Air Taxi Startup Joby Sees Service Starting in Dubai Before US - BLOOMBERG

(Bloomberg) -- Joby Aviation Inc. expects to launch its flying taxi service in Dubai before anywhere else, including the startup’s home turf in the US.

Work on a partnership with the Gulf emirate announced earlier this year is “a bit more advanced in the approach that they’re taking” than in other jurisdictions, Joby’s president of operations, Bonny Simi, said in an interview. “So we’ll be able to launch in Dubai first.”

Joby said in February that it was targeting initial operations by 2025 in Dubai, where it won a six-year exclusive agreement to operate its electric air-taxi services, and commercial services by early 2026. That milestone may now be reached as soon as late 2025, Simi said.

Dubai’s government has provided economic support, while regulators have dedicated resources especially to Joby, helping to “remove as many roadblocks as possible for us to move as quickly as possible and as safely as possible,” Simi said. The support will help to “de-risk that initial launch for us” financially, she said.

Joby initially plans to establish four vertiports across Dubai for its electric vertical takeoff and landing vehicles, Simi said. The launch sites include Dubai International Airport, a global hub for air travel; also the man-made island of Palm Jumeirah, downtown Dubai near the Burj Khalifa tower, and the city’s marina.

Rival Archer Aviation Inc. reached a preliminary deal last year with the government of nearby Abu Dhabi, targeting manufacturing and a service launch by 2026. While Joby will have exclusivity for flights contained within Dubai, Archer plans to operate flights between Abu Dhabi and Dubai, and across the United Arab Emirates.

Other eVTOL market aspirants have also flocked to oil-rich Gulf states. Lilium NV, Embraer SA’s Eve Air Mobility and Volocopter GmbH have all signed agreements in Saudi Arabia, the UAE or both.

Canada's economy to slow with new limits on temporary migrants - BLOOMBERG

BY , Bloomberg News

Growing skepticism about immigration is a real political economy threat: Sean Speer

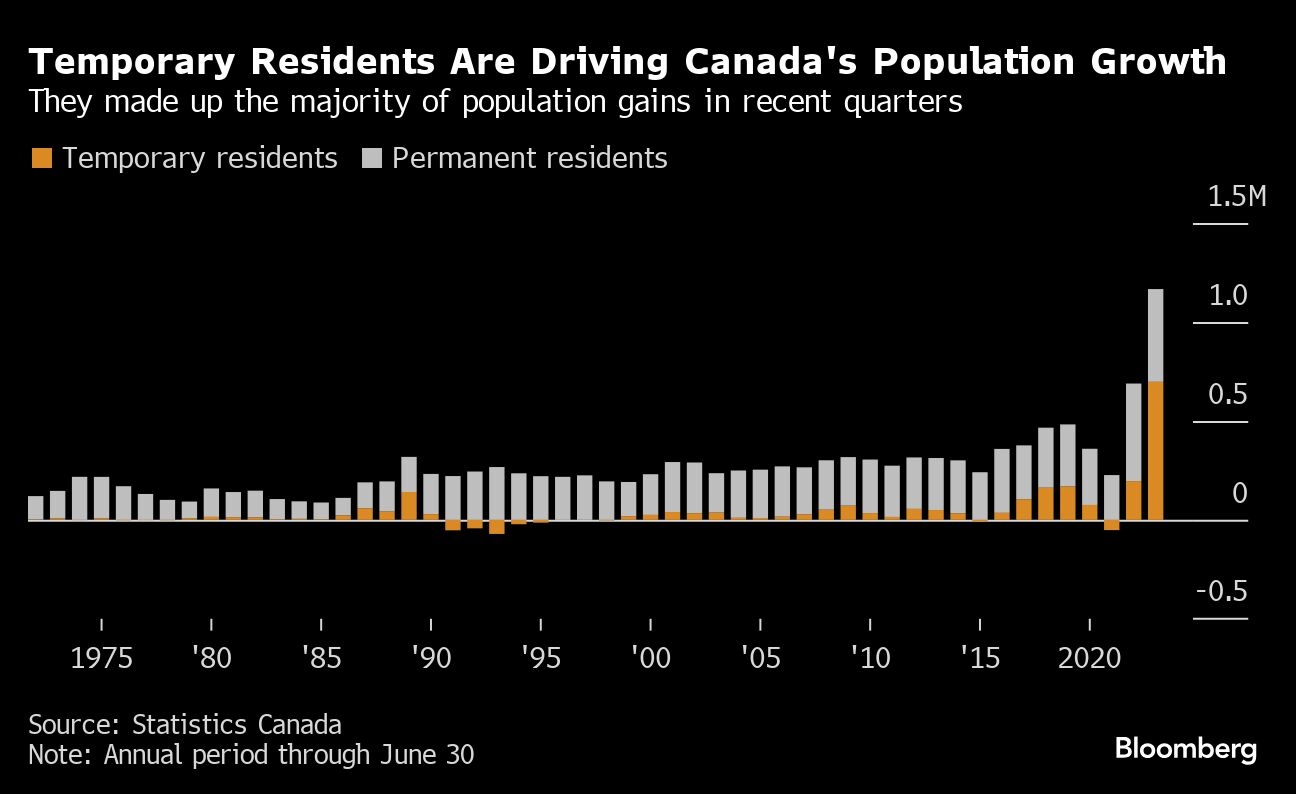

Canada’s planned reduction in temporary residents is set to add downward pressure to inflation and economic growth in the coming months, and the policy will likely halve its population growth rate when it takes full effect next year, economists say.

Prime Minister Justin Trudeau’s government plans to reduce the number of temporary immigrants by 20 per cent over the next three years, bringing the level down to 5 per cent of the population from 6.2 per cent currently. Starting in May, the government will make it harder for firms to rely on temporary foreign workers.

With one of the world’s fastest rates of population growth, the country has benefited from quickly expanding its labour force. But the rapid increase, driven primarily by foreign workers and students, has led to growing anxiety about housing shortages and the cost of living, prompting the Trudeau government to scale back its open immigration policies.

“This policy would have a material impact on the economy moving forward,” Royce Mendes, head of macro strategy at Desjardins, said in a report to investors. “The combination of a highly interest-rate sensitive economy and the likelihood of slower population growth are the main reasons we have been more bearish on the medium-term outlook for the Canadian economy.”

A decrease in temporary residents might offset the short-term economic benefits of any Bank of Canada rate cuts this year, Mendes said, adding that it could have an “even more severe impact” next year and in 2026 as population growth will be cut in half.

Robert Kavcic, an economist at Bank of Montreal, expects Canadian population growth to be slashed to near 1 per cent in the coming years, in line with the pace seen in the decade before the pandemic. The population has been growing around 3 per cent recently.

“The impacts will be: Less pressure on rents and housing, less stress and inflation in services, and lower interest rates than we otherwise would see if these inflows were to continue,” Kavcic said.

Worsening housing affordability was a major impetus for the government’s cap. Rent prices have been surging across major cities and have been a key contributor to consumer price increases in Canada. In February, the overall rate of inflation eased to 2.8 per cent on an annual basis, while rents jumped 8.2 per cent.

Excluding shelter costs, the consumer price index rose 1.3 per cent, below the central bank’s 2 per cent target.

“By way of just slowing the upward momentum in shelter inflation, this reinforces our view that the central bank will cut rates more forcefully than what’s implied by market pricing,” Desjardins’ Mendes said.

Currently, markets are pricing in more than three rate cuts by the end of this year, with a high probability that the Bank of Canada will begin that process in June.

The government’s immigration change will hurt businesses that are relying on importing low-wage foreign workers to fill jobs. According to the Canadian Federation of Independent Business, 22 per cent of small businesses in February said that a lack of unskilled or semi-skilled labour was impeding their ability to maintain their current operations or grow.

“The costs of bringing in a foreign worker are much higher compared to those associated with the hiring of someone already in Canada,” Christina Santini, CFIB’s director of national affairs, said in an emailed statement. “When employers turn to temporary foreign workers, it’s because they can’t find someone already in Canada.”

France Raises Security Alert to Max Level After Attack in Moscow - BLOOMBERG

(Bloomberg) -- French authorities have raised their security alert level to the maximum following the deadly Friday attack in a Moscow concert hall.

Prime Minister Gabriel Attal said the increased countrywide awareness level was justified given “Islamic State’s claim it was responsible for the attack and the threats weighing on our country.”

He made the announcement in a tweet on Sunday evening following a defense and security council organized by President Emmanuel Macron at the Elysee Palace.

Africa Seen as Growing Hot Spot for $3,000-a-Night Hotel Rooms - BLOOMBERG

BY , Bloomberg News

, Source: W Hospitality Group

(Bloomberg) -- Major hotel chains including Marriott International Inc. and Hilton Worldwide Holdings Inc. are on track to more than double their footprint across Africa in the coming years as the continent sees a boom in tourism.

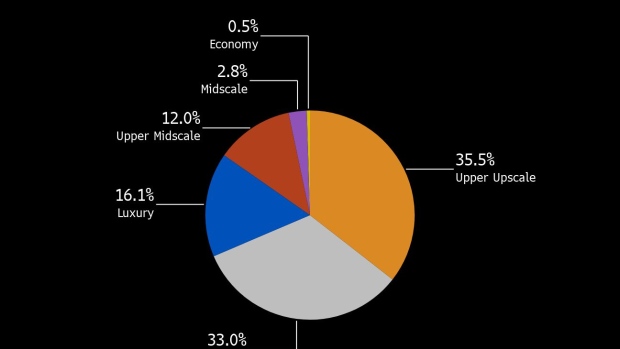

Marriott, which last year opened the JW Marriott Masai Mara Lodge in Kenya with rooms averaging more than $3,000 a night, has more than 138 hotels under development in Africa, while Hilton has 72 properties in the pipeline, according to a report by W Hospitality Group. Hyatt Hotels Corp. is planning to add another 11 locations across the continent, the report shows.

In all, the Lagos, Nigeria-based travel specialist found that the total number of hotel rooms operated by major chains on the continent is expected to soar 75% to 175,346 in the coming years. More than three-quarters of the properties are expected to be upscale, upper upscale or luxury locations.

“There an enormous concentration of new hotels and resorts in the luxury and upper upscale level and hardly anything at the economy and midscale,” Trevor Ward, managing director of W Hospitality Group, said in an interview. “I hope that will come.”

Recent additions to the hotel scene in Africa include Nobu Hotels, which made its debut on the continent last year with an outpost in Marrakesh. Meliá Hotels International SA also opened Ngorongoro Lodge in Tanzania, where a stay can typically be booked for more than $1,100 per day.

Countries across Africa are poised to benefit as tourism to the continent surges in the aftermath of the coronavirus pandemic. Google searches for African safaris, for instance, more than doubled in the first three months of 2023 compared with the same period a year earlier, according to the travel specialist Go2Africa. In Uganda, visitor arrivals last year jumped 57% in 2023, driving earnings to $985 million, according to the tourism ministry. Revenue is expected to surpass 2019 levels this year.

Still, the continent makes up a very small share of the global hotel industry. Hilton, for instance, last year opened almost 400 properties. Just two of those were in Africa. And out of the 560 new locations that Marriott opened in 2023, only four were on the continent, W Hospitality Group’s report found.

Of the 524 properties that hoteliers are currently planning to open across Africa, more than one-quarter are expected to begin taking visitors this year, Ward said. The remaining locations are expected to debut in the next six years, he said.

“It has been very difficult to raise finance for hotels globally, and then when you put in the Africa factor, it gets more difficult,” Ward said. “The costs are just ballooning and when the price goes up while you are under construction, it gets very difficult to bridge that financing gap.”

--With assistance from Fred Ojambo.

(Updates with tourism data from Uganda in sixth paragraph.)

Kenya Airways to Name Strategic Investor by Year-End - BLOOMBERG

(Bloomberg) -- Kenya Airways Plc has started the process of identifying suitable partners to support capitalization of the company to boost its efforts to reduce debt and expand operations.

KQ, as the carrier is known, plans to announce a strategic investor by the end of this year, Chief Executive Officer Allan Kilavuka said Tuesday in a virtual briefing. The carrier, which is 48.9% state-owned, didn’t receive a direct disbursement from the National Treasury last year and instead got support in restructuring some debts, he said.

“The one thing that we have not yet completed is really to rethink our balance sheet — that is completely essential and that’s what we are really focused on this year,” Kilavuka said. “We are still projecting to break even at the very least for 2024.”

KQ said in June it owed creditors $1.35 billion and was at risk of defaulting on a $420.5 million government loan. Other loans include $439.8 million owed to a special purpose vehicle domiciled in Delaware set up for the acquisition of seven aircraft and an engine, and $97.9 million from another one incorporated in the Cayman Islands to purchase 10 Embraer jets. Local lenders are owed more than $224.9 million, while liabilities to suppliers, who include fuel companies, total $164.2 million.

The airline swung to an operating profit of 10.5 billion shillings ($79.6 million) last year, and the annual loss narrowed by 41%, Chief Financial Officer Hellen Mathuka said during the briefing.

KQ shares have been suspended from the Nairobi Securities Exchange since July 2020 as the company implements the operational and corporate restructuring.

“In the near term, the focus is in completing the restructuring plan whose main objectives are to reduce the group’s financial leverage, fund growth and increase liquidity,” Kilavuka said.

50,000 Nigerians May Miss 2024 Hajj, Media Group Raises Alarm - LEADERSHIP

Written by Abdullahi Olesin

Unless the federal government act swiftly, over 50,000 intending Nigerian pilgrims may miss this year’s Hajj exercise.

The Muslim Media Watch Group of Nigeria (MMWG) raised the alarm following the additional N1.9m fee slammed on the intending pilgrims by the National Hajj Commission of Nigeria ( NAHCON).

The national coordinator of the group, Alh. Ibrahim Abdullahi, said this could only be averted if the federal government approves concessional rates of dollars to naira for this year’s Hajj exercise.

LEADERSHIP reports that NAHCON had on Sunday announced additional payment of N1.9 million by intending pilgrims who had earlier paid N4.9million for the exercise due to astronomical increase in the rate of dollars to naira in the last five months.

But, the MMWG national coordinator, who spoke to LEADERSHIP on the outcome of the group’s extra-ordinary meeting held in Abuja, maintained that “without granting concessional rate for dollars to Naira, it would be difficult for over 50,000 Nigerian pilgrims who have paid so far, to participate in the important religious duty of Hajj.”

He maintained that granting concessional exchange rates for Hajj annually has been a ritual by the past administrations in Nigeria.

Abdullahi, therefore, called on President Bola Tinubu to urgently intervene to save this situation, which according to him, has reached a critical stage.

He reminded the federal government that though Hajj is a religious obligation, its positive impact on the lives of the people and people in governance is very significant, adding that Nigeria needed spiritual intervention to move out of the present socio-economic situation as well as insecurity pervading the country.

He added that, “granting that concession could pave way for the success of Tinubu as beneficiaries would pray hard for the President and his noble administration in the holy lands of Makkah and Madinah.”

He, however, commended NAHCON for its untiring efforts over the matter and appealed to the intending pilgrims to be calm.

‘94% of property in Lagos without title’ - PUNCH

Stakeholders in the building industry have disclosed that 94 per cent of property in Lagos State do not have legal titles.

They stated this in separate interviews with The PUNCH at the recent launch of Edge Facility Managers, which was held in Lagos.

The First Vice President of the Nigerian Institution of Estate Surveyors and Valuers, Victor Alonge, said the way forward in maximising the dead capital in the country was to streamline the land titling process.

He said, “The dead capital is dead because the owners have no legal title to land, and without legal title, you cannot access finance for one purpose or the other. In going to a bank, security would be required to serve as collateral for finance to be loaned out. This security means a certificate of occupancy, which serves as a legal title, and without a legal title, banks would not yield their money.

“The solution is to improve the land titling system, giving access to easy registration. Hence, a need for state governors to take it seriously. Lagos State is at the forefront of states with an improved land titling system. You would find out that of the property in Lagos, about 94 per cent have no legal title. And if Lagos is at the forefront, you can imagine states like Nasarawa, Ogun, and Oyo, among others.”

Alonge noted that Edo State had lots of property but the issuance rate of Certificate of Occupancies could be improved.

He added, “There was something that surprised me last week when the Edo State governor came to commission our building in Abuja. He said that when he became governor, the Certificate of Occupancy that was issued since the creation of Edo State up till when he came into power, he was able to count about 2,000 certificate occupancies. However, in less than eight years of his administration, he had been able to issue over 30,000 certificates of occupancy. That is an improvement, but it is still not enough.”

Similarly, the Managing Partner of Ubosi Eleh & Co., Chudi Ubosi, said it was essential to identify the assets available.

He said, “Unfortunately, about 94 per cent of land is without title in Lagos State. That is the nature of what we are because people are afraid of getting the title as they do not trust what the government gives them. They believe that titling gives the government an opening into their lives, by tax deductions, among others.

“In addition, many do not even bother or know the advantages of having a formal title to land, also many are afraid of the process as they always see the government as a bureaucratic monster that consumes. The government needs to do a lot more in building awareness, educating the people, and capacity building.”

More so, the Chief Executive Officer of Edge Facility Managers, Peju Fatuyi, stated that the purpose of the launch was to raise public awareness about activities within the facility management space.

Foreign airlines drop airfares as Nigeria releases 50% of trapped funds - THE GUARDIAN

By Joke Falaju, Abuja

Indications have emerged that foreign airlines have started dropping airfares following the release of about half of the trapped funds owed them by the Nigerian government. The President of the Association of Foreign Airlines and Representatives in Nigeria, (AFARN), Mr Kingsley Nwokeoma in a phone interview pointed out that foreign airlines stopped selling to Nigerians…

British Airways planes. President of National Association of Nigerian Travel Agencies (NANTA), Susan Akporiaye believes stuck fund crisis is rocking the air transport sector.

Indications have emerged that foreign airlines have started dropping airfares following the release of about half of the trapped funds owed them by the Nigerian government.

The President of the Association of Foreign Airlines and Representatives in Nigeria, (AFARN), Mr Kingsley Nwokeoma in a phone interview pointed out that foreign airlines stopped selling to Nigerians from the lower portal due to the trapped funds.

However, the fares have gone down after the government cleared about half of the funds being owed to them.

The Central Bank of Nigeria (CBN) said it has concluded payment of $136.73 million backlog owed to verified foreign airlines.

However, the International Air Transport Association (IATA) disputed the claim, insisting that $700million of their funds is still unpaid.

But Nwokeoma said airlines are dropping their airfares because of CBN’s new policy direction on the trapped funds and stable foreign exchange rates.

He also explained that increased competition on international route also forced foreign airlines to cut airfares.

“About half of the trapped funds has been paid, the good thing is that government is listening and doing what should be done, if they have been doing this like couples of years back, we won’t be where we are today,” Nwokeoma said.

He, however, debunked claims that Nigerians are not able to access the cheap flights portal saying, “you can verify from travel agents that such claims are not true.”

He expressed optimism that the airfares will further come down as the exchange rates gets better, saying “we all know that the aviation industry is dollar denominated.”

To curtail the issue of trapped funds, AFARN President urged government to always keep to agreement because it is based on the Bilateral Air Trade Agreement (BASA) which government is signatory to.

“It is important that the government stick to it and even if if there is a problem, communication is key,”Nwokeoma said.

“Even a payment plan can be designed such as developing a quarterly plan. We hope that the government will stick to what they are doing so that we can get this out of the way.”

Lagos Clamps Down On ‘Unroadworthy’ Vehicles - DAILY TRUST

By Abdullateef Aliyu, Lagos

To ensure road safety and regulatory compliance, the Lagos State Vehicle Inspection Service (VIS) conducted a comprehensive enforcement operation on Wednesday targeting unroadworthy vehicles across the state, the state Ministry of Transportation has said.

The operation, which resulted in the seizure of over 50 rickety commercial vehicles, focused on vehicles that failed to meet the prescribed minimum roadworthiness standards as seen in its brakes, wipers, lights, shocks and tyres, as stipulated in the State’s Transport Sector Reform Law, 2018.

Ad 1/2 00:15

Dinosaurs Spine at Hang Dong, Ta Xua, Son La seen from above

During the enforcement exercise which spanned various key locations including Costain, Ikorodu road, Ojuelegba, Yaba, Oyingbo, Ikeja, and Ojodu Berger, the Vehicle Inspection Officers (VIOs) while diligently scrutinising commercial vehicles to ensure compliance with safety regulations also enlightened the drivers on the danger in non-compliance, which is the cause of road majority of accidents.

Debunking the misconceptions about the VIS’s enforcement focus which was said to target more on private vehicles, the Director, Vehicle Inspection Services, Engr. Akin-George Fashola, explained that the roadworthiness compliance is no respecter of particular categories of vehicles.

“It is expected to be implemented on all vehicles that ply Lagos roads,” he said.

Despite the professionalism displayed by VIS Officers during the operation, the ministry said some defiant commercial vehicle drivers resisted being apprehended and in the cause of their high-headedness damaged some patrol vans belonging to the VIS command.

Saying such acts of defiance will not deter the state government from persisting in enforcement efforts until the prevalence of rickety vehicles is significantly reduced, the VIS director advised all vehicle owners to adopt voluntary compliance with roadworthiness requirements for the safety of lives and property.

Fashola was, however, quoted to have reiterated that the VIS will continue to uphold its commitment to conducting fair and unbiased enforcement drives. He urged all vehicle owners and operators to prioritize regular maintenance and adherence to roadworthiness standards to ensure the safety of all road users.

‘Air Peace will crash airfares on Lagos-London route’ - PUNCH

Former President of the National Association of Nigeria Travel Agencies, Bankole Bernard, has stated that Air Peace’s pricing strategies have compelled foreign carriers to slash their fares.

Speaking on Channels Television’s The Morning Brief programme on Tuesday, Bernard emphasised that failure by foreign airlines to adjust their ticket prices on the Lagos-London route could potentially lead to their exit from the market.

This revelation comes in the wake of Air Peace’s recent launch of direct flight operations to Gatwick Airport in London, offering tickets at a competitive rate of N1.2m.

The airline conducted its inaugural flight to London with 260 passengers aboard a Boeing 777, which has a capacity of 274 seats, on Saturday. The route will be served daily from Lagos.

The move has disrupted market dynamics, prompting foreign airlines that previously enjoyed exclusivity on the route to reconsider their pricing strategies.

Bernard highlighted the significant impact of Air Peace’s entry into the market, indicating that it had forced foreign carriers to reevaluate their pricing structures to maintain their market shares.

Bernard said, “How come all of a sudden airfares have gone down? What could be responsible for that? Number one: there is a new entrant to a major route (Lagos-London).

“There are two major destinations that Nigerians fly to. Number one is Dubai and Dubai has been out of it for a while now. So, we (Nigerians) have resorted to the London route. The UK route is where a lot (of foreign carriers) use to earmark their airfares.

“Now that Air Peace has come into that space with a direct flight that will not cause any layover in any other country, the price has dropped. Why? What happened? Is there magic around that? We should be able to question what made the prices drop.”

According to Bernard, prices would drop as long as there was another form of supply that was different from the conventional ones.

“The supply that we now have, that is Air Peace, which is a direct flight, will put pressure on every other route. So, all the other airlines are forced to quickly adjust or they will be out of the market in no time,” he noted.

The PUNCH observed a difference in the costs of air tickets sold on March 4, 2024, compared to those on Saturday.

As of Saturday, the round-trip economy class ticket from Lagos to London varied in cost among different airlines.

RwandAir Express offered it at N1,102,563; Royal Air Maroc at N1,628,675; and Ethiopian Airlines at N1,641,249

The former NANTA boss mentioned that foreign airlines operating at the four major airports – Lagos, Abuja, Port Harcourt, and Kano – were enjoying substantial profits without facing any significant competition

Bernard suggested that if the airlines had been profitable, there was no need for them to publicly complain about accumulated trapped funds.

He proposed establishing an audit committee to examine the reasons behind those backlogs.

The CBN had about two weeks ago announced the completion of payment of $7bn legacy debt, which included FX forward contracts among foreign exchange-denominated debts.

The CBN, however, declared about $2.4bn of the $7bn debt invalid, saying it could not be verified due to improper documentation among other infractions.

Commercial banks were still reconciling with the foreign airlines to clear the final payment following the announcement of the clearance of the final backlog by the CBN two weeks ago.