MARKET NEWS

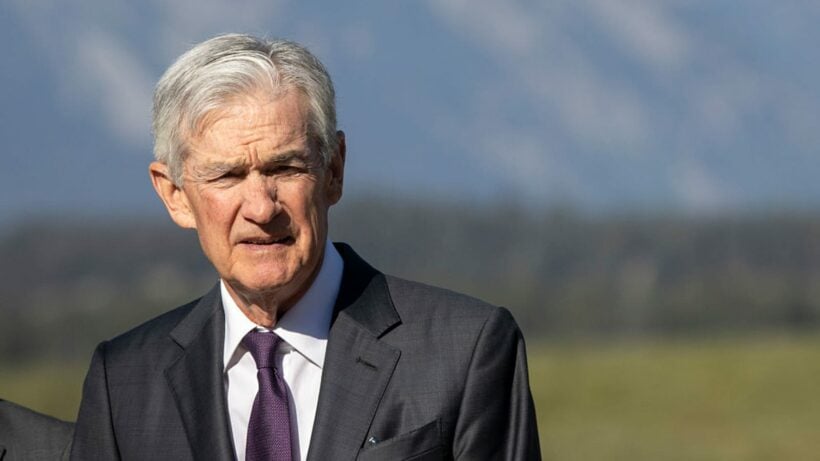

Expectations of Jerome’s rate cuts weren’t built in a day - CNBC

Key Points

- Jerome Powell indicates rate cuts may come soon.

- Furniture will face tariffs later this year, Trump said.

- Shares of two Chinese automakers pop Monday.

- U.S. futures hovered near the flatline while Asia stocks rose Monday.

- Nvidia earnings and inflation data are in focus this week.

Natalie Behring | Getty Images News | Getty Images

Since inflation in America peaked at 9.1% in June 2022, the U.S. Federal Reserve has made controlling price increases — by keeping interest rates high — its main goal.

One consequence of tight monetary policy tends to be a slowing economy and a cooler labor market. For a while, that scenario didn’t materialize, leading many to think the Fed, under chair Jerome Powell’s piloting, had achieved the rare “soft landing,” in which the central bank manages to dampen inflation without plunging the economy into a recession.

But that “golden path” — as the Fed’s Austan Goolsbee likes to term it — is being tarnished by factors such as tariffs and a changing geopolitical landscape.

In the U.S., this has led to a rapidly cooling labor market, prompting Powell to note at Jackson Hole that the risk between high inflation and high unemployment is “shifting.” In other words, the central bank might now turn its attention to supporting employment, rather than slowing price increases.

“The shifting balance of risks may warrant adjusting our policy stance,” Powell said.

And then — boom! Just like that: a glimpse of a shadow of a suggestion that the Fed might start lowering interest rates again was enough to send U.S. stocks surging and Treasury yields falling on Friday.

This proves how much the Fed — and, particularly, its chair — remains the nerve center of the U.S. economy and financial markets. As analysts of antiquity put it: all roads lead to Jerome.

What you need to know today

Jerome Powell indicates rate cuts may come soon. At Jackson Hole on Friday, the Fed chair said growing downside risks to the labor market may “warrant adjusting our policy stance.” Powell also emphasized the Fed’s independence.

Furniture will face tariffs later this year, Trump said. The president’s goal is to “bring the Furniture Business back … all across the Union.” Separately, Canada on Friday removed many of its retaliatory tariffs on the U.S. — but not ones on autos and steel.

Shares of two Chinese automakers pop Monday. Dongfeng Motor Group’s stock surged as much as 69% after the company’s parent announced plans to take it private. Meanwhile, Hong Kong-listed shares of Nio jumped more than 14% — the company unveiled a cheaper SUV on Aug. 21.

Advertisement

U.S. futures hover near the flatline Monday. On Friday, stocks popped on Powell’s dovish speech. Asia-Pacific markets rose Monday. Hong Kong’s Hang Seng index traded near a four-year high.

[PRO] Nvidia and inflation in focus. U.S. stocks could end August on a high note. Their continued rally will depend on Nvidia’s earnings report, out Wednesday stateside, and the personal consumption expenditures price index, out Friday.