Market News

Africa Faces Unrest as Thumping Food Prices Hit It Hardest - BLOOMBERG

- Nations unable to cushion the blow are most at risk of unrest

- Global index shows food prices are holding near a record high

By Monique Vanek and Colleen Goko

Surging international food prices will hit Africa’s economies the hardest and may trigger social unrest if governments fail to cushion the blow, according to a report by Oxford Economics Africa.

Food has a heavier weighting in the inflation baskets of African nations than advanced economies -- often exceeding 25% due to purchasing patterns. Some countries including Ethiopia, Zambia, Sudan, and Nigeria have food weightings above 50%, economists Jacques Nel and Petro van Eck said in a research note.

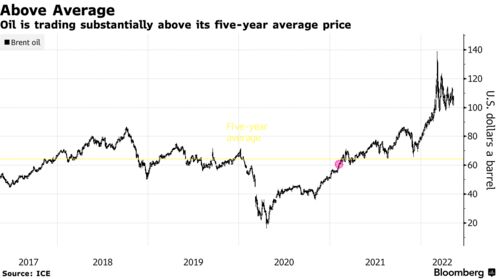

The war in Ukraine, bans on food exports such as palm oil, supply-chain glitches and a drought curbing the US wheat crop have sent prices skyrocketing. In March, the UN’s FAO food price index soared 13%, the fastest on record, before easing slightly in April.

Higher food prices coupled with soaring fuel bills and rising unemployment make for a volatile political environment on the continent and have prompted governments to react even at the expense of fiscal consolidation, said Nel and van Eck.

Egypt and Nigeria have delayed plans to end costly food and fuel subsides while Morocco, Kenya, and Benin have increased minimum wages. South Africa has extended monthly stipends for the jobless and cut its general fuel levy for two months.

Nations that have had their fiscal wings clipped and are unable to provide significant support however, such as Ghana and Tunisia, may face a popular backlash, the authors said.

Data on Wednesday showed Ghana’s inflation rate climbed to an 18-year high in April fueled by food-price growth that surged to 26.6% compared with a year earlier.

Moody’s Investors Service said it expects higher social and political risks over the next 18 months in the Middle East and Africa due to the sustained global food and energy-price shock.

“Although the region may receive some aid from the international donor community, aid is unlikely to fully shield vulnerable households given the likely shortages of basic food staples like cereals,” said Aurelien Mali, a VP-Senior Credit Officer at Moody’s and one of the authors of the report.

Lebanon, Mozambique, Togo, Jordan, Tunisia and Namibia are among the most susceptible to political unrest, given their high import dependency on oil and food, low incomes and already elevated social risks, Moody’s said.

(Updates with oil chart and Moody’s comments)