Market News

Currency hawkers sell redesigned notes amid concern of poor circulation - ICIR

CURRENCY hawkers are already making brisk business from trading the three redesigned naira notes, which have remained inaccessible to point-of-sale (POS) merchants, traders and Nigerians generally.

The Central Bank of Nigeria (CBN) has redesigned the N200, N500 and N1000 notes, which it released into circulation on December 15, 2022, while retiring the old ones that would cease to be legal tender on January 31, 2023.

President Muhammadu Buhari launched the redesigned notes on November 23, 2022.

With the legal tender deadline only a week away, the old notes have remained in wide circulation, just as the redesigned notes have been scarce coming out from commercial banks.

The banks, The ICIR investigation discovered, have mostly ignored the CBN’s directive to be dispensing the new notes, especially through their automated teller machines. Most ATMs are still dispensing the old notes, with only a few ones paying the new ones, especially the N1000 note.

Operators of PoS centres, through which many Nigerians now source their naira currency, complained they have been finding it hard getting the new notes at both banking halls and ATMs.

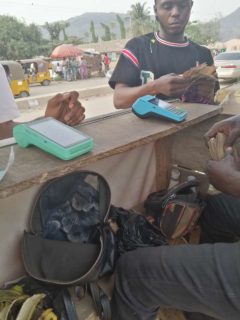

Strangely, the new notes are being made available at the most unlikely of places. Our correspondent observed currency traders hawking the redesigned notes at the popular Dei-Dei bridge in Abuja, the Federal Capital Territory.

“We sell one wrap of N200 for N29,000,” one hawker told The ICIR on Sunday, January 22. A wrap of the N200 note contains 100 pieces, which translates to N20,000. So, on every bundle of the N200 note, the hawkers earn N9,000.

The hawker, Abdul Mohammed, enthused that demand for the note had been high as buyers compete to satisfy their curiosity and enjoy a feel and possession of the new notes.

- Advertisement -

Our correspondent counted over five hawkers at the Dei-Dei junction, indifferent to the fact that their business contravenes certain provisions of the Central Bank laws.

Sections 20 and 21 of the CBN Act of 2017 outlaw any action by anyone who hawks, sprays and squeezes the naira, or dances or writes on it.

The CBN has threatened to sanction commercial banks for continuing to load their ATMs with old notes. An official of the Stanbic IBTC, who pleaded anonymity, told our correspondent that the apex bank’s internal control officials had begun penalising banks that put old notes in their ATMs.

The official, however, complained that banks have not been receiving enough of the new notes from the CBN, even as they lodge their own old notes with the apex bank.

“If you look closely at the ATM points, you will discover that only few are dispensing the new notes.We can only fill the cash points with the available cash we have. I believe it’s going to be better during the week,” he said.

Many citizens expressed the fear the legal tender deadline might just catch them napping with plenty of the old notes still in their possession, with a few or nothing of the new ones at hand. This would be huge losses to many, especially if the CBN does not extend the expiry date.

A bank customer at the Guarantee Trust Bank branch at Area 3, Garki, Abuja, Suleman Aliyu, told The ICIR that the delay in flooding the banks with the new notes close to the deadline meant that some people would lose some money.

- Advertisement -

“If the deadline is January 31, which is nine days from today, and the banks are still supplying the old notes, it means they want some people to lose their money,” Aliyu said.

A PoS operator at Liberty junction in Kubwa, Ikenna Onyeka, told The ICIR that the CBN needed to do better in its supply of the redesigned currency.

“When we make demands for N50,000 from the banks, we get only a few pieces of the new notes to the tune of only about N10,000. What I intend to do is to stop collecting the old notes from the 28th of this month and lodge my oold notes in banks.

“CBN is telling us that there are enough of the redesigned notes in the vaults of the commercial banks, but the banks are saying that they do not have enough supply of the notes. Something is not adding up,” he said.

Checks by The ICIR confirmed that the ATMs were scarcely dispensing the new notes. In some banks where the machines are about four or five, only one machine would be dedicated to dispensing the new notes, while the remaining would be paying the old ones.

When The ICIR visited the Zenith Bank ATM centre at Ogba-Aguda in Lagos last week, only one machine out of the four there was paying only one redesigned note, and that was the N1000 note.

A bank customer, Onyedika Udensi, also told The ICIR his experience, “I have been to three banks – UBA, Union Bank and Stanbic IBTC – in Kubwa this morning and I discovered many of their ATMs were either shut down or not dispensing the new notes.”

Our correspondent discovered that another ATM of the First Bank in Kubwa, a satellite town in the Federal Capital Territory, was not dispensing at all.

The apex bank did reiterate on Friday, January 20 that it has mandated banks to ensure issuance of the new notes strictly through their ATMs.

A statement jointly signed by the Director, Banking Supervision Department, Haruna Mustapha, the Director, Payment System Management Department, Musa Jimoh, explained that the step was to ensure that distribution of the new currency notes was fair, transparent, and evenly spread across the country.

The CBN also allayed the fears of rural dwellers on accessing the new notes before the January 31 deadline.

It announced that it would be inaugurating a cash-swap programme in rural and underserved areas of the country on Monday, January 23 to boost collection of the redesigned naira notes.

The apex bank said that the inauguration was informed by the need to maximise the channels through which underserved and rural communities could exchange their naira notes.

It said that the inauguration would hold in partnership with deposit money banks and super agents.

“The old N1,000, N500 and N200 notes can be exchanged for the redesigned notes or existing lower denominations of N100, N50 and N20, which remain legal tender.

“The super agents can exchange a maximum of N10,000 per person, while amounts above N10,000 shall be treated as cash-in deposit into wallets or bank accounts in line with the cashless policy.

“Bank Verification Number, National Identification Number or Voter’s Card details of the customer should be captured as much as possible,’’ the CBN said.

On the heels of the concern of slow-paced circulation, the Nigeria Governors’ Forum (NGF) invited the Governor of the CBN, Godwin Emefiele, to a meeting on the redesigned naira notes and the timeline to fade out old notes.

The invitation sent out by the Director-General of the Forum, Asishana Okauru, late Tuesday, January 17, noted that the agenda of the meeting would focus on the recent redesigning of the N200, N500 and N1,000 notes, as well as the withdrawal policy of the apex bank.

The agenda of that virtual meeting, was titled, ‘The Economic and Security Implications of Naira Redesign and Withdrawal Policy.’

A statement by the NGF Head of Media and Public Affairs, Abdulrazaque Bello-Barkindo, said, the discussions promised to foster participation and dialogue between various stakeholders, including governments and civil society organisations to come out with a solution to the lingering issue.

The NGF Chairman, Governor Aminu Tambuwal of Sokoto State, in a statement on Wednesday, January 18 at the end of the forum’s first meeting of 2023, noted that the governors were not opposed to the objectives of the naira redesign.

“We, the members of the Nigeria Governors’ Forum (NGF), received a briefing from the Governor of the Central Bank of Nigeria, Mr Godwin Ifeanyi Emefiele, on the Naira redesign, and its economic and security implications, including the new withdrawal policy.

“Governors are not opposed to the objectives of the Naira redesign policy. However, we observe that there are huge challenges that remain problematic to the Nigerian populace,” he said.

Tambuwal pointed out that the governors expressed the need for the CBN to consider the peculiarities of states, especially as they pertained to financial inclusion and underserved locations.

Emefiele has been in the eye of the storm in recent weeks, with allegations of terrorism financing by the Department of State Services (DSS) around his neck, and now troubled by slow circulation of the redesigned notes.

He reportedly met with President Buhari on Thursday, January 19. Although details of the meeting were not disclosed, banking sources said they might not be unconnected with the currency redesign concerns.