Market News

Emerging Markets Hurt Less as Dollar’s Wrath Sinks Rich Nations - BLOOMBERG

- Currency outperformance continues even amid commodity selloff

- Brazilian real, Mexican peso cash in on real-rate advantage

Citigroup calls it a “head scratcher.” Goldman Sachs terms it “striking resilience.” For Columbia Threadneedle, it’s a “reward for proactiveness.”

Whichever way one describes it, the relative resilience building up in emerging-market currencies over their advanced-nation peers has money managers sitting up and taking notice.

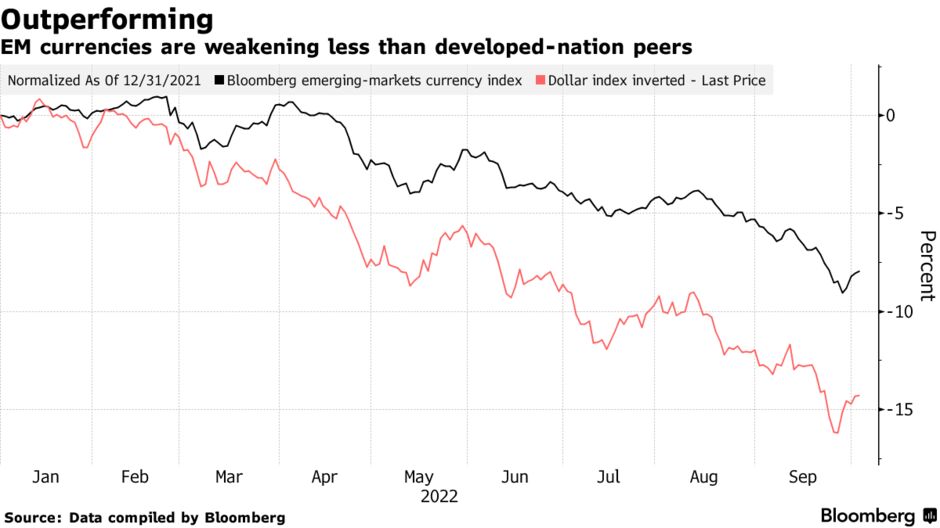

The dollar’s rally to successive records has currencies across the world in a spiral of doom. But a closer look reveals the benchmark gauge for emerging-market exchange rates is posting only half the losses seen in developed countries. And uncharacteristically, this outperformance continues even as commodity prices -- the mainstay of poorer nations -- are tumbling.

“In the last couple of months, prices of commodities have reversed from the levels seen earlier in the year but commodity producers have still performed relatively well compared with the euro zone or Group of 10,” said Dirk Willer, the head of emerging-market strategy at Citigroup Inc. “That’s been a bit of a head scratcher.”

Developing nations’ success in weathering some of the volatility tied to Federal Reserve monetary tightening questions the assumption that they will be the epicenter of any market meltdown driven by higher US yields. In reality, much of the pain is being felt in the UK and Europe, while countries like Brazil and Mexico are seeing their currencies lure investors with juicy yields -- the result of some of the world’s most aggressive rate hikes.

“We are seeing in developed markets the same forces that emerging markets have grappled with for the past few decades; inflation pressures and fiscal deficits,” said Simon Harvey, head of currency analysis at Monex Europe in London. “With all the volatility going on, you are forced to search for higher returns and that’s in emerging markets.”

A commodity rally this year through June 9 helped MSCI Inc.’s benchmark for developing-nation currencies limit its drop to 2.5%, when the gauge representing developed nations retreated 7.4%. Since then, the raw-material gauge has plunged, but emerging markets have still outperformed the Group of 7 by 2 percentage points. In all, of the 23 developing currencies tracked by Bloomberg, 21 have beaten the British pound, 19 have outperformed the euro and all 23 have done better than the Japanese yen.