Market News

Nigeria’s Debt Revamp Proposal Sends Bonds Deeper Into Distress - BLOOMBERG

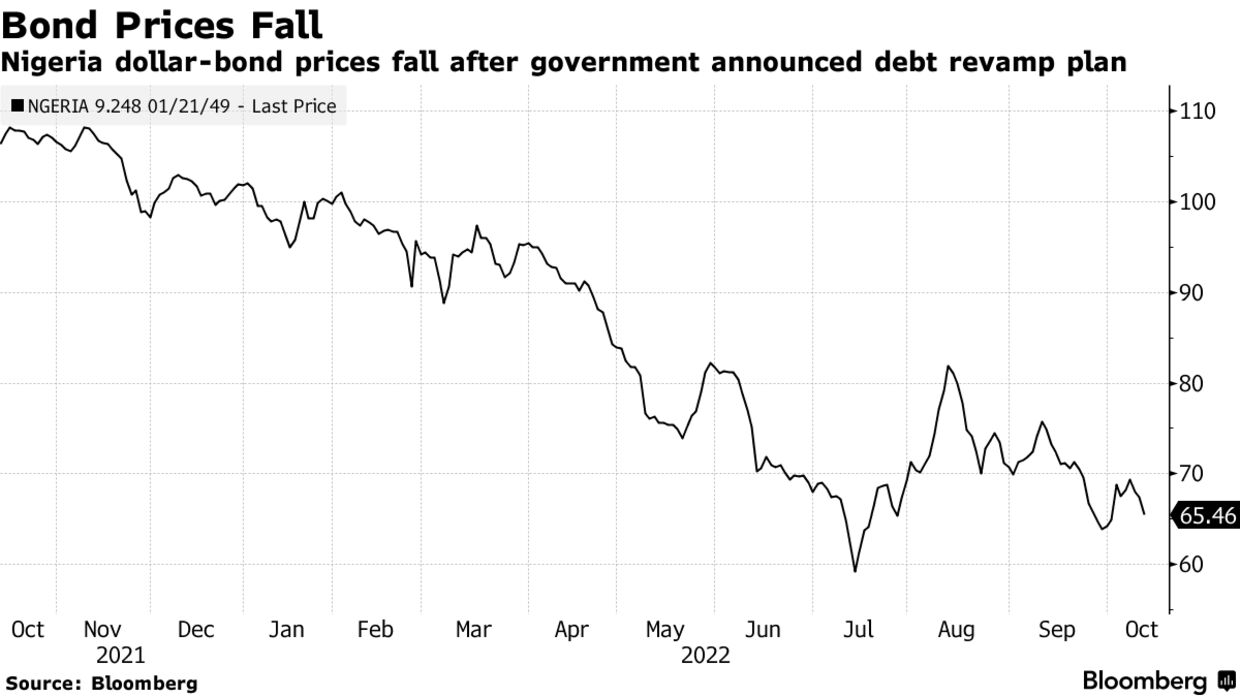

- Yield on dollar bonds maturing in 2047 falls below 56 cents

- Local currency drops to record low of 440.76 against dollar

Nigerian dollar-bonds prices fell and the local currency weakened to a record low after the finance minister of Africa’s largest economy said the government is considering restructuring some of its debt.

Bonds maturing in 2047 were quoted just below 56 cents on the dollar by 2.55 p.m. in London, down from 58.37 cents on Tuesday, while debt maturing in 2049 and 2051 also declined. Six bonds from the West African nation were offered at least 1,000 basis points over US Treasuries, a level typically considered distressed, according to a Bloomberg index tracking sovereign debt from emerging markets.

The naira traded marginally firmer on Thursday afternoon after weakening to a record low of 440.76 per dollar on Wednesday.

Finance Minister Zainab Ahmed said in an interview with Bloomberg TV on Oct. 12 that the government has appointed a consultant “to assess” how it can “get additional relief by way of restructuring and negotiating to stretch out the repayments to longer periods.” She didn’t provide details of the plan.

The government is discussing the restructuring with the International Monetary Fund and the World Bank, Ahmed said in a separate interview with Lagos-based newspaper ThisDay. The country is considering tapping the IMF’s newly created Food Shock Window that provides member nations with access to emergency financing instruments, she said.

“Nigeria has many policy areas that need addressing before a Eurobond restructuring should be discussed,” said Philip Fielding, co-head for emerging-market debt at Mackay Shields UK LLP, which has $132 billion under management and owns Nigerian bonds. “Nigeria’s external debt burden is very low compared with other emerging markets and reducing that through a restructuring would likely not address the main macroeconomic problems.”

While Nigeria’s debt as a proportion of gross domestic product is 23.1%, Africa’s largest economy faces a rising debt-service burden that the World Bank estimates will exceed government revenue this year.

“Debt restructuring would be extremely helpful given the parlous state of public finances and an extremely high debt-servicing ratio,” said Michael Famoroti, head of intelligence at Stears Insight. However, “it would end up being a pure accounting exercise if it does not encourage additional fiscal discipline,” he said.

Budget Shortfall

###span class="styles__xlarge__qGVtF styles_mobile_xlarge__3j9ex styles_text-align-left__rejGO styles_font-weight-bold__2cePf styles_text-decoration-none__eJS-w styles_color-black__1Xe9m"

>span class="_2IYzE-EU8RLAR2wJ2aRWBc_11"###Essential UK insights on the stories that matter. Every weekday at 5pm.

The West African nation last week laid out an expanded spending plan of 20.5 trillion naira ($47 billion), half of which isn’t backed by revenue. Lawmakers have approved a government plan to borrow as much as 8.4 trillion naira to plug part of the shortfall -- an estimated 10.8 trillion naira or 4.8% of gross domestic product. The additional debt is likely to increase the debt-service burden unless revenue jumps.

“Nigeria is surprisingly not getting much benefit from high oil prices,” said Charles Robertson, global chief economist at Renaissance Capital Ltd., pointing to slumping crude production and a gasoline subsidy that cost the government 2.7 trillion naira from January to July.

The country’s move to rework its debt will not resolve the underlying indebtedness and liquidity problem if the government doesn’t change its borrowing or spending strategy, according to Famoroti. “It could simply exacerbate the problem by allowing the finance ministry to kick the can down the line,” he said.

— With assistance by Ruth Olurounbi, Maria Elena Vizcaino and Carolina Wilson

(Updates with comments and bond prices)