Market News

Trump trade tariffs slump widens to ‘nearly all U.S. exports,’ supply chain data shows - CNBC

BY Lori Ann LaRocco

Key Points

- An exports slide that began in early 2025 has reached nearly all ports across the U.S. as the trade impact of President Trump’s tariffs worsens, with agriculture the hardest hit.

- As businesses cancel orders from China, U.S. imports continue to plummet, with a 43% week-over-week drop in containers through April 28.

- “We haven’t seen anything like this since the disruptions of summer 2020,” said Kyle Henderson, CEO of trade tracker Vizion.

What began as a rapid drop in U.S. imports as shippers cut orders from manufacturing partners around the world has now extended into a nationwide export slump, with the U.S. agricultural sector and top farm products including soybeans, corn, and beef taking the hardest hit.

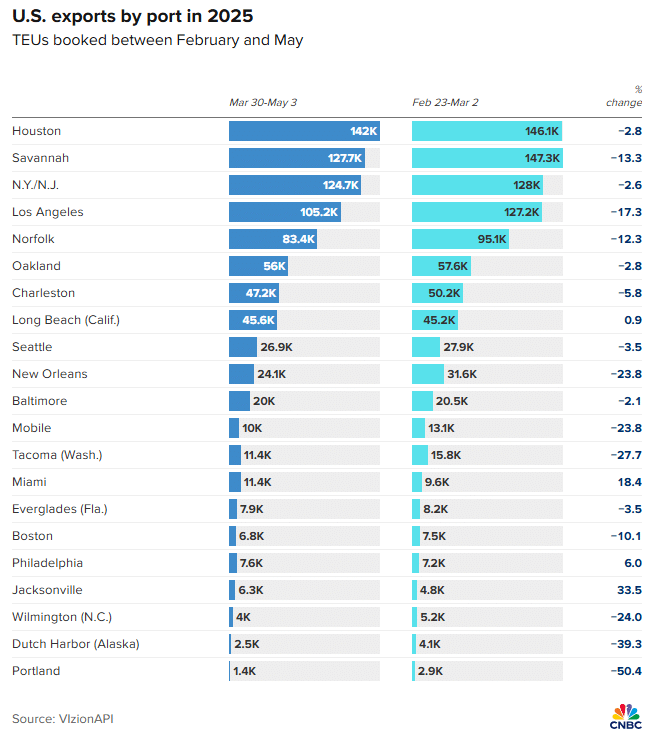

The latest trade data shows that a slide in U.S. exports to the world, and China in particular, that began in January now extends to most U.S. ports, according to trade tracker Vizion, which analyzed U.S. export container bookings for the five-week period before the tariffs began and the five weeks after the tariffs took effect.

The farming sector has been warning of a “crisis” and ports data is showing more evidence of lack of ability to move product out to global markets. Port of Oregon tops the list with a 51% decrease in exports, while Port of Tacoma, a large agricultural export port, has seen a 28% decrease. The port’s top destinations for corn, soybeans, and other ag exports include Japan, China, and South Korea.

Some ports have only seen a small exports decrease to date, such as the Port of Houston and Port of Seattle, at 3% and 3.5%, respectively. But what is clear, according to Ben Tracy, vice president of strategic business development at Vizion, “is that nearly all of U.S. exports have taken a hit.”

The trade data shows declines of over 17% at the Port of Los Angeles, while the Port of Savannah — the top U.S. port for exporting containerized agricultural goods in 2025 — is down 13%, and the Port of Norfolk is down 12%, according to Vizion.

The Port of Oakland also plays a significant role in exports as the leading port for international refrigerated goods. U.S. agricultural exports also leave Los Angeles, Long Beach, New York/New Jersey, Houston, and Seattle/Tacoma.

The slide in exports is linked to the decline in containerships coming to the U.S., as businesses across the economy cancel manufacturing orders, sending Chinese factories and freight ships into retreat, as well as changes in global demand linked to U.S. trade policy. U.S. imports continue to decline, with port data tracked by Vizion showing a 43% week-over-week drop in containers from the week of April 21 to the week of April 28.

“We haven’t seen anything like this since the disruptions of summer 2020,” said Kyle Henderson, CEO of Vizion. “That means goods expected to arrive in the next six to eight weeks simply won’t. With tariffs driving costs higher, small businesses are pausing orders. Products that once moved reliably are now twice as expensive, forcing importers into tough decisions,” he said.

‘Lean’ retail inventories ahead

Retailers have been urging consumers to buy sooner rather than later, and data from Bank of America Global Research suggests why that may be the right move. Its latest forecast shows that the number of inbound container ships to the Port of Los Angeles will see a sharp drop in May, with escalating trade disruptions leading to a 15%-20% decrease in U.S. container imports from Asia in the coming weeks.

In a note to clients, Bank of America warned that the ratio of retail inventories to monthly sales was not especially high, while at the same time, consumers have been buying ahead on expectations of higher prices and lack of product choice.

Based on data Bank of America reviewed on retail payments to transportation and shipping companies, there has been no big ramp in inventories after the frontloading that occurred earlier this year, and supply disruptions may be looming.

“We think it is possible retail inventories may actually look ‘lean’ in coming months,” the Bank of America report stated.

Many retailers only have one to two months of sales in inventory, it found, and any unforeseen demand or supply disruptions can quickly impact what goods retailers can offer and the prices charged, it concluded.