Market News

UK Inflation Expectations Fall to Lowest Since BOE Hikes Began - BLOOMBERG

, Bloomberg News

, Source: BOE Inflation Attitudes Survey

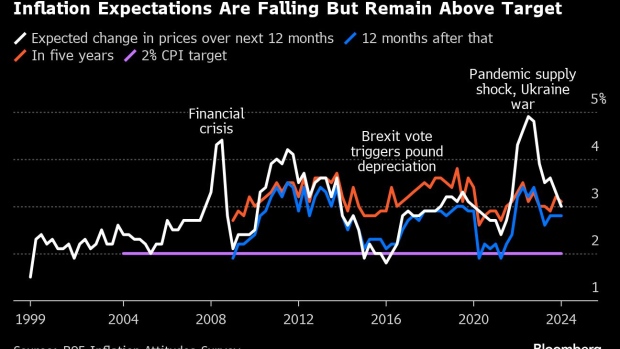

(Bloomberg) -- UK inflation expectations slipped to the lowest level since summer 2021, before the Bank of England embarked on an aggressive interest-rate hiking cycle to contain prices.

Households questioned in February expected prices to rise 3% over the next 12 months, down from 3.3% in November, according to the BOE’s quarterly Inflation Attitudes Survey. It was the lowest since August 2021 shortly before the central bank started on 14 back-to-back rate rises to tackle high inflation.

Longer-term predictions were more stubborn, with expectations for the 12 months from February 2025 remaining unchanged at 2.8%, the survey published Friday showed.

The findings suggest the BOE is successfully winning the battle to keep inflation expectations anchored after the worst cost-of-living crunch in generations. That’s key to curbing persistent pressures because how quickly prices are expected to increase influences the wage demands of workers and price setting by companies.

The central bank started raising interest rates in December 2021 to the current level of 5.25% and is now edging toward cutting after sharp falls in inflation in 2023. Economists expect inflation to dip below the BOE’s 2% target in the coming months, though the central bank is still wary over cutting too soon given strong wage growth and high services inflation.

The improving outlook on inflation also boosted public confidence in the BOE after it collapsed to record lows following the double-digit surge in prices.

While the net balance between Britons that are satisfied or not rose from minus 14 to minus 5, it remains well below levels seen before inflation took off.

The struggle to contain price pressures led to a plunge in public trust and a wave of criticism from politicians. The tensions between the BOE and the government were underscored by a column by senior Conservative MP David Davis in the Daily Telegraph newspaper on Thursday.

Davis, a former Brexit Secretary, called for the BOE to be stripped of the operational independence granted by the Labour government in 1997.

“There is no indication that its decisions have been any better since then compared with the period before Labour came into power,” said Davis. “Margaret Thatcher and Nigel Lawson made better decisions than every government since the ‘independence’ of the Bank was established.”