Market News

Korean Won Topped Dollar as Preferred Currency for Crypto Trades in First Quarter - BLOOMBERG

, Bloomberg News

, Source: Kaiko

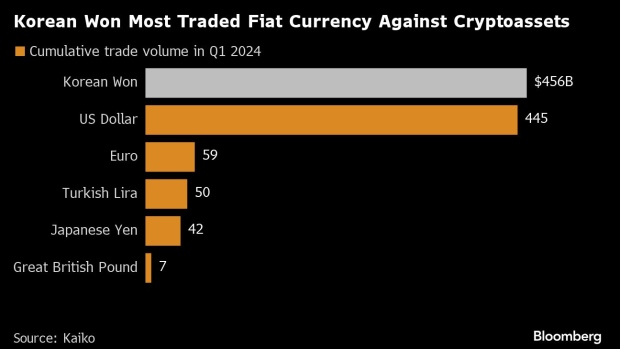

(Bloomberg) -- The South Korean won is now the most traded currency against cryptoassets globally with speculative demand for risky tokens in the country surging.

The Korean won accounted for $456 billion in cumulative trade volume on centralized crypto exchanges in the first quarter of 2024, compared with $445 billion in dollar volume, according to data from research firm Kaiko.

The rise in Korean won denominated trading is partly a function of the ongoing fee war in South Korea. Smaller exchanges like Bithumb and Korbit have recently run zero-fee trading promotions to try to lure traders from Upbit, which dominates the local sector with a market share of more than 80% in spot trading volumes.

South Korea is an outlier even in the high-risk crypto sector, with local preferences skewed toward smaller, often more volatile tokens — so-called altcoins — over larger cryptocurrencies like Bitcoin and Ether. On average, trades involving smaller tokens make up more than 80% of all activity in South Korea.

In March, Koreans flocked to Volatility Shares’ 2x Bitcoin Strategy ETF — ticker BITX — which aims to deliver high returns with commensurately high risks.

Read more: South Koreans Go Large to Hoover Up Bitcoin: Bloomberg Crypto

Demand for cryptoassets in the country is so feverish that it became an agenda item in the recent parliamentary elections, with political rivals trying to woo voters by promising to delay digital asset taxes or lift restrictions on investing in US Bitcoin ETFs.

South Korean regulators will roll out tighter user protection rules from July in response to the disastrous $40 billion collapse of TerraUSD, the ill-fated stablecoin created by Do Kwon.

Read: Do Kwon, Terraform Labs Found Liable for Fraud in SEC Trial

The Virtual Asset User Protection Act will impose strict requirements on exchanges, including potential life sentences for criminal acts, as well as rules around segregating user deposits and taking measures to meet liabilities after hacks or system failures.