Market News

Bitcoin Spot ETF Flows Eclipse Once Dominant Futures-Linked Fund - BLOOMBERG

BY , Bloomberg News

, Bloomberg

(Bloomberg) -- The $2 billion ProShares Bitcoin Strategy portfolio used to be the preeminent exchange-traded fund tied to the cryptocurrency. The outlook for the futures-based ETF is now more complicated as rival funds muscle in.

Nine new ETFs investing directly in the largest digital asset debuted on Jan. 11 in the US, attracting over $10 billion of inflows so far. BlackRock Inc. and Fidelity Investments are among the issuers vying for customers, in part with lower fees compared with the ProShares product.

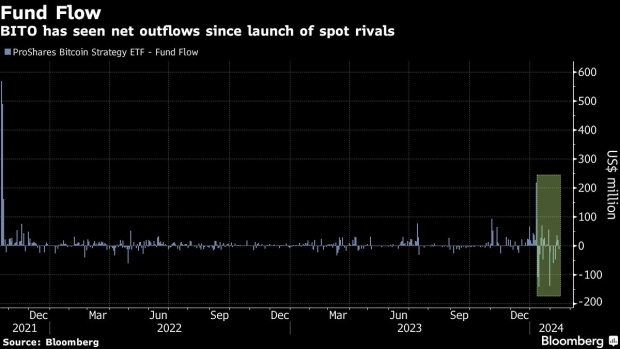

The futures-based ETF, whose ticker is BITO, has seen a $254 million net outflow since the spot rivals began trading, data compiled by Bloomberg show. Until December BITO made up 92% of trading volume for US Bitcoin-linked ETFs. That’s down to 15% with the new spot ETFs commanding much of the rest.

Read more: Bitcoin ETFs ‘Deemed a Success’ by Key Measures One Month Later

BITO incurs costs from rolling futures forward as they expire, a potential impediment to hugging the Bitcoin price that spot funds don’t face. Still, the underlying portfolio of regulated derivatives may give some investors greater comfort than direct exposure to the controversial crypto sector.

‘Enduring’ Benefit

For Simeon Hyman, global investment strategist at ProShares, the regulatory aspect is key to BITO’s ongoing role. “The fact that futures are regulated will be an enduring, important benefit to investors,” he said, adding that the availability of options on the fund is another feature the spot ETFs lack.

The ProShares ETF’s launch in October 2021 came with much fanfare not long before Bitcoin hit a record of almost $69,000. The fund invests in CME Group futures and debuted as one the most heavily traded ETFs ever.

US regulators resisted spot Bitcoin ETFs until court decisions went against them last year in a case brought by the company behind the more than decade-old Grayscale Bitcoin Trust. The fund wanted to covert into an ETF and did so when the new products began trading on Jan. 11.

Asset Flow

Over $6.5 billion has been pulled from the $24 billion Grayscale fund, the largest dedicated to Bitcoin, but the pace of outflows has slowed. BlackRock’s iShares Bitcoin Trust has garnered $5.7 billion of assets so far, followed by Fidelity Wise Origin Bitcoin’s $4.3 billion and ARK 21Shares Bitcoin ETF on $1.3 billion.

“There are examples in other ETFs where various replicated exposures can coexist and remain competitive in all aspects,” said Reggie Browne, the head of ETF trading at market-maker GTS. “Certain retail platforms will not approve spot Bitcoin ETFs for retail households.”

One of the new offerings, the Franklin Bitcoin ETF, has a post-waiver 0.19% expense ratio — the lowest among spot-Bitcoin ETFs — while BlackRock and Fidelity will have 0.25% fees after a waiver period. The ProShares Bitcoin Strategy fund levies 0.95%.

Hyman indicated it remains to be seen what costs the spot Bitcoin ETFs incur. “The spot guys will kind of have to tell us over time what are those trading and implementation costs,” Hyman said. “If you give a dollar to a spot ETF, it has to turn it into Bitcoin and we don’t know what those costs are yet.”