Aboki News

Diplomatic intrigues stall evacuation of Nigerians from Canada - THE GUARD

By Wole Oyebade, Bridget Chiedu Onochie and Joke Falaju, Abuja

• May Arrive Monday

• Evacuees From Thailand To Pay N162.3million For Hotel Accommodation, Feeding

• ‘Govt. Does Not Have Capacity To Foot The Bill’

Diplomatic intrigues and conflict of interest over the choice of operating carrier might explain why the scheduled evacuation of 200 Nigerians from Canada was stalled last Wednesday. While the Nigerian government-designated local carrier, Air Peace, for the special operation, the Canadian government preferred Ethiopian Airlines, though at more expensive fares for the travellers.

Meanwhile, Nigerian evacuees from Thailand are expected to pay about N162.3million for hotel accommodation and feeding. The Guardian learnt that each of the evacuees was expected to pay N240, 000 as hotel accommodation for the period of 16 days and N57, 600 for feeding for the same period, making a total of N297, 600.

The federal government, after the arrival of the evacuees at the Nnamdi Azikiwe International Airport in Abuja, had handed them over to the Nigeria Centre for Disease Control (NCDC) to properly quarantine for 14 days period to ensure they are COVID-19 free.

Although the government did not disclose where the evacuees were being quarantined, The Guardian learnt that the federal government had negotiated with some hotels in the Federal Capital Territory (FCT) to accommodate them, including Bolingo Hotel (300 rooms); Apo Apartments (61 rooms); Chida International Hotel (200 rooms); Belvior Hotel (30 rooms) and Barcelona Hotels (300 rooms).

The evacuees had been concerned about who was to pay their hotel bills, but a letter by the Nigerian Embassy in Bangkok, Thailand, dated May 14, this year and signed by the Head of Chancery, Nicholas Uhomoibi, read: “I am directed to bring to your attention that due to the measure that are beyond control of the COVID-19 local organising team in Nigeria, all evacuees going to Nigeria henceforth are to now pay for the quarantine, isolation, accommodation centre or hotel before departure and arrival in Nigeria.

“In this regard, all prospective evacuees are to take note of the negotiated rate- accommodation, N15, 000 for 16 days, equals N240, 000; feeding is N3, 600 multiplied by 16 days, making N57, 600, making a total of N297, 600.”

The letter urged the evacuees to be informed that the embassy had been instructed not to airlift any evacuees who did not pay the fees. The Ministry of Foreign Affairs, which confirmed the government position yesterday in Abuja, stated that the decision was due to its inability to foot the bill. “The explanation for that is that the government does not have the capacity to foot the bill,” stated a ministry source, who confirmed the amount.The ministry, however, said the government was still negotiating to see how the amount could be reduced, as it was seeking cheaper hotels for the prospective evacuees.

The Guardian yesterday reported that Air Peace was denied landing right permits; hence had to delay the evacuation exercise till Nigerian and Canadian governments resolved the grey areas. But sources from the Ministry of Foreign Affairs yesterday disclosed that the Canadian High Commission had opened talks with Ethiopian Airlines for the evacuation of Nigerians. Ethiopian Airlines (ET) has been airlifting Canadian citizens from different parts of Africa lately. The federal government, through the ministries of Aviation and Foreign Affairs, has, however, waded into the matter, insisting that the Nigerian carrier has to operate the flight, in tandem with its new position that all evacuation flights must be conducted by Nigerian carriers. It was learnt that ET is charging $2, 500 per voluntary returnee for the flight already planned for Monday, May 18, while Air Peace charged $1,134 for the same trip. To date, 319 passengers have paid to the Nigerian airline, which has concluded plans to operate full flight to the North American country.

Some of the Nigerians, who had booked and paid Air Peace for the flight, were already complaining about the insistence of the Canadian High Commission to choose a foreign airline over a Nigerian carrier.

Shocked by the decision of the Canadian High Commission, an official of the Nigerian carrier said Air Peace had successfully flown to 40 countries, including Canada, the United States (US) and the United Kingdom (UK), noting that it was the airline that evacuated Israeli citizens from Nigeria in March. 2

The official added: “We have done many international flights, including landing in Canada. We have made 19 flights to the US since 2014. We have flown to Tel-Aviv several times and in March, we evacuated over 200 Israelis from Nigeria back during this COVID-19 lockdown. We have scheduled flight operations to United Arab Emirates (UAE), UK, Ireland, China, Turkey, Germany, Iceland, Switzerland and other countries.

“We have IATA Operational Safety Audit (IOSA) certification and we are a member of IATA. We have also evacuated Nigerians from South Africa during the xenophobic attack of Africans there.”

Reacting to the incident, former director general of the Nigerian Civil Aviation Authority (NCAA), Benedict Adeyileka, described the action of the Canada High Commission as political, urging the federal government to stand firmly on its position that a Nigerian carrier should conduct the airlift.

“I am a nationalist to the core. Anything Nigerian is good enough as long as it is qualified to carry out the operation, and Air Peace has international operation experience.

“I insist that the Nigerian government should put its foot down on this. Nigerian carriers should not be stopped from conducting international operations,” he said

Buyers crash Nigeria’s multi-million dollars liquefied gas demand - NEW TELEGRAPH

BY Adejumo kabir

Buyers at the weekend deferred deliveries of multi- million dollars Liquefied Natural Gas (LNG) from Nigeria, one of Europe’s key LNG suppliers. This cause by crater in the coronavirus pandemic has seen demand for Nigeria’s cargoes in Europe crash, which has created a fleet of tankers carrying LNG that are now just floating storage, according to commodity tracking firm Kpler, cited by an online news portal, Bloomberg.

Over the past two months, Nigeria continued to send LNG cargoes to one of its main markets, Europe, but with many major European economies in lockdown, demand has plunged, and customers with options to defer have been postponing the offloading of the cargoes.

LNG prices at their lowest in years have forced traders to keep LNG on the tankers, waiting for demand to improve. But prices are not set to improve in the summer, according to Manas Satapathy, managing director for energy at Accenture. “The worst is yet to come, we will likely see super low prices in late June, July, August,” Satapathy told Bloomberg.

The crash in LNG demand in Europe during the pandemic and the high storage levels will likely mean that the continent will struggle to act as a sponge to absorb excess LNG supply this year as it did in 2019, Rystad Energy said in an analysis last week. Last year, Europe became the “de facto global LNG sink,” when milder winter in Northeast Asia slowed down LNG demand growth there, the energy research firm said.

In 2019, Europe’s total LNG imports surged by 80 per cent compared to 2018, while in January and February 2020 – before the European lockdowns and when the coronavirus hit Asia – Europe’s LNG imports jumped 35 per cent, thanks to the UK, Spain, and Belgium.

“We still don’t have an end date for when Europe will completely re-emerge from lockdown, and the impact will probably be deeper coming into the summer months. “With gas storage tanks already almost filled to the brim, Europe’s capacity to import and actually use the same amount of LNG as in 2019 seems like a tall order, especially if we see another mild winter,” Rystad Energy said.

Africa’s largest economy braces for big hit as oil prices plummet - CNBC

KEY POINTS

- The International Monetary Fund (IMF) on Thursday said it will be working closely with the Nigerian authorities in the coming days to assess any vulnerabilities which may be exposed by the sharp decline in crude prices.

- Nigerian dollar bonds sank to record lows stocks on Thursday hit a new four-year low, as fears grow over the devaluation of the naira currency.

The Egina floating production storage and offloading vessel, the largest of its kind in Nigeria, is berthed in Lagos harbor on February 23, 2017.

Stefan Heunis | AFP | Getty Images

The Egina floating production storage and offloading vessel, the largest of its kind in Nigeria, is berthed in Lagos harbor on February 23, 2017.

Stefan Heunis | AFP | Getty Images

With oil prices plunging amid concerns over a price war between Russia and Saudi Arabia, and the coronavirus outbreak obliterating stock markets, Africa’s largest economy is in a precarious position.

The International Monetary Fund (IMF) on Thursday said it will be working closely with the Nigerian authorities in the coming days to assess any vulnerabilities which may be exposed by the sharp decline in crude prices, as Nigerian and Angolan dollar bonds sank to record lows.

Nigerian stocks on Thursday headed for their fifth straight day of losses to a new four-year low, and a fall in oil prices to just over $30 per barrel, rising external debt and a depreciating currency pose a threat to economic stability in the country of more than 190 million people. Nigeria is Africa’s largest economy in terms of GDP (gross domestic product).

While markedly lower oil prices will undoubtedly have broad adverse consequences for the Nigerian economy, the country is not quite as dependent on oil exports as the likes of Angola, which analysts expect to suffer a substantial blow this year.

Currency concerns

However, a prime concern for economists is Nigeria’s managed naira exchange rate, since even prior to the fallout from OPEC’s failure to reach an agreement with Russia on oil production cuts, the country’s foreign exchange reserves were in steady decline.

After the official exchange rate was devalued in 2016, foreign exchange reserves were approaching $25 billion, and the move failed to stop the slide of the parallel market exchange rate, which meant the Central Bank of Nigeria (CBN) was forced to act again the following year when the Nafex (Nigerian Autonomous Foreign Exchange Rate) was implemented. Reserves held just below $30 billion during this period.

“Extrapolating the trajectory observed thus far this year (the foreign exchange buffer shrunk by $2.3 billion during the first two months of 2020) suggests reserves could fall below the $30 billion mark by Q3 (the third quarter) and end the year just above $25 billion,” NKC African Economics Chief West Africa Economist Cobus de Hart said in a note earlier this week.

Oil dependent countries facing fiscal and social strain, IEA’s Birol says

Capital Economics Senior Emerging Markets Economist John Ashbourne on Wednesday echoed this projection, suggesting that reserves will soon fall below the $30 billion mark, which Nigerian policymakers had identified as a key benchmark.

Ashbourne predicted that the naira will end the year down 8% to 400 NGN against the U.S. dollar. He added that in Nigeria’s case, a weaker currency will not provide a boost to competitiveness, since the country does not have significant non-oil exports or the “domestic manufacturing base needed to substitute for imported goods.”

Reuters reported Thursday afternoon that the naira was being quoted at 370 to the dollar on the over-the-counter spot market.

‘Severe adverse consequences’

Parliament recently green lighted President Muhammadu Buhari’s request for $22.7 billion in foreign borrowing, but while external debt accumulation would usually be expected to support reserves, de Hart suggested that the sharp fall in global oil prices could potentially “more than offset” the boost.

“Firstly, should Brent crude oil prices average roughly $40pb (per barrel) for the remainder of the year, it would reduce Nigeria’s goods export receipts by roughly $14 billion (as opposed to our February baseline for oil prices to average $62.4 billion in 2020) — this may also be a conservative estimate, as it does not take into account any adverse impact on non-oil exports,” he said in the note Monday.

What’s more, Nigeria may have difficulty accumulating external debt following the fall in oil prices and its impact on the macroeconomic outlook, while the jittery investment environment raises the risk of a capital flight, de Hart highlighted.

Bloomberg | Getty Images

Bloomberg | Getty Images

Having previously backed the authorities to ride out the storm and maintain its foreign exchange rate at current levels in the immediate future, NKC analysts now believe that the naira’s prospects have “deteriorated markedly” and remains set for a “sharp fall” this year if current conditions persist.

The CBN will again be faced with the choice of whether to let the Nafex buckle or continue to artificially prop it up.

“We believe the CBN will continue to provide support in the near term, with a more drastic adjustment more likely in Q3,” de Hart projected.

“If the Nafex is not permitted to buckle, then the black-market rate should, and this might hold more severe adverse consequences for an economy that is now facing a gloomier outlook on multiple fronts.”

Can Palm Oil Demand Be Met Without Ruining Rainforests? - BLOOMBERG

By Anuradha Raghu

Workers sort bunches of palm fruit at a palm oil mill in Malaysia. Photographer: Sanjit Das/Bloomberg

Palm oil is one of the world’s most widely used and controversial commodities. Cheap, efficient and extraordinarily versatile, it’s found in thousands of everyday products, from cookies to shampoo to fuel. Yet surging cultivation of oil palm trees is linked to burning of tropical rainforests and the destruction of wildlife habitats in Southeast Asia. Environmental concerns have spurred the introduction of so-called sustainable palm oil, but its credibility has been questioned and it’s not clear yet whether there’s adequate market demand for the “greener” version.

1. Why is palm oil so controversial?

The use of palm oil in food products has doubled worldwide in the past 15 years. About half of all items in a supermarket are now likely to contain it, and global consumption could climb to more than 100 million tons per year by 2025, 50% more than in 2016, according to researcher Gro Intelligence. To meet the demand, critics say, some growers in Indonesia and Malaysia, which together account for 85% of global production, use “slash-and-burn” land clearance techniques that routinely blanket parts of Southeast Asia with stinging smoke. In 2015, forest fires in Indonesia alone pumped out more greenhouse gases per day than all sources in the U.S. The fires not only spew carbon dioxide into the atmosphere but also destroy significant carbon-absorbing forests and ground cover.

Indonesia’s Reach

Fires in Sumatra and Borneo have sent smoke to neighbors

2. What’s being done about it?

In an effort to reduce demand for palm oil, the European Union is restricting the types of biofuels made from palm oil that can be counted toward the bloc’s renewable-energy goals and aims to phase out palm oil-based biofuel entirely by 2030. Indonesia and Malaysia have called the act discriminatory and vowed to challenge it at the World Trade Organization. Another approach is to promote environmentally-sound palm oil cultivation. That’s the purpose of the Roundtable on Sustainable Palm Oil, an alliance of buyers and sellers formalized in 2004 that promulgates standards for “certified sustainable” palm oil products. Among its rules: Primary forests cannot be cleared to make room for new palm plantations and growers must abide by fair labor practices. The organization’s 4,000 members include farmers, traders, processors, manufacturers, retailers, investors, and environmental and social groups.

3. How is the push for sustainability going?

Currently, about one-fifth of global palm oil is compliant with the Roundtable’s sustainability standards. However, the value of the label is somewhat disputed. In early November, Greenpeace called eco-friendly palm oil “a con” because some Roundtable members are still cutting down forests. More than a dozen environmental advocacy organizations also endorsed a new report concluding that violations of the agreed-upon standards by Roundtable members are “systematic and widespread.” The Roundtable refuted many of the report’s findings, saying that the organization is still the best global system “to tackle the issues in the areas of the world when oil palm is grown.” A year and a half earlier, an academic study that used data from Indonesian Borneo had found no significant difference between certified and non-certified oil palm plantations on measures of sustainability.

Smoke rises from a forest fire in South Sumatra, Indonesia in 2015.

Photographer: Dimas Ardian/Bloomberg

4. Does sustainable palm oil have a future?

Beyond the credibility issues, there are challenges to expanding the market. Part of the problem lies in the industry’s complex supply chain, with output from enormous plantations and hundreds of thousands of small farmers -- many too poor to bear the cost of compliance audits -- ending up in products made all over the world. Tracking oil from the field to the grocer’s shelf requires significant monitoring and added costs to prevent, for instance, the mixing of sustainably-grown oil with product that doesn’t meet the standard. Certified oil sells on average for about 5% more than the regular kind. Producers report that they’re only able to sell about half their certified oil as such because buyers balk at the premium; sellers dump the rest as conventional oil and forfeit the price difference. The Roundtable in November rolled out a program to spur the market by encouraging members who buy palm oil to increase their purchases year over year.

5. What’s being done to help small producers?

One challenge that has plagued the Roundtable is how to draw in small growers, known as smallholders. The rules to meet sustainability requirements can threaten the viability of these farmers, who make up about 40% of production in both Indonesia and Malaysia. To ease their burden and encourage compliance, the Roundtable in November introduced a new, separate standard for smallholders that allows them to meet sustainability regulations in phases and provides training and support along the way.

6. Why is palm oil so popular?

Oil pressed from the fleshy fruit that grows near the trunks of oil palm trees has a neutral taste, long shelf life and high smoking temperature. It’s used mainly for edible purposes such as cooking and confectionery-making, as well as for biofuel and animal feed. Oil pressed separately from the kernels inside the fruit is more saturated -- and thus semi-solid at room temperature -- and is used to make soaps, cosmetics and detergents. Oil palms can grow on a variety of soil, are resilient to short spells of drought or floods, and bear fruit year-round for decades. Palm oil also has a much higher yield per acre than alternatives -- up to ten times more than rapeseed, soybean, olive and sunflower oils. Its cultivation uses only about 7% of the world’s farming land but accounts for about 40% of total vegetable oil production, according to Oil World. That means that if palm oil were replaced with alternatives, more land would be needed to produce similar volumes.

The Reference Shelf

- The World Wildlife Fund’s report on palm oil.

- The Roundtable on Sustainable Palm Oil certification process.

- Green Palm Sustainability report on certified palm oil.

- Reports from Greenpeace and the Environmental Investigation Agency on palm oil.

- The Guardian identifies 10 things you need to know about sustainable palm oil.

- A Bloomberg QuickTake on Indonesian forest fires.

- The European Union’s delegated act on palm oil.

Sterling surges as Boris Johnson’s Conservative Party is projected to win UK election - CNBC

KEY POINTS

- The pound jumps more than 2% versus the U.S. dollar after publication of a U.K. election exit poll.

- The Conservative Party would win 368 seats if the poll proves accurate, granting a comfortable majority in Parliament.

- Markets have largely priced in a majority for Prime Minister Boris Johnson’s Conservative Party, with speculative sterling shorts significantly reduced in recent months.

The U.K. general election will be held on Thursday, December 12th, 2019.

Ken Jack | Getty Images News | Getty Images

The U.K. pound jumped more than 2% after an exit poll projected an 86-seat majority for the Conservative Party in the U.K. general election.

Shortly after 10 p.m. London time, a survey of thousands of people who had just left the voting booth indicated that the Conservatives were on course to gain around 50 seats, ensuring a healthy majority.

In reaction the pound rose to $1.3451, more than 2% higher than before the poll was announced, and touched its highest level against the greenback since June 2018. Sterling also jumped against the euro, up 1.4% to 83.265 pence.

The exit poll by Ipsos Mori is commissioned by Sky News, the BBC and ITV and is generally considered more accurate than polls leading up to election day.

How do UK elections work?

The Conservative Party is tipped to gain around 50 seats in the election, while Labour would lose 71 seats from its performance in 2017. In Scotland, the Scottish National Party is forecast to win as many as 55 seats, tightening its grip north of the border.

In a snap research note, Paul Dales, chief U.K. economist at Capital Economics, said the result, if accurate, would free the path for Prime Minister Boris Johnson to push through his Brexit plan.

“If the Conservatives do win a majority, passing a Brexit divorce deal in the coming weeks would remove any risk of a no-deal Brexit on 31st January, reduce the immediate uncertainty and lift business investment at least a bit,” said Dales.

The analyst added that if a big majority over all other parties is realized then Johnson may now have the scope to “ignore the Brexiteers in his party and provide businesses with some certainty by quickly extending the transition period.”

The transition period is currently scheduled to begin as soon as the Withdrawal Deal is passed through Parliament and Britain officially leaves the European Union. That is expected to happen at the end of January. As it stands, the U.K. and EU would then only have until December 2020 to negotiate their future relationship.

Sterling had shed value during the day and at one point had lost three-quarters of a percent against the U.S. dollar before recovering ground in the hours leading up to the exit poll.

Largely priced in

Markets had largely priced in a majority for Johnson’s Conservative Party, with speculative sterling shorts significantly reduced in recent months.

Having fallen below $1.20 in early September after Johnson lost his working majority in Parliament, the pound had recovered around 10% of its value to trade above $1.32 as voters headed to the polls on Thursday, with a final YouGov poll suggesting a 28-seat majority for the ruling party.

The recovery began when Johnson agreed to a new Brexit deal with the EU on Oct. 17. Positive sterling moves ahead of the election suggested that markets were hoping for certainty in the event of a Conservative majority, which would mean Johnson could likely take the U.K. out of the bloc on that withdrawal agreement ahead of the Jan. 31 deadline.

The pound has yet to fully recover from the historic plunge suffered after the U.K.’s landmark vote to leave the EU on June 23, 2016. Before results began to emerge that night, cable had risen as high as $1.50 as traders banked on a vote to remain.

By the time the result became clear, it was down at just above $1.32, around the same level reached on Thursday morning as voters headed to the polls three and a half years later.

South Africa's growth forecasts slashed, recession risk high - REUTERS

JOHANNESBURG (Reuters) - Forecasts for South African growth were slashed in a Reuters poll of economists taken as rolling power shortages got worse, suggesting the poll’s median 40% chance the country has sunk into a recession may be too low.

South Africa’s economy has struggled in the nearly two years since President Cyril Ramaphosa took office. It shrank 0.6% last quarter, the second quarterly contraction in three quarters, and the poll conducted in the past week predicted 0.9% growth this quarter, much slower than the 1.4% forecast a month ago.

While the poll was being conducted, the country has been suffering its most severe blackouts in a decade, indicating the risk to forecasts is likely to be to the downside.

Barclays analysts wrote that they see clear downside risks in South Africa, given the ongoing decline in the South African Reserve Bank’s leading indicator for economic activity.

However, the economy is expected to grow 1.0% next year and 1.4% in 2021, better than this year’s 0.4%, according to the poll of 20 economists.

December will probably show this year’s average change in consumer prices slowed to 4.2%, 0.4 percentage points slower than in 2018.

ADVERTISEMENT

The South Africa Reserve Bank kept its repo rate unchanged at 6.5% in a close decision last month, saying it wanted to see inflation expectations closer to the midpoint of its 3% to 6% target range.

The central bank will wait until May to cut rates by 25 basis points to 6.25%, which would be only the second cut in two years, the poll said.

The rand has lost over 3% since the year began, but retailers have found ways to avoid passing the cost of falling prices to their consumers.

“Add this to expectations for a benign commodity price outlook (such as oil), inflation is expected to remain moderate during next year,” said Thea Fourie, senior economist, sub-Saharan Africa at IHS Markit.

Consumer inflation will average a little higher at 4.6% in 2020 and 4.7% in 2021, the poll said. But 11 of 15 economists said the central bank overestimated the inflation pass-through from the rand over the past two years.

“SARB models have consistently overestimated this pass-through, thereby overestimating inflation,” said Razia Khan, chief economist for Africa and the Middle East at Standard Chartered.

ADVERTISEMENT

A separate Reuters poll last week suggested emerging-market currency gains would probably be dominated by high-yielding currencies rather than low-risk bets next year as economic growth finally recovers in response to lower interest rates.

However, the high-yielding rand might not even be part of that theme next year because its central bank has not stimulated the economy as much as other emerging-market central banks.

(Other stories from the December Reuters global long-term economic outlook polls package:)

Editing by Larry King

Factbox: Key figures in Nigerian President Buhari's second cabinet - REUTERS

LAGOS (Reuters) - Nigeria’s President Muhammadu Buhari on Wednesday swore in a new cabinet, three months after starting his second term as leader of the country with Africa’s biggest economy.

Here are some of the key figures in the government led by the 76-year-old former military ruler:

TIMPIRE SILVA - PETROLEUM MINISTER

As minister of state for petroleum, Timpire Silva holds arguably the most powerful ministerial post outside of the presidency due to the key role played by oil in Africa’s largest economy.

President Muhammadu Buhari opted to keep the portfolio of petroleum minister for himself, just as he did in his first term. Buhari took a largely hands-off approach and left Silva’s predecessor - former ExxonMobil executive Emmanuel Kachikwu - to oversee the ministry.

He is widely expected to maintain that approach, which would see Silva represent Nigeria at OPEC meetings and oversee the ministry.

Silva is a veteran of politics in the southern oil-producing Niger Delta region, having served as governor of Bayelsa state in 2007 and as an elected official in the Rivers State House Assembly in the early 1990s.

ADVERTISEMENT

Prior to his elevation to the cabinet, Silva chaired the governing board of the Oil and Gas Free Zone Authority, a national regulatory body set up to foster public-private partnership investments in Nigeria’s oil and gas free zones.

ZAINAB AHMED - FINANCE MINISTER

Zainab Ahmed was promoted to finance minister in the latter stages of Buhari’s first term, in September last year, having previously served as the junior minister for budget and national planning.

Prior to entering the government, Ahmed burnished her anti-corruption credentials as head of the Nigeria Extractive Industries Transparency Initiative (NEITI). She occupied that role from 2010 until her appointment in 2015 at the budget and national planning ministry.

Ahmed did not deviate from the policies put in place by her predecessor, Kemi Adeosun. And she has signalled that she is unlikely to plot a different course in the near future.

In April, she said Nigeria had no intention of removing costly subsidies on petroleum products after the International Monetary Fund (IMF) advised the country to eliminate them to protect public finances.

Unlike Adeosun, whose role was only that of finance minister with no responsibility for the budget, Ahmed’s role encompasses budget and national planning with the merger of previously separate ministries.

BASHIR MAGASHI - DEFENCE MINISTER

Addressing multiple security problems in Nigeria is one of the main priorities of Buhari’s second term.

In Magashi, Buhari has selected a retired major general who is just two years his junior. The hope is that Magashi’s military background will help with the fight in the northeast against Boko Haram insurgents and militants with ties to Islamic State.

Magashi started his military career as a second lieutenant in 1968. He also served as the commander of a brigade in the northwestern state of Sokoto.

Buhari once referred to himself as a “converted democrat”.

Just as he pursued a career in politics after the military, Magashi also entered politics after retiring as a major general in 1999 and unsuccessfully ran for governor in the north’s commercial hub, Kano state, in 2007.

OTUNBA ADEBAYO - INDUSTRY, TRADE AND INVESTMENT MINISTER

Otunba Adebayo takes control of the trade and investment ministry at a time when Nigeria will need to overcome the apparent inconsistencies of its protectionist policies and being a signatory to the African Continental Free Trade Agreement.

His ministry will also seek to attract new investment after currency controls and multiple exchange rates, in place since 2015, prompted many oversees investors to flee.

Adebayo, whose first career was as a lawyer, is steeped in Nigerian politics. He was deputy national chairman of Buhari’s ruling party in the south of the country. And, prior to that, he was elected governor of southwestern Ekiti state in 1999.

He has replaced one of the few technocrats in Buhari’s first cabinet. Okechukwu Enelamah, Adebayo’s predecessor, was a private equity investor Lagos who co-founded investment and financial advisory firm Africa Capital Alliance.

Reporting by Alexis Akwagyiram; Additional reporting by Felix Onuah in Abuja; Writing by Alexis Akwagyiram and Alison Williams

Nigeria Air still on aviation road map – FG - PUNCH

BY Okechukwu Nnodim, Abuja

Although suspended, the Nigeria Air project is still on the aviation roadmap of the Federal Government, the Minister of Aviation, Hadi Sirika, announced on Wednesday.

He said the proposed national carrier, Nigeria Air, will be implemented, as he was received by employees of the Federal Ministry of Aviation after his inauguration as minister.

“Nigeria Air is still on the roadmap. So, we need your support,” Sirika told his staff.

He added, “One aeroplane that comes into the country means 300 jobs. More than that is the catalyst for the economic growth of our country. It also adds to our gross domestic product.”

The returnee minister said he would further strive to raise the contribution of the aviation sector to the country’s Gross Domestic Product.

“What we have done is that we have raised the aviation contribution to GDP from 0.4 to 0.6 (per cent). I believe that in the coming year, we will get to one per cent at least,” he said.

He added, “I do believe that the aviation sector has a lot for Nigerians; it connects people, countries, continents, markets and be that catalyst that is missing to rejuvenate our economy. Having 200 million people in the centre of Africa is a huge advantage.”

Trump Wants a Weak Currency. Rivals Do Too, and That’s a Problem - BLOOMBERG

By Anchalee Worrachate and Liz McCormick

-

Fed rate cuts may not weaken dollar amid global dovishness

-

Any intervention could face strong countermeasures by rivals

Despite the Fed’s increasing dovishness, the greenback has beaten most Group-of-10 peers this quarter.

Photographer: Paul Yeung/Bloomberg

Major economies around the globe all seem to covet a weaker currency as risks to growth mount. That makes engineering a lower dollar, euro or other heavyweight all the harder.

President Donald Trump has repeatedly badgered the Federal Reserve to cut rates and complained that the U.S. dollar is too strong. But he’s got competition. It might not mention the exchange rate explicitly, but the European Central Bank is poised to loosen policy, weighing on the common currency.

Bank of Japan Governor Haruhiko Kuroda said the bank will “persistently continue with powerful monetary easing” to boost inflation. In China, the central bank looks set to step up stimulus to revive growth.

Thanks to synchronized monetary easing, any simultaneous moves to weaken currencies might cancel each other out -- making beggar-thy-name policies a waste of time.

“Everyone is sort of pushing on the same piece of string,” said Charles Diebel, head of fixed income at Mediolanum Asset Management. “If you have the Fed easing and the ECB easing, it’s just a relative game. It’s very hard for currency volatility to remain elevated.”

2010 Redux

Despite the Fed’s increasing dovishness, the greenback has beaten most Group-of-10 peers this quarter. The Bank of Korea surprised markets with a rate cut last week, but the won only weakened briefly. Even though the Swiss National Bank keeps reiterating it has leeway to ease, the franc continues to be buoyant against the euro.

Foreign-exchange strategists say the risk of a U.S. move to weaken the dollar has risen after Treasury Secretary Steven Mnuchin said last week that there’s no change in the nation’s currency policy “as of now.”

Dollar is most expensive G-10 currency.

Welcome to the latest race to the bottom. In 2010, when major central banks were printing money and cutting rates, causing their exchange rates to fall, then-Brazilian Finance Minister Guido Mantega famously labeled it a “currency war.” The difference is that back then, the dollar was falling and other countries tried to catch up with it.

Now, the greenback is among the most overvalued G-10 currencies, according to a Bank for International Settlements model on real effective exchange rates.

A desire among policy makers to expand their toolkit to prop up growth is understandable. The International Monetary Fund has revised down its growth forecast for 2019 repeatedly -- including on Tuesday -- as trade and geopolitical tensions threatened to damp the world economy. Major central banks, including those in Switzerland and Australia, are sticking to a low-rates policy.

Monetary Struggle

“If the U.S. wants a weaker dollar now, they are going to struggle to get that with just the use of monetary policy,” said Kit Juckes, a strategist at Societe Generale SA. “Fed policy is no longer the driver of the dollar -- growth is. A rate cut by the Fed isn’t going to get the euro stronger if the prospect of growth there is weak.”

Any competitive devaluations are naturally fraught with political tensions, while prolonged low interest rates risk asset bubbles and financial repression.

See it as a U.S.-Europe story, according to Stephen Jen, the chief executive officer of Eurizon SLJ Capital. He reckons the BOJ has already done so much easing that it is now worried about the economic effects of sustained negative rates. Meanwhile, the People’s Bank of China may refrain from enacting a large stimulus amid fears it could destabilize the economy over the long haul.

“It’s really the euro and the dollar racing lower,” Jen said in an interview. “The Fed doesn’t really have a strong case to cut at all as the U.S. economy is doing fine. The real issues are happening outside the U.S. That’s a very different situation than the Europeans face. They are facing weakness right there in Germany.”

Markets expect the Fed to announce a 25-basis-point cut in interest rates next week. Despite that, the euro depreciated 1.7% against the dollar this quarter, and is down 2.5% this year.

It’s unlikely that the U.S. would intervene partly because it risks triggering counter-measures by other monetary authorities, said Bilal Hafeez, former head of G10 foreign-exchange and rates strategy at Nomura Holdings Inc. and now the CEO of Macro Hive.

“What’s more likely is that the Fed would cut rates more aggressively” said Hafeez. “But the extent of dollar weakness will be limited because other central banks are becoming more dovish.”

(Adds latest IMF forecast reduction in 10th paragraph.)

ECB signals a rate cut, sends the euro to a 2-month low - CNBC

- The central bank said it expects its key interest rates to remain “at their present or lower levels” at least through the first half of 2020.

- This is an update on the wording in previous statements and suggests a rate cut could be on the horizon.

Mario Draghi, president of the European Central Bank (ECB).

Bloomberg | Bloomberg | Getty Images

The European Central Bank (ECB) kept rates unchanged but altered its forward guidance on Thursday amid deteriorating economic data in the euro zone.

The central bank said it expects its key interest rates to remain “at their present or lower levels” at least through the first half of 2020, updating the wording on previous statements and suggesting a rate cut could be on the horizon.

The bank also signaled that there could be additional measures to stimulate the euro zone economy. It said it was examining options, “including ways to reinforce its forward guidance on policy rates, mitigating measures, such as the design of a tiered system for reserve remuneration, and options for the size and composition of potential new net asset purchases.”

Potential new net asset purchases suggest the central bank could reintroduce its quantitative easing program, where it purchases government bonds from euro zone countries to further stimulate lending and stoke inflation.

On Thursday, the euro zone central bank kept the rates on its main refinancing operations, marginal lending facility and deposit facility unchanged at 0%, 0.25% and -0.40%, respectively. These have been at record lows following the euro sovereign debt crisis of 2011.

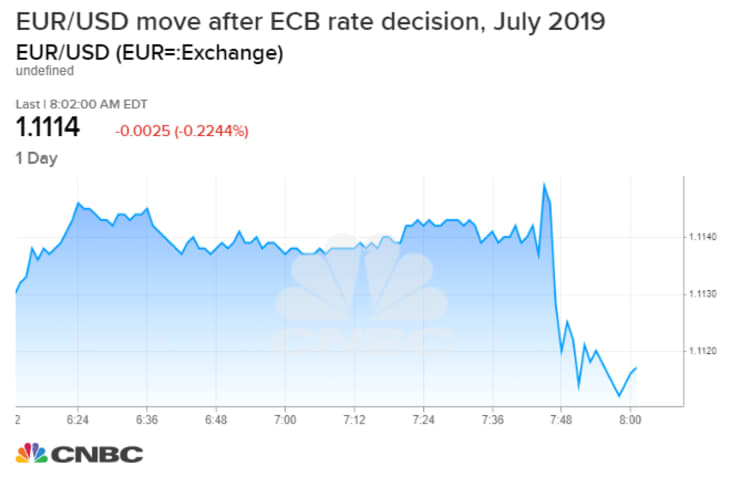

Euro fell to an eight-week law after ECB decision.

Traders are now waiting to hear from President Mario Draghi, who is due to speak at 1:30 p.m. London time.

Sintra speech

Draghi warned last month that without a clear improvement for the euro zone economy, the central bank would announce further stimulus measures. This caused market players to up their forecasts for new interest rate cuts or even a bond-buying program. Draghi, speaking in June in Sintra, Portugal, made it clear that his institution was ready to use all necessary measures to revamp the flagging economy.

Data out Wednesday further highlighted the recent weakness, showing German manufacturing PMIs (Purchasing Managers’ Index) falling to 43.1 in July from 45.0 in June. At the same time, new orders in the country dropped at their fastest pace since July 2012, on the back of weakness in Chinese demand and in the auto sector.

The ECB had embarked on a major stimulus package following the sovereign debt crisis of 2011. This included cutting interest rates to record lows, purchasing government bonds and facilitating more lending to euro zone banks. The bank tried to normalize its policy last year — and catch up with other central banks like the U.S. Federal Reserve — but with global trade wars and softness in China most of these banks have now signaled a U-turn. In the U.S., investors now believe there’s an 80% chance that the Fed announces a 25 basis point cut when it meets next week.